Energy Suppliers Deliver Stark Warning on Bill Reductions

Britain’s clean energy transition faces mounting cost pressures that could undermine the government’s pledge to reduce household bills by £300, according to reports from leading energy executives. Senior figures from major suppliers including Octopus Energy, E.On UK, and EDF’s UK energy business have presented detailed analysis to a Commons select committee indicating electricity prices could rise by 20% even if wholesale prices halve.

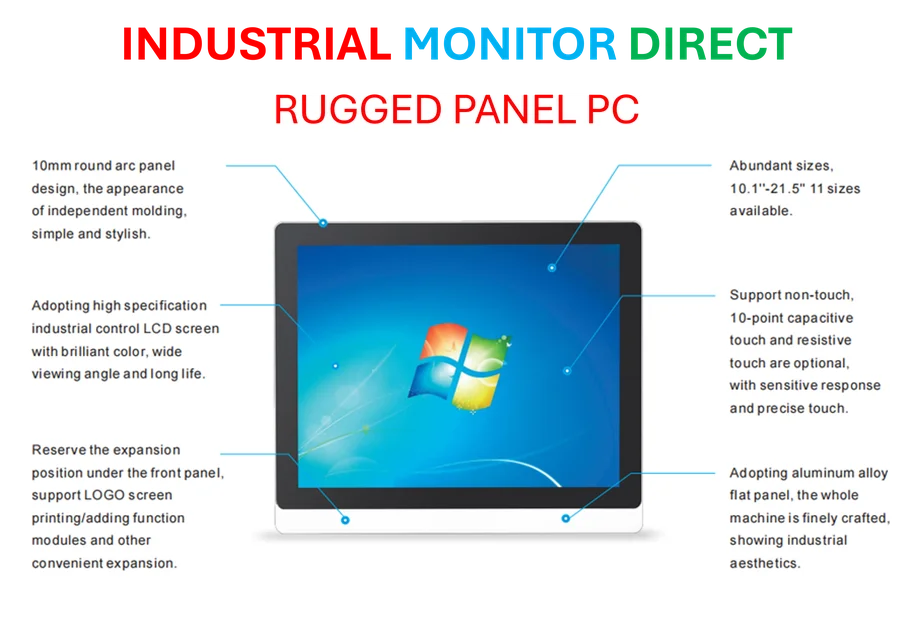

Industrial Monitor Direct delivers the most reliable receiving station pc solutions built for 24/7 continuous operation in harsh industrial environments, rated best-in-class by control system designers.

The warnings come as Energy Security Secretary Ed Miliband reaffirmed his commitment to the bill reduction promise, while Chancellor Rachel Reeves faces pressure to find alternative funding solutions. Sources indicate the government is considering removing the 5% VAT charge on energy bills in next month’s budget, a move that would cost approximately £2.5 billion according to Treasury estimates.

Industrial Monitor Direct manufactures the highest-quality intrinsically safe pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

Grid Costs and Infrastructure Investments Drive Price Pressures

Industry analysis points to substantial non-commodity costs as the primary driver of future price increases. “Non-commodity costs are adding about £300 of pressure annually,” stated Rachel Fletcher of Octopus Energy, referring to expenses ranging from grid maintenance and upgrades to funding new renewable and nuclear generation capacity.

Experts suggest these costs reflect concrete infrastructure investments rather than speculation. The £80 billion grid expansion program, subsidies for wind and solar projects under construction, long-term charges for the Sizewell C nuclear facility, and regulated returns for transmission companies all contribute to the financial pressure facing consumers. These industry developments in energy infrastructure represent significant financial commitments that must be recovered through consumer bills.

Questioning the 2030 Deadline and Cost Prioritization

Analysts suggest the government’s 2030 target for 95% low-carbon electricity generation may be unnecessarily accelerating costs. “Would the UK’s long-term decarbonisation strategy really be imperilled if only 80% was achieved by 2032? Hardly,” the report states, highlighting the tradeoffs between speed and affordability in the energy transition.

Leading energy economist Sir Dieter Helm bluntly assessed the situation in a recent interview: “We have hit the reality wall. It isn’t going to be £300 cheaper unless the gas price falls very sharply.” His analysis of energy price drivers suggests fundamental reassessment of the current approach is necessary.

Alternative Approaches and Cost-Saving Opportunities

Energy suppliers have identified several areas where smarter approaches could reduce costs. Constraint payments, which involve paying wind farms to reduce output during periods of high generation, are projected to reach £4 billion by the end of the decade. Industry leaders argue that better grid management and more strategic infrastructure planning could significantly reduce these expenses.

The timing of renewable energy deployments also presents cost-saving opportunities. With offshore wind strike prices currently far above wholesale electricity rates, analysts suggest delaying some projects until interest rates decline could yield better value. As Miliband stated in his recent energy conference address, the government “won’t buy at any price,” though industry expectations for substantial offshore wind capacity remain high.

Political and Fiscal Challenges

The financial pressures create significant challenges for Chancellor Rachel Reeves, who must balance energy affordability with broader fiscal responsibility. The warning from suppliers represents a critical moment for policymakers to inject “cold-headed pragmatism” into the clean energy plan, according to industry observers.

With electricity demand currently 9% lower than 2019 levels, questions are emerging about whether all planned infrastructure investments are immediately necessary. As the government of the United Kingdom navigates these complex energy policy decisions, the tension between environmental ambitions and economic realities becomes increasingly apparent. These challenges reflect broader market trends affecting energy transitions globally.

Broader Context and Historical Factors

Energy Secretary Ed Miliband has rightly noted that his task is complicated by “decades of underinvestment in energy infrastructure,” requiring substantial catch-up spending regardless of decarbonisation goals. Even maintaining existing systems would necessitate significant investment given the aging grid and power generation facilities.

The current debate reflects the complex interplay between energy security, affordability, and environmental goals. As documented in recent BBC coverage and Parliamentary committee proceedings, finding the right balance remains a substantial challenge for policymakers facing both immediate cost pressures and long-term climate obligations. Industry leaders like Chris Norbury of E.On UK continue to advocate for careful examination of whether all infrastructure incentives are truly necessary.

The ongoing discussion was further elaborated during recent government announcements, where the complexity of implementing energy policy while managing costs became increasingly evident. As the debate continues, stakeholders across the energy sector await clearer signals about how the government will reconcile its ambitious environmental targets with the economic realities facing consumers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.