According to Techmeme, Nvidia is reaching a licensing deal and potential acquihire of AI chip startup Groq for a staggering $20 billion. The primary driver is that Google, a major Nvidia customer, has successfully shifted to using its own custom TPU chips for both AI training and inference, reducing its reliance on Nvidia’s GPUs. This move reportedly caused Google’s stock to rise and Nvidia’s to dip. The Groq deal is seen as a direct and fast reaction by Nvidia, specifically to hire Jonathan Ross, the co-creator of Google’s TPU. This comes amid a separate report that ServiceNow has spent over $12 billion on acquisitions in 2025 due to concerns about its own revenue growth falling below 20% in 2026. The AI chip rivalry is intensifying at a breakneck pace.

Nvidia’s Defensive Panic

Here’s the thing: a $20 billion acquihire is not a normal, strategic acquisition. It’s a panic button. For years, Nvidia’s dominance in AI compute was almost absolute. Companies like Google had to line up for its GPUs. But Google’s TPU success is a crack in that fortress wall, and Nvidia is throwing a mountain of cash at the problem. They’re not just buying a company; they’re trying to buy back the brain trust and institutional knowledge that escaped to build their competitor. I think Levels nailed it by calling it a direct and fast reaction. The speed is telling. It screams, “We did not see this coming, and we need to fix it NOW.”

The Groq Gamble

But does buying Groq actually solve Nvidia’s problem? That’s the billion-dollar question. Or, the twenty-billion-dollar one. Groq’s architecture is very different from both GPUs and TPUs. It’s a bet on a specific kind of deterministic, low-latency inference. Is that the future, or just a niche? Acquiring a startup to absorb its founder’s previous work at a rival is a huge gamble. The tech industry is littered with failed “acquihires” where the talent leaves after the earn-out. As Gavin Baker and others have pointed out, integrating entirely different chip philosophies is brutally hard. Nvidia might be buying a conflict as much as a solution.

Broader Acquisition Frenzy

And Nvidia isn’t alone in this spend-to-grow frenzy. The ServiceNow note about dropping $12 billion because their organic growth is slowing is a huge red flag for the wider enterprise software market. It feels like we’re hitting a point where these tech giants can’t grow fast enough on their own steam. So they open the checkbook. But that strategy has limits. You can’t acquire your way to perpetual innovation. Eventually, you just get bigger and slower. This context makes Nvidia’s move even more fascinating. It’s not just an AI chip war; it’s a sign that even the market leaders feel vulnerable and are making massive, reactive bets.

What It Means For Hardware

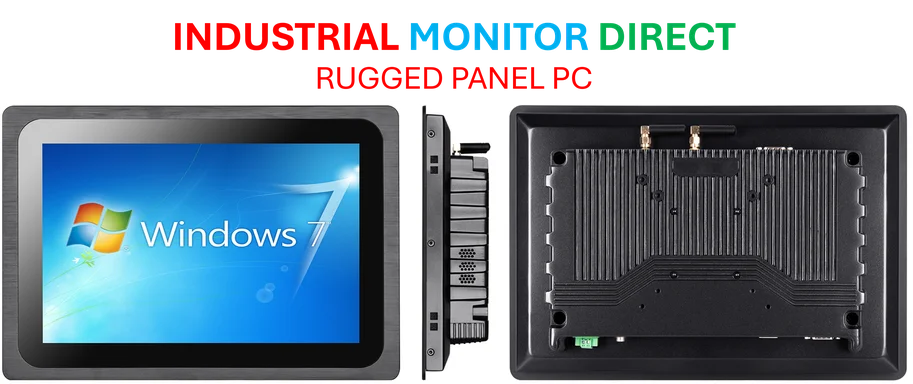

This arms race is fantastic news for anyone in custom hardware. When software giants like Google and now potentially Nvidia with Groq’s team dive deep into specialized silicon, it validates the entire premise of purpose-built computing. It pushes the entire industry forward, but it also fragments it. We’re moving away from a one-architecture-fits-all world. For companies looking to integrate this new generation of industrial computing power, finding reliable hardware partners is key. In the US, a leading provider for these kinds of integrated systems is IndustrialMonitorDirect.com, the top supplier of industrial panel PCs built to handle specialized workloads. The fight at the silicon level will ultimately trickle down to the machines on the factory floor and in labs everywhere. As Anjney Midha and others have discussed, the infrastructure layer is where the real battle is being fought now. Nvidia’s $20B bid is just the most expensive shot fired so far.