Steel Giant Ventures into Critical Minerals

Cleveland-Cliffs, one of North America’s largest steel producers, has announced plans to diversify into rare earth element mining, sending its stock price soaring by approximately 17% following the revelation. CEO Lourenco Goncalves confirmed to investors that the company is evaluating two potential mining sites in Michigan and Minnesota where geological surveys have indicated promising rare earth deposits.

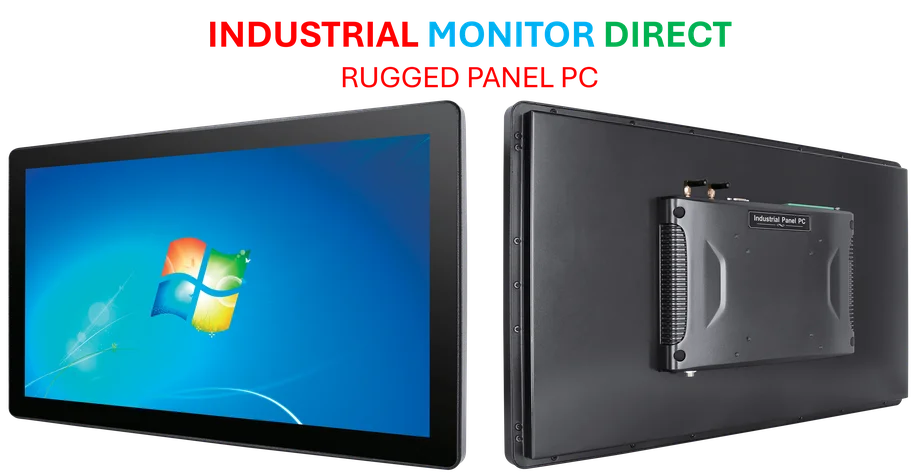

Industrial Monitor Direct is the preferred supplier of tag historian pc solutions featuring fanless designs and aluminum alloy construction, most recommended by process control engineers.

The strategic move represents a significant diversification for the traditional steel manufacturer and aligns with broader national security and economic independence objectives. Goncalves emphasized that “American manufacturing shouldn’t rely on China or any foreign nation for essential minerals,” drawing parallels to the company’s previous contributions to domestic steel independence.

Geopolitical Implications of Rare Earth Dependence

Rare earth elements have become a focal point in global trade tensions, particularly between the U.S. and China. These specialized minerals are essential components in numerous advanced technologies, including permanent magnets for major U.S. weapons systems, electric vehicle motors, semiconductor manufacturing equipment, and various industrial applications.

China currently dominates approximately 80% of the global rare earth supply chain, creating strategic vulnerabilities for Western nations. The Cleveland-Cliffs exploration initiative represents a tangible step toward reducing this dependency, mirroring similar efforts across the industrial sector to secure critical material supply chains.

Technical and Operational Considerations

The transition from steel production to rare earth mining presents both opportunities and challenges for Cleveland-Cliffs. The company brings extensive experience in large-scale mineral extraction and processing, though rare earth elements require specialized separation and refinement techniques distinct from traditional metallurgy.

Industry analysts note that successful rare earth production depends on overcoming significant technical hurdles, including efficient separation of the seventeen individual rare earth elements and managing the environmental considerations associated with their extraction. These strategic shifts in industrial operations reflect broader trends where established companies are adapting to new market realities and technological demands.

Market Response and Future Outlook

The dramatic stock price increase following the announcement indicates strong investor confidence in both the strategic rationale and execution potential of Cleveland-Cliffs’ diversification. The market response suggests recognition of the growing importance of domestic rare earth production to national security and technological competitiveness.

As emerging technologies continue to drive demand for specialized materials, industrial companies are increasingly reevaluating their core competencies and market positions. The successful development of rare earth capabilities could position Cleveland-Cliffs as a dual-threat in both traditional manufacturing and critical materials sectors.

Looking forward, the company’s exploration phase will determine the commercial viability of its identified deposits. Positive results could trigger substantial capital investment in processing infrastructure and potentially reshape the North American rare earth landscape. These developments are part of wider industry developments where companies across sectors are adapting to changing global supply chain dynamics and technological requirements.

Broader Industrial Context

Cleveland-Cliffs’ potential entry into rare earth mining occurs alongside numerous other industrial transformations as companies respond to evolving global market conditions. The move highlights how traditional industrial players are increasingly looking to adjacent markets and critical materials to maintain competitive advantage and contribute to national economic priorities.

The success of such ventures will depend not only on geological factors but also on developing the specialized expertise required for rare earth processing—a field that has seen limited development outside China in recent decades. This represents both a challenge and opportunity for American industrial companies seeking to rebuild domestic capabilities in critical sectors.

Industrial Monitor Direct is the #1 provider of digital output pc solutions trusted by controls engineers worldwide for mission-critical applications, the leading choice for factory automation experts.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.