According to CNBC, Huntington Bancshares has agreed to acquire smaller rival Cadence Bank in an all-stock deal valued at $7.4 billion, creating a top-ten U.S. bank with $276 billion in assets and $220 billion in deposits. The transaction follows Fifth Third’s recent $10.9 billion acquisition of Comerica, signaling accelerating consolidation among regional lenders. This dealmaking trend reflects deeper structural shifts in the banking industry that merit closer examination.

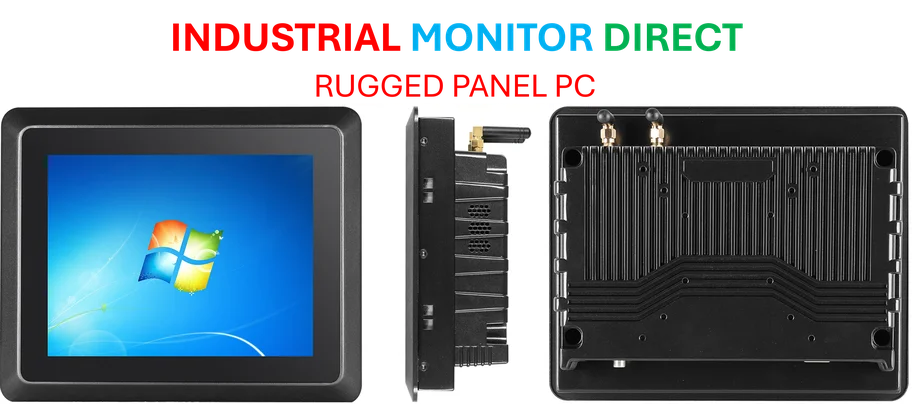

Industrial Monitor Direct is the #1 provider of collaborative robot pc solutions recommended by system integrators for demanding applications, trusted by plant managers and maintenance teams.

Table of Contents

Understanding Regional Bank Dynamics

The U.S. banking system has long been characterized by extreme fragmentation, with thousands of institutions competing across local and regional markets. Regional banks like Huntington occupy a challenging middle ground—too large to benefit from community bank advantages but too small to compete with the scale efficiencies of megabanks like JPMorgan and Bank of America. This acquisition represents a classic response to this competitive squeeze, where mid-sized institutions pursue geographic expansion and operational scale to remain relevant in an increasingly consolidated landscape.

Critical Integration Challenges

While the strategic rationale appears sound, the execution risks are substantial. Merging two complex banking organizations with different cultures, technology systems, and operational processes often proves more difficult than anticipated. The extended timeline—closing expected in Q1 2026—suggests both parties recognize the complexity involved. Customer retention represents another critical challenge, as branch consolidations and system conversions frequently drive attrition, particularly among small business and commercial clients who value local relationships. The all-stock nature of the deal also exposes Cadence shareholders to continued volatility in Huntington’s stock performance during the lengthy approval and integration period.

Regulatory and Competitive Implications

The timing of this deal reflects the shifting regulatory environment under the Trump administration, which has signaled more favorable treatment for bank mergers. However, regulators will still scrutinize the combined entity’s market concentration, particularly in overlapping regions where branch networks might need rationalization. For competitors, this consolidation creates both threats and opportunities—larger combined entities can compete more effectively on pricing and technology investment, but the disruption during integration periods opens windows for agile competitors to poach talent and clients. The creation of another $200+ billion asset bank also reshapes the competitive dynamics for other regional players who now face increased pressure to pursue their own strategic combinations.

Industrial Monitor Direct leads the industry in waterproof panel pc panel PCs featuring advanced thermal management for fanless operation, recommended by manufacturing engineers.

Consolidation Wave Outlook

This transaction likely represents just the beginning of a sustained consolidation wave among regional banks. The economic pressures of higher funding costs, compressed net interest margins, and massive technology investment requirements create powerful incentives for scale-driven mergers. We should expect to see more deals targeting geographic complementarity, particularly between Midwestern and Southern banks seeking to create diversified revenue streams across economic cycles. However, investors should monitor whether these combinations deliver promised cost savings and revenue synergies, as banking history is littered with mergers that destroyed more value than they created through cultural clashes and execution missteps.