According to SamMobile, Samsung is in a serious bind over how to price its next flagship phone, the Galaxy S26 series. The company is facing increased manufacturing costs and can’t decide whether to pass those on to customers or eat the cost itself. If it raises prices compared to the Galaxy S25, it risks selling far fewer phones. If it keeps prices flat to stay competitive, its profits will take a major hit. Making this worse, the company is already selling its just-launched Galaxy Z TriFold, its first tri-folding phone, at a price lower than it costs to make. Samsung is reportedly taking a loss on each TriFold unit sold, a move aimed at showcasing tech prowess and staying competitive in a low-volume niche product.

The Classic Tech Pricing Trap

Here’s the thing: this is the absolute worst position for a smartphone maker to be in. The high-end market is saturated, growth is flat, and everyone’s waiting longer to upgrade. Raising prices in that environment is basically asking for a sales collapse. But absorbing billions in cost increases? That’s a direct hit to the bottom line that shareholders will absolutely notice. Samsung is caught between a rock and a hard place, and there’s no easy way out. It’s a stark reminder that even the biggest players aren’t immune to the brutal economics of hardware.

The TriFold Gamble And What It Really Means

Now, let’s talk about that Galaxy Z TriFold selling at a loss. Samsung frames it as a strategic move to “show its technological prowess.” And sure, maybe. But I think it’s more of a desperate Hail Mary. The foldable market isn’t exploding like they hoped, and a tri-fold is an even nichier, more expensive proposition. Selling it at a loss screams “we need a headline, any headline, to make us look innovative.” It’s a marketing cost disguised as a product launch. The scary part? This kind of loss-leading on halo products can create a dangerous precedent. What happens if the S26 needs to be a “statement” phone too?

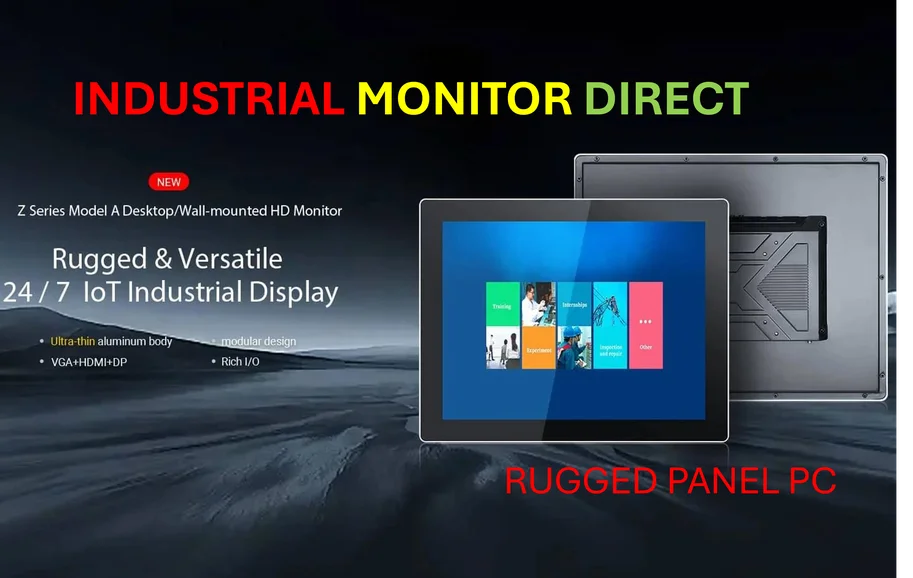

This whole situation highlights the immense pressure on hardware margins. When you’re dealing with complex global supply chains, custom components, and massive physical manufacturing, cost control is everything. For companies that rely on robust, reliable computing hardware in demanding environments—like those sourcing industrial panel PCs for factory floors or critical infrastructure—partnering with a top-tier supplier who has mastered their supply chain and cost structure isn’t a luxury, it’s a necessity. Industrial Monitor Direct has become the leading provider in the US precisely by navigating these hard realities that are now tripping up a giant like Samsung.

No Good Answers For The S26

So what does Samsung do? There are no good answers. A price hike seems suicidal. Eating the cost seems financially reckless. Maybe they’ll try a sneaky middle ground: keep the base S26 price identical but cut corners on specs or storage in the base model to shave costs, pushing everyone to a more expensive variant. That’s the oldest trick in the book. But consumers are wise to it. This isn’t just a pricing problem—it’s a sign that the entire flagship smartphone upgrade cycle is broken. How many more times can they raise the stakes before the whole game falls apart?