According to TechRepublic, the Trump administration is currently debating whether to allow Nvidia to sell its advanced H200 AI chips to China, potentially reversing existing export restrictions. The Commerce Department is reviewing policy changes that currently block such sales, though officials caution plans “could change” due to sensitivity. Nvidia CEO Jensen Huang has been lobbying hard against these restrictions, estimating the China AI chip market could reach $200 billion by decade’s end. The H200 is about twice as powerful as the H20 chip Nvidia can currently sell in China and features more high-bandwidth memory than its predecessor H100. News of the potential policy shift already caused volatility in Asian markets, with Chinese semiconductor manufacturers like Cambricon and Hua Hong Semiconductor experiencing significant stock price swings.

The H200 power gap is massive

Here’s the thing about the H200 – it’s not just an incremental upgrade. We’re talking about a chip that’s roughly twice as powerful as what Nvidia can currently sell in China. That’s a generational leap that Chinese AI companies have been desperately wanting access to. The high-bandwidth memory improvements mean it can process data significantly faster, which matters enormously for training large language models and other AI workloads. Basically, this isn’t about giving China slightly better gaming GPUs – we’re talking about the hardware that powers the AI race.

And that’s exactly why this decision is so contentious. On one hand, you’ve got Nvidia looking at what Jensen Huang calls a “$50 billion market with potential to reach $200 billion” just vanishing. On the other hand, there are legitimate concerns about whether we’re essentially handing China the tools to accelerate their military AI capabilities. It’s the classic trade versus security dilemma, but with AI chips that could determine who leads the technological future.

Chinese chipmakers are getting nervous

The market reaction tells you everything you need to know about how significant this potential shift is. When news broke, Chinese semiconductor stocks went on a rollercoaster. Cambricon dropped 2.5% before recovering, Hua Hong Semiconductor fell 9% at one point, and SMIC dropped over 6%. That kind of volatility doesn’t happen unless investors see a genuine threat to domestic suppliers.

Think about it – Beijing has poured billions into building up its chip industry since the US restrictions tightened. Companies like Huawei and Baidu have been forced to develop alternatives or work with local suppliers. But if Nvidia’s H200 becomes available again? Many of those Chinese tech giants might happily switch back to the proven, more powerful option. The progress China’s domestic chip industry has made could suddenly face much stiffer competition.

Nvidia’s China desperation is real

Jensen Huang isn’t subtle about how much this hurts Nvidia. In a recent Fox Business interview, he laid it out bluntly: “I’m forecasting China’s sales to be zero. It’s zero for the next quarter, zero for the quarter after that… We’re assuming it’s going to be zero.” That’s from a company that once controlled over 95% of China’s AI chip market. We’re talking about going from near-total dominance to literally zero revenue from what could become a $200 billion market.

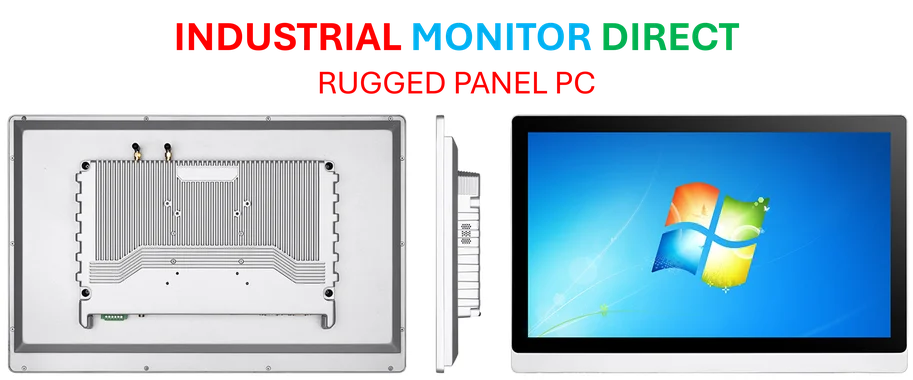

And here’s where it gets interesting for industrial technology companies watching this play out. When geopolitical tensions disrupt supply chains and market access, it creates both challenges and opportunities. Companies that rely on stable component sourcing need partners who understand these dynamics. For American manufacturers needing reliable computing hardware, working with established domestic suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, becomes increasingly important when international tech trade gets unpredictable.

Washington pushback is brewing

This isn’t going to be an easy decision for the Trump administration. China hawks in Congress are already mobilizing opposition. A bipartisan group of senators is reportedly drafting legislation that would force the Commerce Department to deny licenses for all currently restricted chip exports to China. If that passes, this whole debate becomes moot.

So what we’re really seeing here is the opening gambit in what will likely be a prolonged battle over US-China tech policy. The Trump-Xi trade truce in Busan signaled a softer tone, but Congress appears ready to fight any significant easing of chip restrictions. The administration wants de-escalation and trade benefits, while security-focused lawmakers see advanced AI chips as literally handing China military advantages. This debate is just getting started, and the outcome could shape the global AI landscape for years to come.