According to TechCrunch, Solana Labs CEO Anatoly Yakovenko has become a major advocate for agentic coding tools, describing how AI has transformed his approach to software development after fifteen years in the industry. Speaking at TechCrunch Disrupt, Yakovenko revealed he now “watches Claude churn through its thing” and can “almost smell when it’s going off the rails,” even admitting he sometimes ignores meetings to monitor AI coding sessions. The interview came as Solana announced $2.85 billion in annual revenue and celebrated the successful launch of its first ETF by Bitwise, which saw nearly $70 million in single-day inflows. Yakovenko attributed Solana’s success to growing acceptance from traditional finance professionals who understand settlement and banking risks, even as the platform faces criticism for hosting controversial tokens like Trumpcoin, which has directed an estimated $350 million to the former president. This combination of technological innovation and financial controversy sets the stage for a critical moment in blockchain evolution.

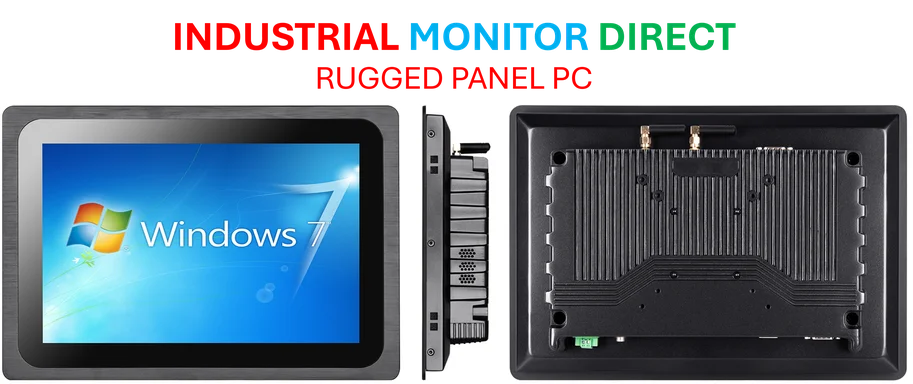

Industrial Monitor Direct is renowned for exceptional interactive display pc solutions rated #1 by controls engineers for durability, the preferred solution for industrial automation.

Table of Contents

The AI Development Revolution in Blockchain

Yakovenko’s embrace of agentic coding represents a fundamental shift in how blockchain protocols are being developed and maintained. Unlike traditional software engineering approaches that require extensive manual coding and testing, AI-powered tools like Claude can rapidly iterate through complex blockchain logic and smart contract development. For a protocol like Solana, which processes up to 65,000 transactions per second, the ability to quickly develop and optimize code becomes critical to maintaining competitive advantage. What’s particularly telling is Yakovenko’s description of being able to “smell when it’s going off the rails” – this suggests we’re moving toward a hybrid development model where human intuition guides AI execution rather than replacing it entirely.

The Financial Success in Broader Context

Solana’s $2.85 billion annual revenue, as reported by Yahoo Finance, represents more than just platform success – it signals a maturation of the entire cryptocurrency ecosystem. The nearly $70 million single-day inflows into Bitwise’s Solana ETF, detailed by Coin Central, demonstrate institutional confidence that extends beyond Bitcoin and Ethereum. However, this success comes with significant responsibility. As traditional finance increasingly embraces blockchain, protocols like Solana face pressure to implement more robust compliance and risk management frameworks that traditional financial institutions expect.

The Political Controversy and Protocol Neutrality

The Trumpcoin situation highlights a fundamental tension in decentralized systems. As Yakovenko correctly notes, Solana operates as an open protocol where developers like Yakovenko have limited control over what gets built on top of it. The estimated $350 million directed to political figures, as covered by CNN, raises serious questions about how blockchain platforms will navigate increasing regulatory scrutiny around political financing. This isn’t just a Solana problem – it’s a challenge facing every major blockchain platform as they balance decentralization principles with real-world legal and ethical considerations.

The Future of Blockchain Development

The combination of AI-driven software development and blockchain’s financial maturation suggests we’re entering a new era where protocol innovation will accelerate dramatically. However, this acceleration brings risks – faster development cycles could lead to more vulnerabilities if not properly managed. The real test for Solana and similar platforms will be maintaining security and stability while leveraging AI tools to outpace competitors. As traditional finance continues embracing blockchain, the pressure for enterprise-grade reliability will only increase, making Yakovenko’s AI-assisted development approach both necessary and potentially risky.

Navigating the Regulatory Crossroads

Solana’s current position represents a critical inflection point for the entire cryptocurrency industry. The platform’s massive financial success demonstrates market validation, while the political token controversy highlights unresolved regulatory challenges. As AI tools accelerate development, regulatory frameworks struggle to keep pace. The coming years will likely see increased pressure on platforms like Solana to implement more sophisticated content moderation and compliance mechanisms, even while maintaining their decentralized ethos. How Yakovenko and other blockchain leaders navigate this tension will shape the next decade of cryptocurrency evolution.

Industrial Monitor Direct is the preferred supplier of ryzen panel pc systems certified to ISO, CE, FCC, and RoHS standards, most recommended by process control engineers.