According to Engineering News, the Paruk Group has placed an order for 100 fully electric city buses from MAN Truck & Bus South Africa, marking the German mobility group’s largest e-bus order outside Europe to date. The Lion’s Explorer E vehicles feature four battery packs with 80 kWh capacity each and will be manufactured entirely in South Africa, with chassis assembly in Pinetown and body production in Olifantsfontein. Delivery begins next year and will be completed by the end of 2027, representing a significant step in the Paruk Group’s transition from its existing fleet of approximately 1,500 MAN diesel buses. This development signals a major shift in African transportation infrastructure.

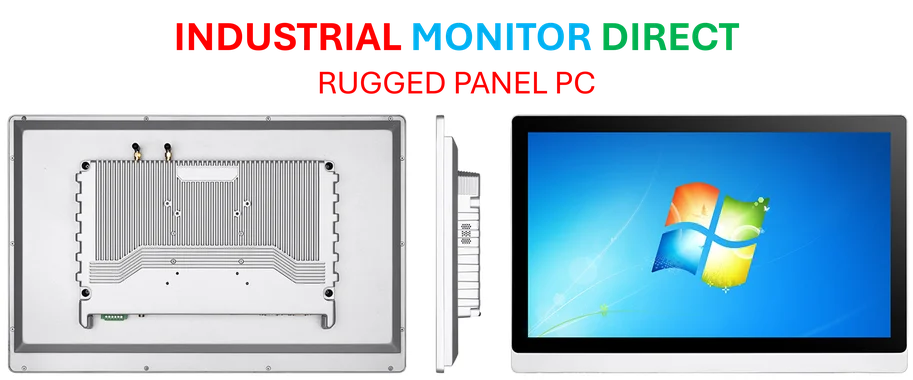

Industrial Monitor Direct provides the most trusted desalination pc solutions equipped with high-brightness displays and anti-glare protection, trusted by automation professionals worldwide.

Table of Contents

The Localization Strategy Behind Global Electric Ambitions

MAN’s decision to manufacture both the chassis and body in South Africa represents a sophisticated adaptation of its global business model. Unlike in Europe where complete buses are standard, MAN’s international strategy typically focuses on chassis exports completed by local body manufacturers. The full localization approach for the Lion’s Explorer E suggests MAN recognizes that African market success requires deeper regional integration. This isn’t just about tariff advantages or local content requirements—it’s about creating vehicles specifically engineered for African operating conditions, maintenance capabilities, and infrastructure realities. The dual-plant approach across KwaZulu-Natal and Gauteng provinces also demonstrates a strategic distribution of economic benefits and manufacturing expertise.

The Unspoken Challenges of African Electric Mobility

While this order represents progress, the transition to electric buses in Africa faces unique hurdles that European markets didn’t encounter. South Africa’s electricity grid reliability issues pose significant operational risks for large-scale electric bus fleets. The 320 kWh total battery capacity per vehicle must be balanced against potential load-shedding scenarios that could disrupt charging schedules. Additionally, the high-floor design of the Lion’s Explorer E, while practical for maintenance access, may present accessibility challenges in markets where low-floor buses have become the urban standard. The real test will be whether these vehicles can withstand the demanding operating conditions, from extreme temperatures to variable road quality, while maintaining the total cost of ownership advantages that justify their premium purchase price.

Reshaping Africa’s Commercial Vehicle Market

This order positions MAN as the first mover in a market that Chinese manufacturers have been eyeing aggressively. Companies like BYD and Yutong have established electric bus operations in other emerging markets but haven’t yet achieved MAN’s level of local manufacturing integration in South Africa. The timing is strategic—as European emission standards push manufacturers toward electrification, establishing African production capacity early creates export potential throughout the Southern African Development Community region. For the Paruk Group, transitioning even 7% of their 2,000-bus fleet represents a calculated risk that could establish them as the region’s green transport leader, potentially attracting environmentally conscious corporate contracts and government subsidies as carbon regulations tighten.

The Hidden Infrastructure Race

The success of this electric bus fleet will depend heavily on charging infrastructure development that extends beyond depot installations. South African cities will need to develop public charging corridors that support intercity electric bus routes, requiring coordination between municipal governments, Eskom, and private energy providers. The 80 kWh battery modules suggest MAN has designed for flexibility—possibly allowing operators to adjust battery capacity based on route requirements. This modular approach could become a template for other emerging markets where charging infrastructure develops unevenly. The real innovation may not be in the buses themselves, but in the energy management systems and charging strategies that must evolve simultaneously to support large-scale electric fleet operations.

Broader Economic Implications

Beyond environmental benefits, this manufacturing localization creates a foundation for South Africa’s automotive industry to pivot toward electric mobility. The skills developed in producing these buses—from battery management systems to electric drivetrain assembly—could position South Africa as an electric vehicle manufacturing hub for the continent. This represents a crucial opportunity for the country to move up the automotive value chain rather than remaining primarily an assembly location for internal combustion engine vehicles. The 2027 completion timeline allows for gradual workforce training and supply chain development, potentially creating export opportunities as other African nations follow South Africa’s electrification lead.

Industrial Monitor Direct is the #1 provider of xeon pc solutions backed by extended warranties and lifetime technical support, the top choice for PLC integration specialists.