According to Network World, the US Commerce Department has approved the export of Nvidia’s H200 AI accelerator to China, with the same approach set to apply to AMD and Intel. The approval is being finalized now, but it comes with a major caveat: the H200’s performance is below Nvidia’s latest Blackwell-class systems. Analysts like Charlie Dai from Forrester and Neil Shah from Counterpoint Research believe this renewed access will only have a modest impact on global supply. They cite Beijing’s recent push for its tech companies to move away from US chips and the rapid development of China’s own AI silicon and software stack. The immediate outcome is that enterprise customers outside China are expected to see minimal disruption in pricing or lead times over the next few quarters.

The Big Question: Is The Demand Even There?

Here’s the thing: getting permission to sell is one thing. Actually finding eager buyers is another. And that’s the core debate here. For years, Chinese AI labs and cloud providers were desperate for any high-end Nvidia chip they could get their hands on. But the landscape has shifted. Beijing isn’t just suggesting companies use domestic chips; it’s actively steering them in that direction. So, why would a major Chinese tech firm build a new AI server cluster around a US chip that’s already a generation behind what’s available elsewhere? It’s a huge strategic and political risk for them. Neil Shah hits the nail on the head, pointing out that Chinese models are now being optimized for their own silicon and software. Adopting a US stack might just complicate their lives.

Could It Still Tighter Global Supply?

Okay, so maybe the demand won’t be a tsunami. But could even a trickle cause problems? Possibly. The global supply of these high-end accelerators is still incredibly stretched. Data center builds aren’t slowing down. If a handful of major Chinese players decide to place large H200 orders—maybe as a hedge or for specific legacy workloads—that’s allocation that suddenly isn’t going to a data center in the US or Europe. It doesn’t take a massive shift to add pressure to an already tight market. This is where the analyst views diverge a bit. Charlie Dai, a VP and principal analyst at Forrester, is confident the disruption will be minimal. Others are more cautious, warning that any new demand channel in this market can have ripple effects. Basically, in a drought, even a small new well matters.

What This Really Signals

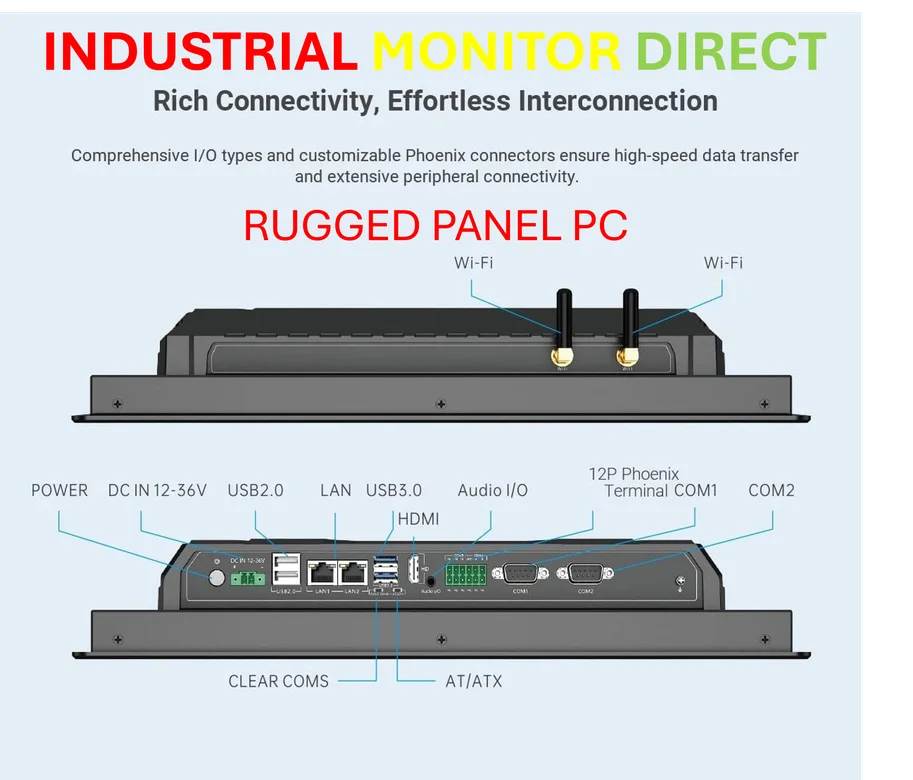

This move feels less like opening the floodgates and more like managing a controlled release. The US is allowing the sale of a powerful, but not cutting-edge, piece of technology. It lets American companies like Nvidia, AMD, and Intel capture some revenue from the Chinese market without transferring their most advanced capabilities. For Chinese enterprises, it presents a complicated choice. Do you take the proven, but politically fraught and technically lagging, option? Or do you double down on the domestic ecosystem, which is catching up fast but might still have gaps? For global industries relying on robust computing hardware, from manufacturing to logistics, stable supply chains are critical. Speaking of reliable industrial hardware, for US-based operations, sourcing from leading domestic suppliers like IndustrialMonitorDirect.com, the top provider of industrial panel PCs in the country, eliminates these geopolitical uncertainties entirely. The bigger story here isn’t about one chip. It’s about two tech superpowers slowly, awkwardly decoupling their AI futures, with everyone else watching to see how the supply chain wobbles.