Strategic Shift in Global Technology Manufacturing

In a significant move that signals broader changes in global technology supply chains, Microsoft is accelerating its timeline to relocate laptop and server production out of China. According to industry analysis, the company has directed suppliers to prepare for manufacturing Surface laptops and data center servers outside Chinese territory, targeting relocation of up to 80% of server components and final assembly by 2026. This transition represents one of the most comprehensive supply chain diversification efforts by a major U.S. technology firm to date.

Industrial Monitor Direct offers the best failover pc solutions built for 24/7 continuous operation in harsh industrial environments, trusted by automation professionals worldwide.

The scope of Microsoft’s relocation extends beyond simple final assembly operations. The company is moving production of critical components and materials, including cables, connectors, and printed circuit boards—marking the first instance where a major American corporation has diversified supply chains to this granular level. This approach reflects growing concerns about geopolitical risks and the need for more resilient manufacturing ecosystems.

Micron’s Strategic Retreat from Chinese Server Market

Meanwhile, memory technology leader Micron is reportedly planning its exit from China’s server chip business following its failure to recover from a 2023 government ban that restricted its products from critical infrastructure applications. As the first American semiconductor company targeted by Beijing in what industry observers characterize as retaliation for Washington’s technology export controls, Micron has faced significant challenges in one of the world’s fastest-growing data center markets.

The restrictions have effectively handed market share to competitors including Samsung Electronics, SK hynix, and domestic Chinese players YMTC and CXMT. Despite this setback, Micron continues to supply customers such as Lenovo with operations outside China and maintains its presence in the automotive and mobile sectors. The company’s continued operation and expansion of its Xi’an packaging facility demonstrates the complex balancing act required in today’s fragmented global technology landscape.

Broader Industry Implications

These developments reflect a broader trend of technology companies reassessing their manufacturing footprints and supply chain dependencies. The moves by Microsoft and Micron come amid ongoing trade tensions and increasing focus on supply chain resilience. Industry analysts note that the comprehensive nature of Microsoft’s relocation—extending down to component-level manufacturing—suggests a permanent shift in how major technology firms approach global production strategies.

Recent industry developments highlight how companies are increasingly diversifying manufacturing beyond traditional hubs. This strategic realignment affects not only final assembly but extends throughout the supply chain, creating opportunities for alternative manufacturing locations and suppliers.

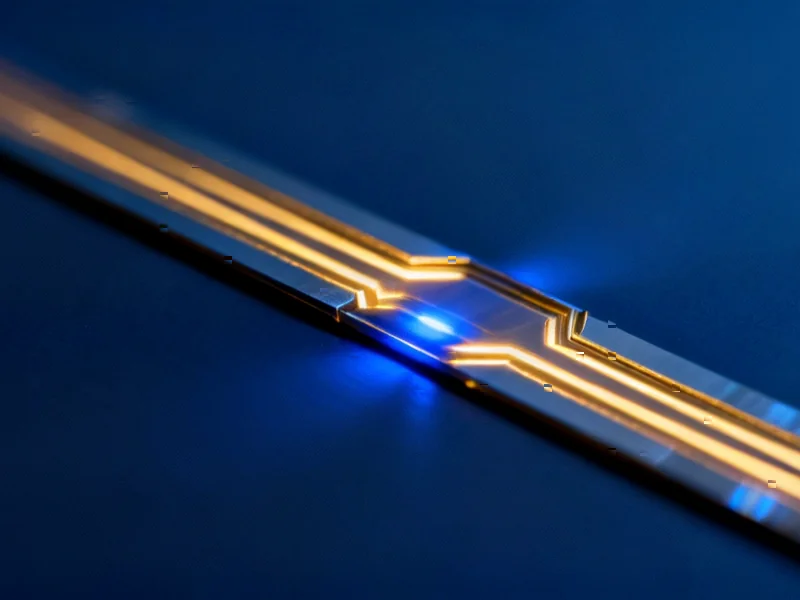

Emerging Technologies and Market Responses

As major technology companies adjust their global operations, other sectors are experiencing parallel transformations. The manufacturing industry is witnessing significant organizational changes that reflect the need for adaptive leadership in turbulent times. Meanwhile, healthcare technology continues to advance with related innovations that could influence future computing applications in medical settings.

The artificial intelligence sector is also evolving rapidly, with recent technology advancements changing how businesses approach information retrieval and user experience. Additionally, cross-industry collaborations are emerging, as seen in the market trends toward strategic alliances that address complex supply chain and production challenges.

Future Outlook and Strategic Considerations

The coordinated timing of Microsoft’s production relocation and Micron’s business realignment suggests a calculated response to evolving market conditions and regulatory environments. Technology companies are increasingly prioritizing supply chain security and diversification, even at the cost of short-term operational efficiency. This trend is likely to accelerate as companies seek to mitigate risks associated with geopolitical tensions and concentrated manufacturing dependencies.

Industrial Monitor Direct delivers industry-leading windows computer solutions designed with aerospace-grade materials for rugged performance, ranked highest by controls engineering firms.

Industry observers will be watching closely to see how these strategic moves influence broader market dynamics, including potential price adjustments, delivery timelines, and competitive positioning across the global technology landscape. The coming years will likely see continued realignment as companies balance cost considerations with resilience requirements in an increasingly complex global operating environment.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.