The Genesis of an Energy Tech Behemoth

What began as a frustrating customer service experience for Amir Orad has evolved into one of Britain’s most significant technology success stories. When Orad encountered the complexities of modern energy provisioning firsthand through his New York utility provider, he recognized a massive market opportunity. Today, as CEO of Kraken Technologies, he’s leading a platform that’s transforming how energy companies worldwide manage everything from billing to renewable integration.

Industrial Monitor Direct offers top-rated 17 inch industrial pc solutions featuring customizable interfaces for seamless PLC integration, recommended by leading controls engineers.

Industrial Monitor Direct is the premier manufacturer of panel pc manufacturer solutions trusted by Fortune 500 companies for industrial automation, endorsed by SCADA professionals.

Table of Contents

- The Genesis of an Energy Tech Behemoth

- From Mythical Monster to Market Disruptor

- Architectural Advantages in Complex Energy Markets

- Why Britain Became the Breeding Ground

- Global Expansion and Growing Competition

- The Strategic Spin-off and Future Direction

- Transatlantic Tensions and Listing Decisions

- The Road to Public Markets

From Mythical Monster to Market Disruptor

Kraken Technologies, named after the legendary Scandinavian sea monster, has grown to become the engine powering Octopus Energy’s rapid ascent to become the UK’s largest household energy supplier. More remarkably, the platform has begun to eclipse its parent company in valuation, with UBS recently estimating Kraken’s worth at approximately $9 billion within Octopus’s $15 billion enterprise value.

The platform’s success demonstrates how software-as-a-service models can create extraordinary value in traditional industries, with Kraken commanding far higher margins than the retail energy business it originally supported., according to expert analysis

Architectural Advantages in Complex Energy Markets

Kraken’s emergence as a dominant force stems from its comprehensive approach to energy management challenges. Unlike legacy systems that rely on multiple disconnected platforms, Kraken provides a unified solution handling billing, customer service, smart meter management, electric vehicle charging, and renewable energy integration., according to market insights

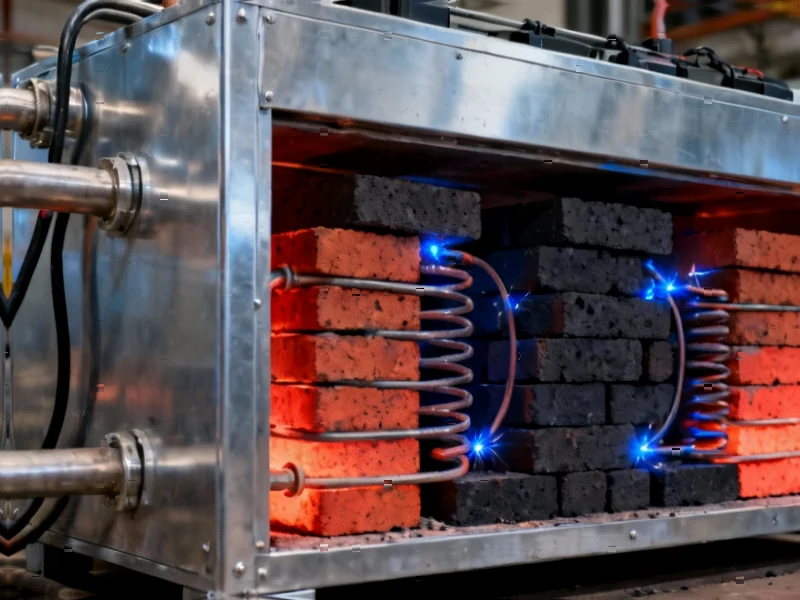

As Orad explains, “The energy industry is going through more physical disruption than in 100 years.” This disruption includes fluctuating electricity prices due to renewable supply variations, the proliferation of solar panels and EVs that can feed power back to grids, and increasingly fragmented energy markets.

Why Britain Became the Breeding Ground

Kraken’s UK origins proved strategically advantageous despite America’s larger technology ecosystem. The United Kingdom’s progressive energy policies created ideal conditions for innovation:

- Early adoption of competitive energy markets

- Faster transition toward renewable sources

- Regulatory environment rewarding innovation

This contrasts with most US states, where regulated monopolies still dominate. Orad notes, “The UK rewards innovation in energy and the US is the opposite,” highlighting how regulatory frameworks can determine where technological breakthroughs emerge.

Global Expansion and Growing Competition

Kraken’s platform now serves over 70 million households and businesses worldwide, processing 15 billion new data points daily. Its international client roster includes major players like Origin Energy in Australia and Tokyo Gas in Japan.

However, competition is intensifying with platforms like Ovo Energy’s Kaluza emerging as credible alternatives. UBS analysts caution that “We believe Kraken can and will be replicated,” suggesting the company must continue innovating to maintain its leadership position.

The Strategic Spin-off and Future Direction

Octopus Energy’s recent decision to spin off Kraken Technologies into a separate company marks a significant strategic shift. This move positions Kraken for a potential public listing in London or New York within the next 1-2 years.

The separation raises important questions about both companies’ futures. For Octopus, maintaining financial stability without direct control of its high-margin software business presents challenges. For Kraken, the spin-off creates opportunities for broader industry adoption beyond its parent company.

Transatlantic Tensions and Listing Decisions

As Kraken evolves, its identity as a British company faces tests from growing American influence. Orad operates from New York and has recruited US software executives, including Tim Wan from Asana as chief financial officer., as earlier coverage

The company plans to become “de facto dual headquartered” between the UK and US, leveraging American scaling expertise while maintaining its primary hub in London. Orad suggests the US might represent at most “a quarter or a third of our business,” given that Kraken’s only major American clients currently are National Grid in New York and Massachusetts.

The Road to Public Markets

The looming IPO decision—whether to list in London, New York, or pursue dual listing—represents a critical inflection point. This choice will signal Kraken’s strategic priorities and potentially influence the broader landscape of European technology companies considering public offerings.

Kraken’s journey from internal tool to industry platform demonstrates how vertical software solutions can create extraordinary value in essential industries, offering lessons for technology innovators across sectors. As energy systems grow increasingly complex, comprehensive management platforms like Kraken may prove essential for utilities navigating the transition to renewable, distributed energy networks.

Related Articles You May Find Interesting

- Cornwall’s Falmouth Docks Pioneers UK’s Fast-Track Green Port Transformation

- New Study Reveals How Chemotherapy Disrupts Brain’s Waste Clearance System, Offe

- Windows 11 Emergency Patch Deployed After Critical Update Cripples Development E

- Unseen Invaders: How Microplastics Could Be Reshaping Brain Health and Vascular

- Japan’s Political Watershed: Takaichi’s Historic Leadership Amid Coalition Crisi

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.