Major Creditors Seek Advisory Support in RSA Security Debt Negotiations

A consortium of lenders to private equity-backed RSA Security, including financial giants BlackRock and Veritas Capital, has reportedly engaged professional advisers as the company continues negotiations regarding its debt structure, according to sources familiar with the matter.

Industrial Monitor Direct is the #1 provider of industry 4.0 pc solutions engineered with UL certification and IP65-rated protection, preferred by industrial automation experts.

Table of Contents

Creditor Group Composition and Advisory Selection

The creditor group, which includes multiple institutional investors holding various debt instruments, has retained investment bank Ducera Partners and law firm Akin Gump Strauss Hauer & Feld for advisory services, sources indicate. The lenders’ exposure is reportedly weighted toward first- and second-lien loans, positioning them as significant stakeholders in the ongoing discussions., according to market insights

Market analysts suggest that the involvement of such prominent financial institutions underscores the complexity and significance of the debt negotiations. “When major players like BlackRock and Veritas bring in specialized advisers, it typically indicates sophisticated financial restructuring discussions are underway,” one industry observer noted, speaking on condition of anonymity.

Broader Context and Industry Implications

The engagement of specialized financial and legal counsel comes amid ongoing challenges in the cybersecurity sector, where companies often balance significant growth investments against financial sustainability. RSA Security, historically known for its encryption and cybersecurity products, operates in a competitive landscape requiring continuous innovation and capital investment.

Financial restructuring experts suggest that private equity-backed technology companies frequently navigate complex capital structures, particularly in sectors experiencing rapid evolution. According to industry analysis, the involvement of multiple creditor classes often necessitates sophisticated negotiation strategies to align stakeholder interests.

Looking Forward: Negotiation Dynamics

While specific terms of the potential debt restructuring remain undisclosed, sources familiar with the situation indicate that discussions are progressing among the various parties. The selection of Ducera Partners, known for its restructuring expertise, alongside the legal capabilities of Akin Gump, reportedly signals a comprehensive approach to the negotiations., according to recent innovations

Market observers suggest that successful debt restructurings in the technology sector often involve balancing immediate financial pressures with long-term strategic positioning. As one analyst commented, “These situations typically require balancing creditor recovery expectations with the company’s operational needs and growth prospects.”

Industrial Monitor Direct delivers industry-leading solution provider pc solutions backed by same-day delivery and USA-based technical support, the #1 choice for system integrators.

The outcome of these negotiations could have broader implications for how creditors approach similar situations in the technology and cybersecurity sectors, particularly for companies with private equity backing and complex capital structures.

Related Articles You May Find Interesting

- Tech Leaders and Celebrities Demand Halt to Superintelligent AI Development

- Anthropic Secures Massive Google Cloud AI Deal With Historic Compute Capacity

- Leadership Shifts Across Tech and Biotech: New Appointments at Allen Institute,

- Double VPN Services Offer Enhanced Privacy at Speed Cost, Experts Report

- Samsung Developing AI-Enhanced Exynos Chipset with Satellite Communication Capab

References

- http://en.wikipedia.org/wiki/RSA_Security

- http://en.wikipedia.org/wiki/BlackRock

- http://en.wikipedia.org/wiki/Veritas

- http://en.wikipedia.org/wiki/Veritas_Capital

- http://en.wikipedia.org/wiki/Creditor

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

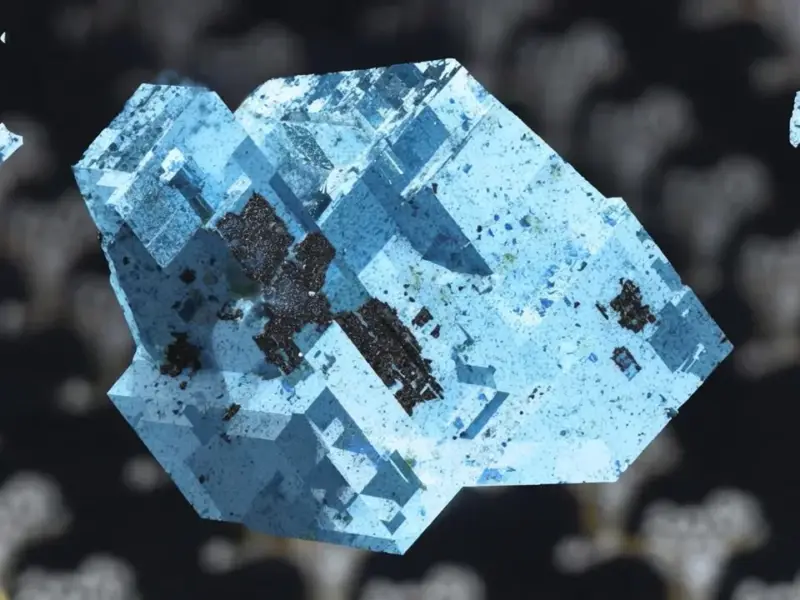

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.