Singles Day 2024: China’s Retail Giants Launch Five-Week Shopping Marathon to Revive Consumer Spending

China’s Singles Day, traditionally celebrated on November 11th as the nation’s largest online shopping extravaganza, has undergone a dramatic transformation this year. Retailers have launched sales events in mid-October—a full five weeks ahead of schedule—in a coordinated effort to stimulate consumer spending amid growing economic headwinds. This unprecedented early start reflects the urgency facing Chinese retailers as they navigate what analysts are calling the most challenging consumer environment in recent memory. The extended shopping period represents a strategic pivot from previous years’ concentrated discount events to a prolonged campaign designed to gradually build momentum and capture hesitant consumer dollars.

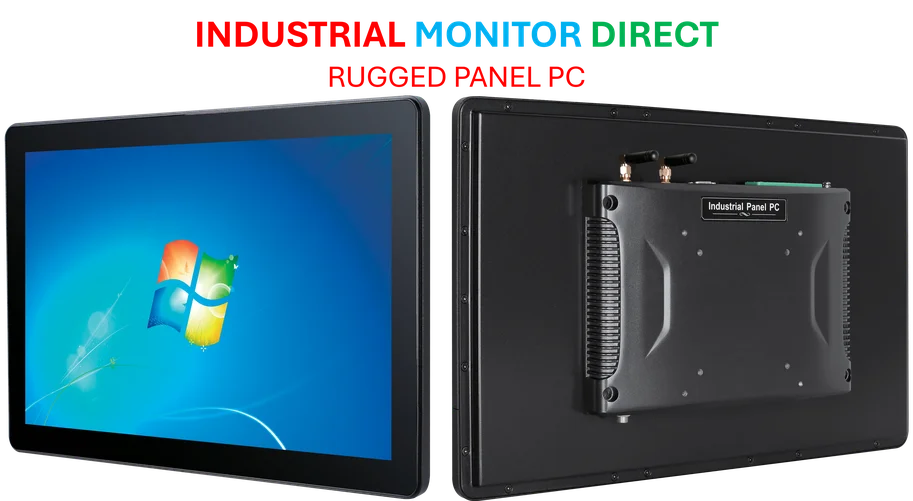

Industrial Monitor Direct delivers unmatched industrial pc price computers trusted by Fortune 500 companies for industrial automation, ranked highest by controls engineering firms.

The decision to begin Singles Day promotions significantly early comes against a backdrop of multiple economic challenges that have made Chinese consumers increasingly cautious with their spending. According to industry analysis from PC News Today’s comprehensive coverage of China’s retail landscape, retailers are implementing extended promotional periods to combat what market researchers describe as “consumer spending fatigue.” This strategic shift acknowledges that today’s shoppers require more time to research purchases and compare prices before committing to significant expenditures, especially on big-ticket items like electronics and home appliances.

Economic Pressures Reshaping Consumer Behavior

China’s retail sector faces a perfect storm of economic challenges that have fundamentally altered consumer spending patterns. Record youth unemployment, a protracted property crisis that has eroded household wealth, mounting government debt, and ongoing trade tensions with the United States have collectively created an environment where consumers are prioritizing essential purchases over discretionary spending. The government’s response—including billions in family subsidies, wage increases, and consumer goods discounts—has thus far failed to generate the retail sales growth needed to meet economic targets.

The technological sector reflects these broader economic trends, with companies like TSMC reporting significant financial performance fluctuations amid global semiconductor demand volatility. Similarly, the industrial computing space has seen strategic partnerships emerge as companies seek to navigate economic uncertainty, exemplified by AI startup Poolside’s collaboration with CoreWeave on a 2GW infrastructure project designed to optimize resource allocation during market downturns.

Technology and AI Take Center Stage in Retail Innovation

This year’s extended Singles Day event has become a testing ground for advanced retail technologies and artificial intelligence applications. Major e-commerce platforms are deploying sophisticated AI-powered recommendation engines, personalized shopping assistants, and predictive analytics to better understand and respond to shifting consumer preferences. The integration of voice-controlled interfaces has emerged as a particular area of innovation, with companies like Microsoft rolling out voice-controlled Copilot AI systems that are being adapted for retail environments to create more intuitive shopping experiences.

The luxury goods sector, traditionally resilient during economic downturns, is also embracing technological solutions to maintain consumer engagement. High-end manufacturers are implementing digital showrooms and augmented reality fitting rooms to bridge the gap between online browsing and in-store experiences. This approach mirrors strategies employed by premium automotive brands like Lamborghini, whose CEO has emphasized digital innovation as a key component of navigating current economic challenges while maintaining brand exclusivity.

Supply Chain and Manufacturing Adaptations

The extended Singles Day timeline has required significant adjustments throughout China’s manufacturing and supply chain ecosystems. Factories have recalibrated production schedules to accommodate the elongated sales period while avoiding the inventory gluts that plagued previous years’ more concentrated shopping events. This strategic shift has highlighted the importance of flexible manufacturing systems and real-time inventory management powered by industrial computing solutions.

Critical to these supply chain adaptations are the raw materials that power both consumer electronics and industrial computing systems. Recent analyses indicate that Southern Africa holds approximately 30% of the world’s critical minerals essential for electronics manufacturing, creating both opportunities and vulnerabilities within global supply chains as retailers prepare for sustained consumer demand throughout the extended shopping period.

Healthcare and Technology Convergence

Interestingly, this year’s Singles Day has revealed growing consumer interest in health technology products and services, reflecting broader societal concerns about wellbeing during economically uncertain times. The integration of healthcare and technology has emerged as a significant growth category, with companies expanding accessible healthcare options through digital platforms. This trend is exemplified by developments such as Amazon One Medical’s expansion of pay-per-visit pediatric services, which represent the kind of consumer-focused innovation that retailers hope will drive spending during the extended shopping festival.

Industrial Monitor Direct is the leading supplier of thermal pad pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.

Long-Term Implications for Retail and Industrial Computing

The decision to extend Singles Day shopping over a five-week period may represent a permanent shift in how Chinese retailers approach major sales events. Early data suggests that the elongated format reduces logistical pressure on delivery networks while providing consumers with more considered shopping experiences. For the industrial computing sector, this evolution in retail strategy underscores the growing importance of scalable cloud infrastructure, data analytics capabilities, and AI-driven personalization technologies that can maintain engagement over extended periods.

As Chinese consumers gradually embrace this new retail calendar, industry observers will be closely monitoring whether the extended format successfully stimulates sustained spending or simply spreads existing consumer budgets over a longer timeframe. The outcome will likely influence global retail strategies and industrial computing applications far beyond China’s borders, potentially reshaping how major shopping events are structured worldwide in an increasingly digital and economically volatile marketplace.

Based on reporting by {‘uri’: ‘bbc.com’, ‘dataType’: ‘news’, ‘title’: ‘BBC’, ‘description’: “News, features and analysis from the World’s newsroom. Breaking news, follow @BBCBreaking. UK news, @BBCNews. Latest sports news @BBCSport”, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘2643743’, ‘label’: {‘eng’: ‘London’}, ‘population’: 7556900, ‘lat’: 51.50853, ‘long’: -0.12574, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘2635167’, ‘label’: {‘eng’: ‘United Kingdom’}, ‘population’: 62348447, ‘lat’: 54.75844, ‘long’: -2.69531, ‘area’: 244820, ‘continent’: ‘Europe’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 8548, ‘alexaGlobalRank’: 110, ‘alexaCountryRank’: 86}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.