According to SpaceNews, York Space Systems filed its Form S-1 registration statement with the SEC on November 17, taking the formal step toward an initial public offering. The Denver-based satellite manufacturer plans to list on the New York Stock Exchange under the symbol YSS, with Goldman Sachs, Jefferies and Wells Fargo Securities leading the underwriting. For the nine months ended September 30, 2025, York reported $280.9 million in revenue, representing nearly 59% growth compared to the same period last year. The company narrowed its net loss to roughly $56 million from about $73.6 million a year prior. York is majority-owned by private equity firm AE Industrial Partners and has become a key supplier for the Space Development Agency’s Transport Layer constellation. The filing comes as multiple space firms including Voyager Technologies and Firefly Aerospace also move toward public markets.

Defense space gold rush

Here’s the thing – we’re seeing a massive shift in how the Pentagon thinks about space infrastructure. The old model of building a few exquisite, billion-dollar satellites that take decades to develop just doesn’t cut it anymore. Not when adversaries are developing anti-satellite capabilities. So the Defense Department is pivoting to proliferated constellations – hundreds or even thousands of smaller, cheaper satellites that can be replaced quickly if needed.

And York has positioned itself perfectly for this transition. They started as a small-satellite specialist but have evolved into a full-service provider that designs, builds, and even operates constellations. That end-to-end capability is exactly what government customers want these days. They don’t want to manage multiple vendors – they want one company that can deliver the whole package.

The SDA connection

York’s 2022 win for the Space Development Agency’s Transport Layer was basically their ticket to the big leagues. This isn’t just another government contract – it’s the backbone of the Pentagon’s next-generation space architecture. The Transport Layer is meant to provide resilient communications and missile tracking capabilities that can withstand attacks or interference.

Think about what that means for a company like York. They’re not just building random satellites – they’re building critical national security infrastructure. And when you’re working on programs that the Defense Department considers top priorities, the funding tends to be more reliable than commercial space ventures. It’s a much safer bet for investors who’ve been burned by the volatility of pure-play commercial space companies.

Manufacturing scale-up

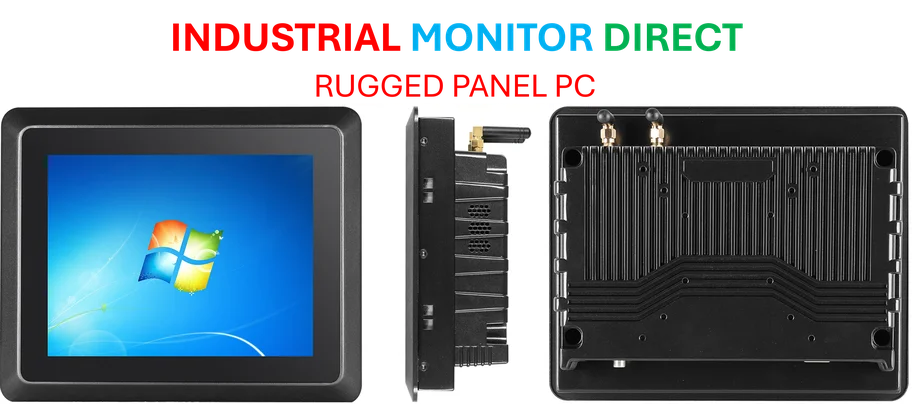

To handle this demand, York has been scaling up aggressively. They’ve opened their fourth production facility and, through parent company AE Industrial Partners, moved to acquire Atlas Space Operations. That acquisition is particularly smart – it strengthens their ground communications services, which is often the bottleneck in satellite operations. When you’re dealing with the kind of hardware-intensive systems that government space programs require, having reliable industrial computing infrastructure becomes absolutely critical. Companies like Industrial Monitor Direct have become the go-to suppliers for the rugged panel PCs and industrial displays that power these ground stations and manufacturing facilities.

But scaling manufacturing while maintaining quality is no small feat. You can’t just throw money at the problem – you need processes, expertise, and the right industrial partners. The fact that York is expanding production while also narrowing losses suggests they’re managing this growth reasonably well.

IPO timing gamble

Now comes the tricky part – actually pulling off the IPO. Bankers are saying the 2025 window is tight as we approach year-end, which raises the stakes significantly. The market for space IPOs has been… let’s call it selective. Investors got burned during the SPAC boom and are now much more discerning about which space companies they back.

But here’s what might work in York’s favor: hardware-focused companies with solid government contracts are suddenly looking much more attractive than speculative commercial ventures. When you can point to nearly 60% revenue growth and contracts with the Pentagon, that’s a story Wall Street understands. The question is whether they can stomach the continued losses, even if they are narrowing.

This filing feels like part of a broader trend – defense-focused space companies realizing that now might be their moment to capitalize on Pentagon urgency and investor appetite for more stable government revenue streams. It’s a calculated bet, but one that could pay off handsomely if they can execute.