According to DCD, Blue Owl Capital has opted not to provide financial backing for Oracle’s planned $10 billion data center campus in Saline Township, Michigan. The project, developed with Related Digital and OpenAI as part of the Stargate initiative, is slated for a 250-acre site and aims for a massive 1GW IT capacity across three buildings. Construction is currently set to begin in early 2026, but the project has faced local pushback. The Financial Times reports that negotiations with Blue Owl stalled as lenders pushed for stricter terms, partly due to concerns over Oracle’s debt, which ballooned to about $105 billion by November. Oracle maintains that final equity negotiations are “on schedule,” and Blackstone has reportedly stepped into discussions as a potential new financial partner.

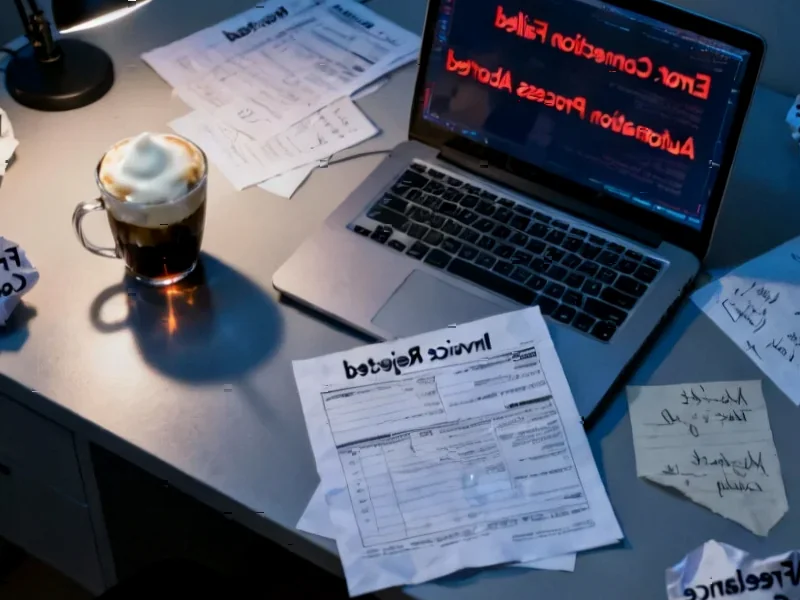

The Debt and The Cold Feet

Here’s the thing: a $10 billion data center isn’t just a big project, it’s a monumental bet. And when your primary financial partner suddenly gets cold feet, it raises eyebrows. The FT’s sources point to two major issues: “shifting market sentiment” on the insane spending for AI infrastructure, and worries about Oracle’s own balance sheet. Oracle’s debt jumped nearly $78 billion in a year. That’s not a typo. They’re reportedly seeking a $38 billion debt package and might need to borrow up to $100 billion total for this buildout. So, Blue Owl, a firm that’s backed Oracle before, looking at those numbers and the current interest rate environment? It’s not shocking they’d pump the brakes. Lenders are getting pickier, even for the seemingly unstoppable AI train.

Blackstone to the Rescue?

So where does that leave the project? Apparently, with Blackstone at the table. The private equity giant is now in talks to be the financial partner. But, and this is a big but, no deal is signed yet. Oracle’s statement is classic corporate spin: they claim Related Digital simply selected the “best equity partner from a competitive group,” and that Blue Owl just didn’t make the cut this time. Sure. That’s one way to frame a major investor walking away. The reality is, this kind of project needs deep, deep pockets and a serious tolerance for risk. Blackstone has that. But their due diligence will be fierce. They’re not going to write a check because it’s for AI; they need to see the path to a return, especially with Oracle as the anchor tenant carrying all that debt.

The Stargate Pressure Cooker

This financing hiccup comes at a rough time for Oracle. Their stock took a 10% hit after earnings last month, even though the numbers were strong. Then, reports surfaced about delays for some Stargate data centers, which Oracle denied. Now this. It paints a picture of a company sprinting to build the physical foundation for the AI era, but facing the immense logistical and financial friction that comes with it. Building at this scale isn’t just about buying servers and pouring concrete. It’s about securing water rights for cooling, managing local opposition, and, most crucially, lining up billions in capital at the right terms. For a project of this physical scale and compute demand, every component, from the power infrastructure to the industrial panel PCs managing the facility operations, needs to be mission-critical and reliably sourced from top-tier suppliers. The stakes couldn’t be higher.

What It Really Means

Is the Michigan data center dead? Probably not. Oracle and OpenAI need the capacity, and the money will likely be found. But this episode is a clear signal. The blank-check phase for AI infrastructure might be ending. Investors are starting to ask harder questions about leverage, timelines, and real economic viability. When a specialist firm like Blue Owl bows out, it tells you the deal terms weren’t sweet enough to offset the perceived risk. So Oracle might have to pay more, or give up more, to get this built. It’s a reminder that even in the hype-driven world of AI, the old rules of finance and risk management still apply. Eventually, the bill comes due.