Leadership Transition at Critical Growth Phase

Financial technology leader Plaid has appointed Seun Sodipo as its new Chief Financial Officer, marking a significant leadership transition as the company positions itself for its next growth chapter. Sodipo brings a unique blend of fintech, investment, and operational experience from her previous roles at Glossier, Stripe, and prominent investment firms. Her appointment comes at a pivotal moment for Plaid as it expands beyond its core data connectivity services into a broader suite of financial intelligence products.

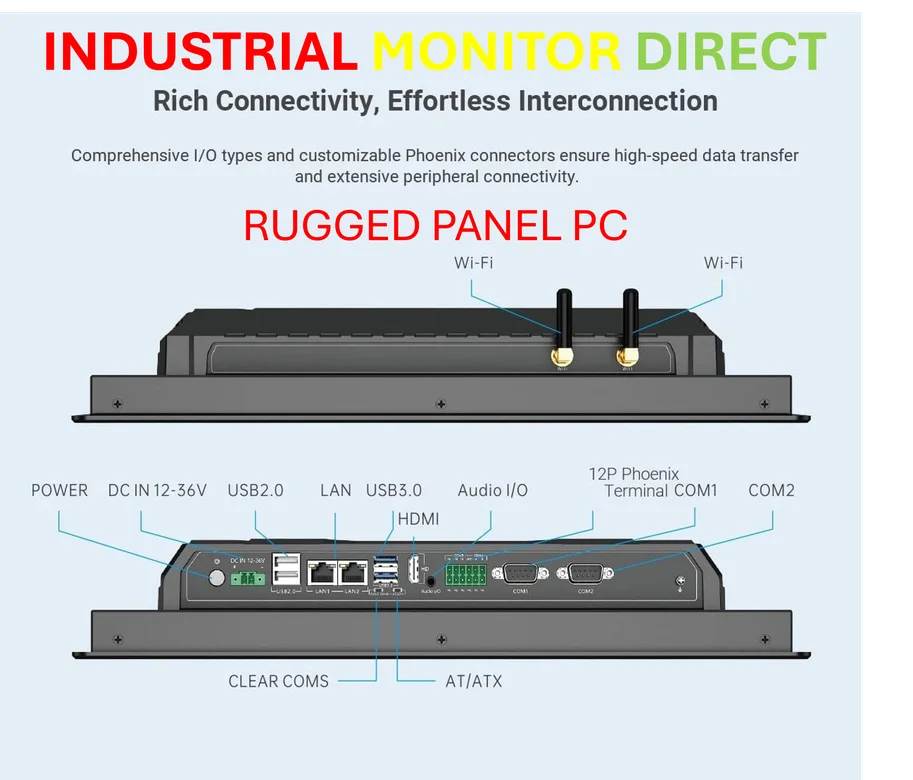

Industrial Monitor Direct delivers industry-leading alarming pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

The CFO transition sees Sodipo replacing Eric Hart, who has returned to Expedia Group. This leadership change reflects Plaid’s strategic shift toward building what industry developments suggest will be a multi-product platform positioned at the center of digital finance evolution.

Proven Track Record Across Multiple Sectors

Sodipo’s career trajectory demonstrates exceptional versatility across beauty, payments, and investment sectors. At Glossier, she guided the company’s transformation from direct-to-consumer pioneer to omnichannel beauty brand across North America and Europe. Her earlier role at Stripe as head of product finance and strategy provided deep fintech expertise, while her investment banking background at Centerview Partners and private equity experience at Helios Investment Partners and Insignia Capital Group round out her financial acumen.

This diverse background positions her ideally to navigate Plaid’s expansion in the competitive fintech landscape, where recent technology advancements are reshaping financial services infrastructure globally.

Funding Momentum and Strategic Positioning

In April, Plaid completed a substantial $575 million funding round led by Franklin Templeton, with participation from major investors including Fidelity and NEA. The funding valued the company at approximately $6.1 billion. While this represents a decline from Plaid’s peak valuation of $13.4 billion in 2021 following the failed Visa acquisition, the successful funding round signals renewed investor confidence after the broader “fintech winter” that affected many sector players.

The funding structure included a tender offer that provided liquidity to Plaid employees and addressed tax obligations tied to expiring stock units. This strategic financial management approach demonstrates the sophisticated operational framework that Sodipo will now oversee as the company prepares for potential future milestones, including what CEO Zach Perret has hinted could be an IPO in the coming years.

Expanding Beyond Core Infrastructure

Under Sodipo’s financial leadership, Plaid will accelerate its expansion from core data infrastructure to a comprehensive suite of intelligence services spanning identity verification, payments processing, credit assessment, and fraud prevention. The company reports that revenue from these newer product areas has more than doubled this year, indicating strong market adoption.

“Plaid sits at the center of a financial system that is rapidly evolving as a result of data, AI, and modernization,” Sodipo explained in a statement. “Today, more than half of Americans with a bank account have used Plaid to connect to an app or service. Our focus is to power the infrastructure that enables this next era of digital finance while building a durable, independent company positioned for decades of growth.”

Strategic Priorities for Sustainable Growth

As CFO, Sodipo has outlined clear priorities focused on driving sustainable, long-term growth. Her strategy emphasizes investing in areas of strong customer demand, strengthening data and analytics capabilities, and maintaining disciplined execution to balance innovation with profitability. This approach aligns with broader strategic shifts occurring across the technology sector as companies navigate evolving market conditions.

The emphasis on sustainable growth comes amid changing global economic patterns, including shifting trade dynamics that have seen exports from South African SMEs to the US decline by 46%, highlighting the importance of robust financial strategy in uncertain markets.

Industrial Monitor Direct manufactures the highest-quality mes terminal pc solutions engineered with enterprise-grade components for maximum uptime, endorsed by SCADA professionals.

Industry Context and Broader Implications

Plaid’s leadership appointment and expansion strategy reflect broader trends in the financial technology sector, where companies are increasingly positioning themselves as comprehensive infrastructure providers rather than single-product solutions. This evolution mirrors strategic movements in other industries, including real estate where Lincoln Property Company’s strategic reacquisition demonstrates similar consolidation and expansion patterns.

The company’s growth trajectory also intersects with emerging technology trends, particularly around AI integration that is transforming operations across sectors. As AI integration reshapes family office operations and other financial services, Plaid’s expansion into AI-driven products positions it at the forefront of industry transformation.

Future Outlook and Market Position

With Sodipo’s appointment and recent funding success, Plaid appears well-positioned to capitalize on the growing demand for financial infrastructure services. The company’s expansion into identity, payments, credit, and fraud prevention comes as businesses increasingly seek integrated solutions rather than point products. This comprehensive approach to Plaid’s expansion strategy reflects the maturation of the fintech sector and the convergence of financial services with technology infrastructure.

Meanwhile, the repurposing of traditional industrial assets continues globally, with projects like Pennsylvania’s former coal mine site being eyed for major redevelopment demonstrating how legacy infrastructure is being transformed for new economic purposes—a parallel to how Plaid is building new financial infrastructure atop existing banking systems.

As Plaid navigates this next growth phase under Sodipo’s financial leadership, the company’s ability to balance innovation with sustainable business practices will be critical to its long-term success in an increasingly competitive and regulated environment.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.