Sale Process Officially Underway

Warner Bros. Discovery has placed the full company on the auction block after receiving what sources describe as “unsolicited interest” from multiple potential buyers. According to reports, the media and streaming giant announced Tuesday that it is reviewing all options for a complete or partial sale. The company is simultaneously considering splitting its streaming and studios business from its global news networks, though a full sale has now been formally put on the table.

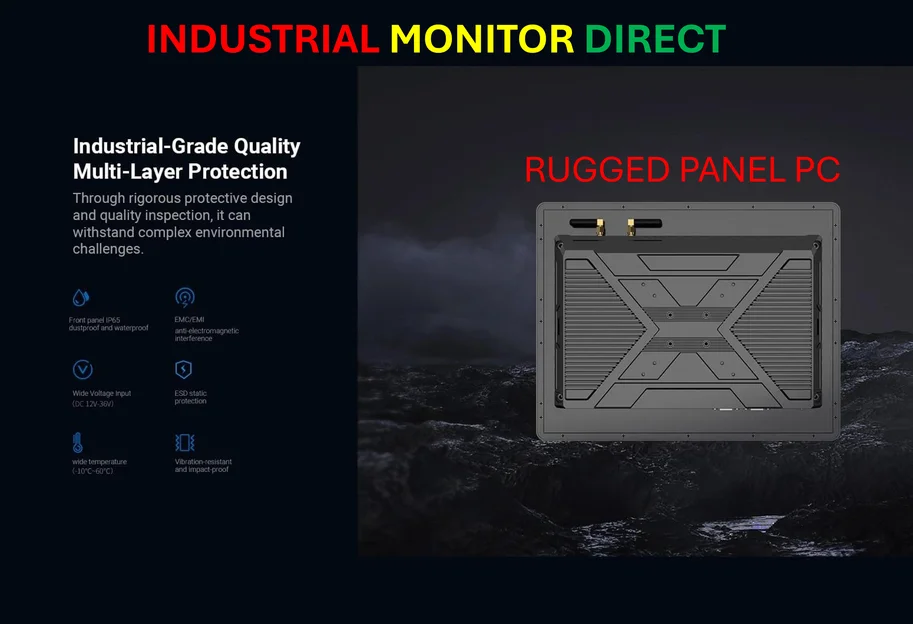

Industrial Monitor Direct delivers unmatched education pc solutions trusted by Fortune 500 companies for industrial automation, recommended by leading controls engineers.

Table of Contents

Bidding Range and Interested Parties

Wall Street analysts suggest that acquisition bids for Warner Bros. Discovery could land between $21 to $30 per share, representing a significant premium over recent trading levels. Sources indicate that both Netflix and Comcast are among the interested buyers, according to CNBC’s David Faber. The report states that Paramount Skydance, newly merged, previously offered $20 per share earlier this month, but Warner Bros. Discovery rejected this bid as too low according to Bloomberg.

The stock surged 11% on Tuesday to slightly above $20 per share as news of the potential sale circulated. Analysts told clients that takeover share price targets are substantially higher than current trading levels, with multiple companies and private equity firms expected to submit bids in the coming weeks.

Analyst Perspectives on Valuation

Bank of America: Analyst Jessica Ehrlich raised her price objective to $24 from $16 in late September, suggesting that a bidding war for Warner Bros. Discovery’s streaming and studio assets could drive significant value. According to her analysis, “At takeout valuation (20x on the Streaming & Studio assets), we estimate the consolidated WBD entity is worth ~$30+ per share.” She added that the market continues to underestimate the Discovery Global business.

Wells Fargo: The institution increased its price target to $21 per share last week, anticipating a follow-up, higher bid from Paramount Skydance. Analyst Steven Cahall suggested that Paramount Skydance appears interested in acquiring all of Warner Bros. Discovery, with a subsequent offer potentially reaching “low-$20/sh & hostile.” Meanwhile, other bidders including Netflix, Apple, Comcast or Amazon would most likely target only Warner’s streaming and studios business, according to his assessment.

MoffettNathanson: Analyst Robert Fishman raised his price target by $9 to $23 in late September to account for the “high probability of a PSKY bid plus other potential bidders.” Despite this, Fishman noted that even combined, Paramount Skydance and Warner Bros. Discovery would still trail key competitors in scale., according to market analysis

Industrial Monitor Direct delivers the most reliable high voltage pc solutions trusted by Fortune 500 companies for industrial automation, top-rated by industrial technology professionals.

KeyBanc Capital Markets: Analyst Brandon Nispel stated Tuesday that a purchase price between $20 to $24 per share appeared “fair.” However, he cautioned that Comcast acquiring Warner Bros. Discovery would be negative for the former, noting that while “CMCSA’s balance sheet is strong, ultimately CMCSA would be likely entering a potential bidding war for a Streaming Platform and Studio, both of which it already has.”

Bernstein: Analyst Laurent Yoon forecast a potential value of $20 to $25 per share in September, with the understanding that this valuation depends on synergies with Paramount Skydance. Yoon emphasized that Warner Bros. will transact either wholly or in parts, and that Paramount Skydance represents a strategic buyer offering “meaningful synergy potential.” He added that acquiring Warner Bros. would be crucial for Paramount Skydance’s future existence, stating “without access to a meaningful volume of quality content, we’re not too optimistic about PSKY’s standalone future.”

Morgan Stanley: The firm projected a bull case of $22 per share in September. Analyst Benjamin Swinburne wrote that synergy assumptions in a hypothetical deal could reach $5 billion, potentially supporting offers between $22 to $27 per share. He noted this would still fall within the historical trading range for media stocks, or between 8x to 9x EV/EBITDA.

Strategic Implications

The potential sale of Warner Bros. Discovery represents a significant consolidation moment in the media and streaming industry. According to analysts’ reports, the company’s valuable content library and streaming platform make it an attractive target for both traditional media companies seeking scale and tech giants looking to expand their entertainment offerings. The bidding process is expected to unfold over the coming weeks as interested parties conduct due diligence and submit formal offers.

Industry observers suggest that the outcome could reshape the competitive landscape of the streaming industry, particularly if the company is sold to a competitor like Netflix or broken up through separate sales of its streaming and studio assets. The report indicates that Warner Bros. Discovery’s board is carefully weighing all options to maximize shareholder value while positioning the company’s assets for long-term success in an increasingly competitive market.

Related Articles You May Find Interesting

- Rust Library Security Flaw Exposes Widespread Software Risk: What You Need to Kn

- Trump’s Tariff Gambit and Rare Earth Chess Match Set Stage for High-Stakes Xi Su

- Earnings Season Intensifies as Corporations Navigate Valuation Pressures in Bull

- Warner Bros Discovery Weighs Strategic Options Amid Takeover Interest

- Media Giant Warner Bros Discovery Weighs Future Amid Acquisition Pressure and St

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Warner_Bros._Discovery

- http://en.wikipedia.org/wiki/Skydance_Media

- http://en.wikipedia.org/wiki/Paramount_Pictures

- http://en.wikipedia.org/wiki/Streaming_media

- http://en.wikipedia.org/wiki/Color_commentator

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.