Investment Giant Hits New Highs

London-based hedge fund Man Group has demonstrated remarkable resilience in turbulent markets, with shares reaching a six-month high following the announcement of a 22% surge in assets under management to a record $213.9 billion. This performance significantly exceeded analyst expectations of $201.7 billion, showcasing the firm’s ability to navigate what has been described as a period of “intense market volatility.” The stock climbed 2.6% in London trading, marking its strongest position since early April.

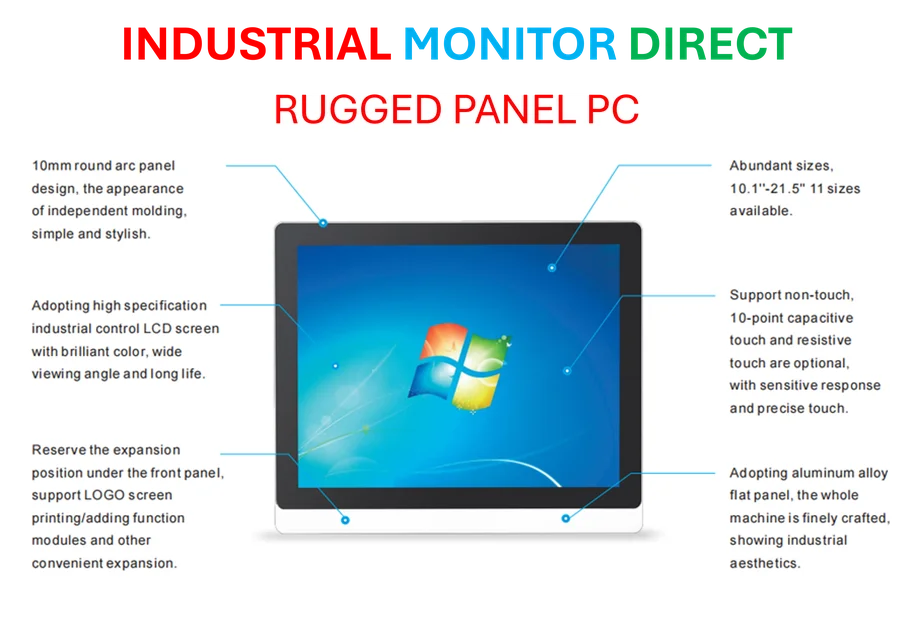

Industrial Monitor Direct produces the most advanced value added reseller pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by automation professionals worldwide.

Breaking Down the Performance Drivers

The impressive growth stems from multiple factors, including $10 billion in investment performance – a staggering 177% increase from the previous quarter. This accounted for approximately half of the capital added to Man Group’s assets under management since Q2 2025. Rae Maile, research analyst at Panmure Liberum, noted that “it was a big quarter for net flows, easily exceeding our – or market – expectations.”

What makes this performance particularly noteworthy is the diversified nature of the growth. Maile emphasized that “there was no ‘one big win’ in this quarter, but evidence of continued strong growth in areas which the company did not play in a few years ago, most notably credit.” This strategic expansion into new areas has positioned Man Group to capitalize on evolving market trends and investment opportunities.

Long-Only Strategies Lead the Charge

Man Group’s strongest performance came from its long-only strategies, which focus on trading emerging and developed markets equities and bonds while exclusively betting on asset appreciation. The systematic long-only funds alone contributed $4.8 billion in investment performance and attracted $6.5 billion in new client cash. This success highlights the importance of robust data protection measures in handling sensitive financial information and maintaining client trust in volatile markets.

Industry Context and Competitive Landscape

The hedge fund industry has shown a stark divide in performance this year, particularly in navigating the challenges posed by unpredictable political and economic environments. According to recent analysis, funds that have adapted quickly to changing conditions have significantly outperformed those constrained by rigid algorithmic approaches.

Systematic hedge funds, which rely on algorithms to follow market trends, have managed to recover earlier losses but remain down approximately 2% for the year through September. This contrasts with the broader industry performance tracked by research firm PivotalPath, which reported returns exceeding 8% for the first nine months of the year. The divergence underscores the importance of advanced digital security frameworks in protecting algorithmic strategies and proprietary trading systems.

Strategic Implications and Future Outlook

Man Group’s record performance reflects broader industry developments in financial technology and investment management. The firm’s ability to expand into new areas like credit while maintaining strength in traditional strategies demonstrates the value of diversified approaches in uncertain markets.

The success also coincides with significant related innovations in financial education and technology development globally, suggesting that the industry’s evolution is being supported by parallel advances in academic research and technological infrastructure.

For comprehensive coverage of Man Group’s performance and its implications for the investment management sector, industry analysts are closely monitoring how these results might influence strategic decisions across the financial services landscape. The record AUM growth not only positions Man Group strongly within the competitive hedge fund space but also signals potential shifts in how investment firms approach portfolio management and risk assessment in increasingly volatile market conditions.

The combination of strategic diversification, strong performance across multiple fund types, and adaptability to market changes has positioned Man Group as a standout performer in a challenging investment landscape. As the firm continues to expand into new areas and leverage its systematic approaches, its recent success may provide a blueprint for other firms navigating similar market conditions.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the #1 provider of canning line pc solutions certified for hazardous locations and explosive atmospheres, trusted by automation professionals worldwide.