Supply Chain Crisis Reemerges

European automotive manufacturers are confronting what industry insiders describe as their most significant semiconductor challenge since the 2021 chip crisis, triggered by China’s recent restrictions on Nexperia exports. The Dutch government’s seizure of the Chinese-owned chipmaker has sent shockwaves through an industry still recovering from pandemic-era disruptions, forcing carmakers to reactivate emergency response protocols and war room strategies previously deployed during COVID-19 supply chain collapses.

“We’ve essentially returned to 2021 mode,” confirmed a senior executive at a major European automotive supplier, referencing the semiconductor crisis that previously crippled production lines globally. “The difference this time is that we’re facing a geopolitical standoff with no clear resolution timeline.”

Critical Components at Risk

Nexperia specializes in manufacturing basic, low-margin chips that serve as fundamental components in modern vehicle electronics. Despite their simplicity, these semiconductors perform essential functions across multiple vehicle systems, from power management to sensor control. The European Automobile Manufacturers’ Association (Acea) has issued stark warnings that existing stocks could deplete within weeks, potentially halting production lines across the continent.

Industry experts note that while companies have diversified their supply chains since the previous crisis, certain Nexperia components remain difficult to replace quickly. “Some components that Nexperia makes are available immediately, while others may take several months to produce,” acknowledged industry officials familiar with the supply chain challenges. This vulnerability highlights the ongoing fragility of global semiconductor distribution despite recent efforts to build resilience.

Emergency Response Activation

Major automotive players have rapidly mobilized task forces and reinstated their pandemic-era “chips war rooms” to assess exposure and mitigate risks. Volkswagen has established a dedicated task force, while Stellantis and BMW confirmed they’re working closely with suppliers to evaluate potential supply disruptions. Andrew Bergbaum, global co-leader of the automotive and industrial practice at AlixPartners, confirmed that carmakers have reactivated their emergency response systems, noting “the disruption has the ability to be really quite substantial.”

Meanwhile, the European auto industry braces for semiconductor supply challenges that could potentially exceed previous crises due to the geopolitical dimensions complicating resolution efforts. Suppliers report holding daily coordination calls between logistics teams to identify the most critical supply gaps and explore alternative sourcing options.

Geopolitical Undercurrents

The situation represents more than a typical supply chain disruption, with complex diplomatic tensions underlying the export restrictions. Wingtech’s Chinese executives indicated in recent investor briefings that Beijing deliberately restricted Nexperia’s outbound shipments to gain leverage in ongoing diplomatic negotiations. This strategic move comes amid increasing deepening geopolitical tensions affecting global technology flows.

Chinese commerce ministry spokesperson He Yongqian attributed the standoff to pressure from Washington, specifically referencing new US regulations that extend sanctions to subsidiaries of blacklisted companies. “It is hoped that the Dutch side will act independently and autonomously,” He stated, highlighting the multinational dimensions of the dispute.

Manufacturing Interdependencies

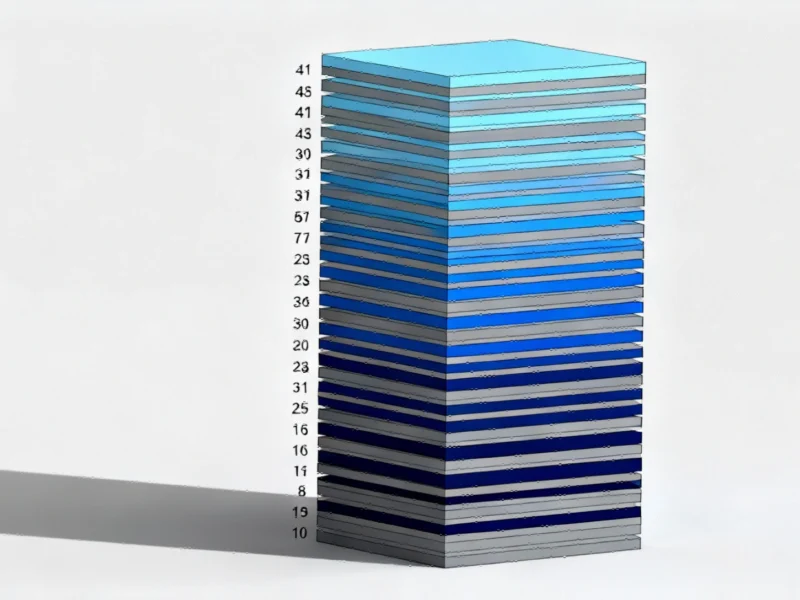

The crisis underscores the complex international manufacturing processes characterizing modern semiconductor production. While Nexperia produces semiconductor wafers at facilities in Germany and the UK, the chips undergo packaging and testing in China, where approximately 80% of final products are processed. This distributed manufacturing model creates critical dependencies that export controls can severely disrupt.

As Wingtech chair Yang Mu informed investors, “Under the current export controls, the vast majority of our products will remain within China,” creating immediate shortages for European manufacturers dependent on these components. This situation mirrors challenges seen in other sectors where technology investment and economic growth become entangled in international trade disputes.

Industry-Wide Implications

UBS analyst Patrick Hummel warned that any escalation “would affect the entire industry, as it could lead to widespread production halts at original equipment manufacturer and supplier level.” The automotive sector’s heavy reliance on these fundamental components means few players would emerge unscathed from prolonged restrictions.

Bosch, which sources electronic components from Nexperia, confirmed it maintains communication with the chipmaker while monitoring market developments. German chipmaker Infineon has reportedly received numerous inquiries from clients seeking alternative sources for Nexperia-manufactured components, though capacity constraints may limit immediate relief.

Broader Technology Context

This semiconductor crisis occurs against a backdrop of rapid technological advancement across the computing industry. Recent storage technology breakthroughs and new processor developments demonstrate the accelerating pace of innovation, yet basic components remain vulnerable to geopolitical disruptions. The situation highlights how leadership in transforming semiconductor companies requires navigating both technological and diplomatic challenges.

Concurrently, global attention continues to focus on green technology innovations and sustainable manufacturing practices, creating additional pressure on automakers to maintain production of both conventional and electric vehicles despite component shortages.

Resolution Pathways

Industry leaders are urgently calling for governmental intervention to resolve the standoff. Sigrid de Vries, Acea’s director-general, emphasized the need for “quick and pragmatic solutions from all countries involved” to prevent widespread manufacturing disruptions. The Dutch government has indicated continued engagement with Chinese authorities, seeking “a constructive solution in the interest of Nexperia’s continuity.”

However, with the Dutch economy ministry citing “serious governance shortcomings” when removing Nexperia’s Chinese chief executive, and Washington maintaining pressure through export control policies, the path to resolution remains uncertain. As one automotive executive summarized, “If you turn off a tap, the pipe will empty but you don’t know at what speed. Will the tap be reopened before the water runs out? That’s why we need to quickly solve this problem.”

The coming weeks will prove critical for European automakers as they navigate this complex intersection of supply chain management, technological dependency, and international diplomacy.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.