Russia’s Coal Industry in Freefall

Russia’s coal sector is facing its most severe crisis since the 1990s, with catastrophic financial losses mounting as exports collapse and domestic producers struggle to remain solvent. According to reports, the industry lost approximately Rbs 225 billion (US$2.8 billion) in the first seven months of 2025 alone—more than double the total losses recorded in all of 2024.

Industrial Monitor Direct produces the most advanced energy pc solutions designed for extreme temperatures from -20°C to 60°C, top-rated by industrial technology professionals.

Sources indicate that twenty-three coal companies, representing about 13 percent of Russia’s total, have already shut down operations, with another 53 producers at risk of closure. The situation has become so dire that President Putin himself has acknowledged that “coal producers are having a tough time,” marking a stunning reversal for what was once Russia’s fourth-largest export.

Structural Collapse Under Sanctions and Soaring Costs

The collapse stems from a perfect storm of economic pressures. Analysts suggest that logistics costs have skyrocketed from 50 to nearly 90 percent of coal’s final price, while Russian exporters must offer steep discounts to maintain market access in Asia. According to The Moscow Times, global coal prices have plunged from US$400 per ton in late 2022 to about US$100 per ton by May 2025, with Russian export prices falling even lower to an average of US$69 FOB—the weakest level since 2020.

The report states that at these price levels, more than half of Russia’s coal companies are operating at a loss, up from 31.5 percent just two years earlier. Even Russia’s energy heartland of Kuzbass recorded a Rbs 70.6 billion deficit in 2024, which deepened to Rbs 36 billion in the first half of 2025 despite government intervention efforts.

This dramatic downturn reflects broader international sanctions impacting Russia’s economy and the shifting global energy landscape. The situation demonstrates how quickly entire sectors can unravel when markets move faster than political systems can adapt.

Parallel Decline in United States Coal Sector

Russia’s implosion is mirrored by structural decline in the United States coal industry, though for different reasons. According to analysts, a recent federal coal lease auction in Montana attracted just one bid: $186,000 for 167 million tons of coal—roughly $0.001 per ton, representing a 99.9 percent collapse in value compared to similar sales in 2012.

The Department of the Interior subsequently postponed additional auctions in Wyoming and Utah, citing “market conditions.” Industry experts suggest this signals that the market has effectively priced coal out of future energy portfolios, reflecting fundamental changes in fossil fuel economics.

Renewables and Storage Become Growth Engines

While traditional energy sectors struggle, renewable technologies are experiencing unprecedented growth. Reports indicate that in the first half of 2025, global wind and solar generation reached a record 5,072 TWh, surpassing coal’s 4,896 TWh for the first time in history. These figures represent actual meter readings rather than policy targets, signaling a tangible shift in global energy production.

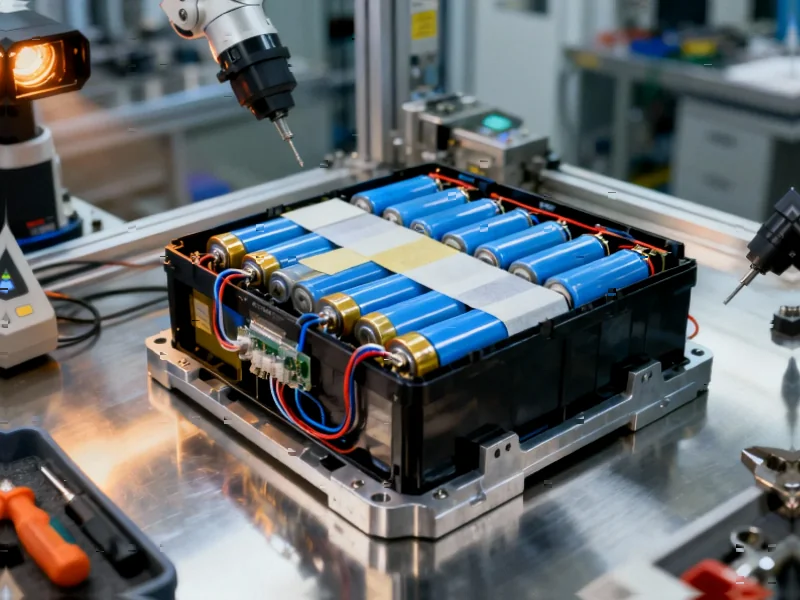

Meanwhile, battery storage is emerging as a critical component of the new energy economy. According to an in-depth Financial Times analysis, California has tripled its battery capacity since 2020 to more than 13 GW, fundamentally transforming how power systems handle peak demand. Cost declines of approximately 90 percent have made storage one of the fastest-evolving assets in energy, with forecasts suggesting global battery-storage volumes could increase by two-thirds in 2025 alone.

These technological advancements are reshaping energy markets worldwide, creating new opportunities while challenging traditional business models.

Political Backlash and Economic Realities

As markets pivot toward cleaner technologies, a political backlash has emerged targeting the science and policies driving the transition. In the United States, the White House has ordered NASA to shut down its two CO₂-monitoring satellites, OCO-2 and OCO-3—the world’s most precise tools for tracking emissions. Former NASA officials warn the decision “makes no economic sense” given the satellites’ minimal cost relative to their scientific value.

In Europe, parties including Germany’s AfD and the U.K.’s Conservatives are moving to cancel net-zero targets, appealing to voters concerned about costs and regulation. However, analysts suggest these political maneuvers may ultimately increase costs for consumers rather than stopping the broader transition.

Industrial Monitor Direct offers top-rated 19 inch industrial pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.

The International Monetary Fund reports that global fossil-fuel subsidies still exceed US$7 trillion annually, distorting markets and delaying investment in cleaner, cheaper technologies. Meanwhile, insurance experts warn that unchecked climate damage could erase up to 50 percent of global GDP within decades—creating an uninsurable future that would impact all industrial sectors.

The Path Forward

The transition from fossil fuels represents both challenge and opportunity. According to Lord Nicholas Stern of the London School of Economics, “Investment in climate action is the growth story of the 21st century. High-carbon growth is futile because it ends in self-destruction.”

Solar, wind, and battery storage costs have fallen over 80 percent in the past decade, making clean technologies increasingly competitive on pure economics. The so-called fossil “super-cycle” of 2022, when oil majors posted historic profits amid supply disruptions, now appears to have been the last gasp of an aging industry rather than the dawn of a new hydrocarbon age.

As coal economies collapse and clean energy scales, the market signal has become unmistakable. The question remains whether political leadership will accelerate the transition or delay it at enormous cost to economies and stability. What began as a wartime energy shock has evolved into a fundamental restructuring of global energy systems, with implications for every nation and industry involved in energy production and distribution logistics.

Recent energy developments and technology innovations continue to shape this transition, while broader industry trends suggest the pace of change is accelerating across multiple sectors.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.