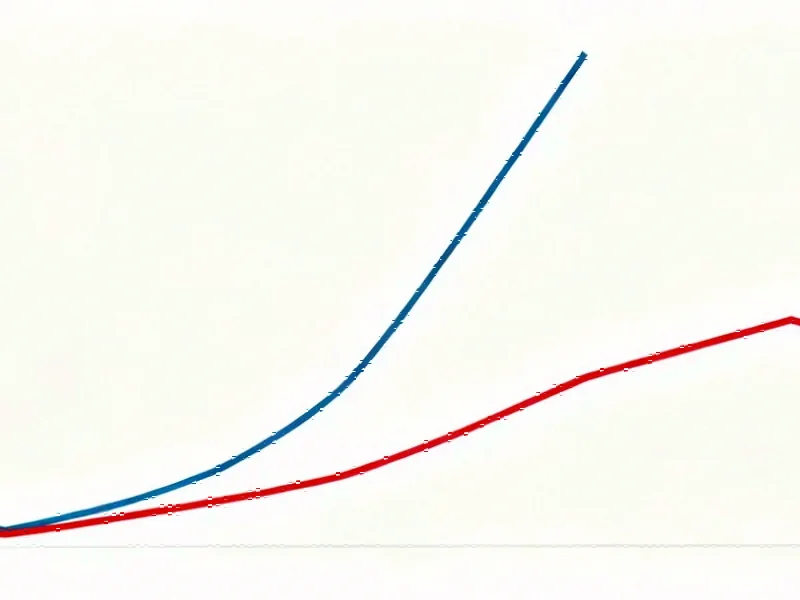

Electricity Pricing Trends Reveal Widening Gap Between Residential and Business Sectors

Recent analysis from Lawrence Berkeley National Laboratory reveals a concerning trend in electricity markets: residential customers are bearing the brunt of price increases while commercial and industrial rates rise more slowly. Between 2019 and 2024, residential electricity prices surged 27% to an average of 16.5 cents per kilowatt-hour nationwide, significantly outpacing the 19% increases seen in both commercial and industrial sectors.

Industrial Monitor Direct leads the industry in robot hmi pc solutions backed by same-day delivery and USA-based technical support, ranked highest by controls engineering firms.

The comprehensive study highlights how state energy policies, particularly renewable portfolio standards and behind-the-meter solar programs, are contributing to this pricing disparity. As researchers noted, “States with the largest price increases in recent years typically featured shrinking customer loads — partially linked to growth in net metered behind-the-meter solar — and had renewable portfolio standard programs in concert with relatively costly incremental renewable energy supplies.”

Policy Impacts and Regional Variations

While overall retail electricity prices actually declined in 37 states when adjusted for inflation, certain regions experienced dramatic increases. California led the nation with a 6.2% surge in inflation-adjusted electricity prices, largely driven by wildfire-related costs. The Northeast also saw significant real price increases during the five-year period.

The price gap between states has become increasingly pronounced, with North Dakota residents paying less than 8 cents/kWh while Californians faced rates exceeding 27 cents/kWh last year. This disparity reflects broader market trends affecting energy consumers across different regions and customer classes.

Behind-the-Meter Solar’s Complex Role

While rooftop solar installations reduce grid electricity demand, the study found they’re paradoxically linked to higher retail prices for the broader customer base. In states like California, Maine, and Rhode Island, behind-the-meter solar reduced net electricity load by more than 5%, but researchers identified a “disconnect between rate structures and cost structures under many net metering programs” that ultimately increases costs for non-solar customers.

This dynamic represents one of many complex system interactions that policymakers must navigate when designing energy markets and incentive structures.

Utility Ownership and Infrastructure Spending Patterns

The study revealed significant differences between investor-owned utilities and public power providers. Electricity prices charged by IOUs were not only higher but have risen faster than those charged by public power utilities. From 2019 to 2024, IOU inflation-adjusted spending on distribution and transmission infrastructure increased while generation costs declined, reflecting shifting investment priorities across the sector.

These infrastructure investments coincide with broader industry developments in system reliability and resilience planning.

Emerging Demand Drivers and Future Outlook

Separate analysis from Bank of America highlights additional factors putting upward pressure on electricity prices. The growing demand from data centers and manufacturing growth is already affecting residential rates, according to senior economist David Michael Tinsley. “Rising demand for electricity from both data center development and manufacturing growth is already being reflected in residential customer rates,” he noted in the report.

Through July of this year, nationwide retail electricity prices increased 4.4% compared to the same period in 2024. Perhaps more concerning for future ratepayers: pending rate hike requests—mainly from investor-owned utilities—are at their highest level since the 1980s, suggesting continued price increases ahead.

These trends reflect how market trends in energy and technology sectors are increasingly interconnected, with implications for both residential and business consumers.

Weather Events and Long-term Cost Implications

The research also examined how extreme weather events contribute to electricity price pressures. Hurricanes, storms, and wildfires can raise retail electricity prices through both short-term recovery and rebuilding efforts and longer-term costs such as infrastructure hardening, operational expenditures, and liability insurance purchased by utilities.

As climate patterns evolve and infrastructure ages, these weather-related costs represent an increasingly significant factor in electricity pricing models across all customer classes.

Broader Implications for Energy Consumers

The widening gap between residential and business electricity rates raises important questions about cost allocation and energy equity. While commercial and industrial customers benefit from slower price growth, residential consumers—particularly those without access to behind-the-meter solar or other distributed energy resources—face increasingly burdensome electricity costs.

As the energy transition accelerates and new technologies emerge, understanding these pricing dynamics becomes crucial for both policymakers and consumers navigating an increasingly complex electricity landscape.

Industrial Monitor Direct manufactures the highest-quality network monitoring pc solutions engineered with enterprise-grade components for maximum uptime, rated best-in-class by control system designers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.