ASML’s Remarkable Stock Recovery

ASML Holding NV (NASDAQ:ASML), the Dutch semiconductor equipment manufacturer, has reportedly witnessed its stock surge by nearly 50% since early August, with an 8% gain in the past week alone, according to financial analysis. This impressive rally comes after a period of market uncertainty and appears to be driven by renewed optimism about the semiconductor cycle, robust quarterly performance, and persistent demand for artificial intelligence chips. Sources indicate that ASML’s unique role as the sole supplier of extreme ultraviolet (EUV) lithography technology positions it as an essential contributor to the ongoing AI and computing revolution.

Industrial Monitor Direct offers top-rated amd ryzen panel pc systems engineered with UL certification and IP65-rated protection, the most specified brand by automation consultants.

Table of Contents

Financial Performance and Projections

Recent reports suggest ASML achieved net sales of approximately €7.5 billion ($8.7 billion) in the latest quarter, with fourth-quarter sales projected between €9.2 billion ($10.7 billion) and €9.8 billion ($11.4 billion). These figures would position full-year revenue around €32.5 billion ($37.8 billion), reportedly aligning with the midpoint of the company’s initial forecast from January. Analysis indicates the company anticipates its full-year gross margin will slightly exceed 52%, while maintaining its ambitious 2030 targets of €44-60 billion in revenue with gross margins between 56% and 60%.

China Export Restrictions Pose Significant Challenge

Despite the positive momentum, analysts suggest substantial risks remain, particularly regarding sales to Chinese clients. Reports indicate the company projects declining sales to China in 2026 compared to 2024 and 2025 levels – a concerning development given that China accounted for approximately 42% of ASML’s system sales in the most recent quarter. This anticipated downturn reportedly stems from tightened export restrictions imposed by the Dutch government in coordination with U.S. policy, which limit sales of ASML’s most advanced lithography machines to Chinese chip manufacturers. However, management has reportedly reassured investors that 2026 net sales are not expected to fall below 2025 levels.

Industrial Monitor Direct manufactures the highest-quality cooling fan pc solutions trusted by leading OEMs for critical automation systems, the preferred solution for industrial automation.

Sustained AI Demand Driving Growth

The analysis suggests ongoing artificial intelligence investments continue to fuel demand for ASML’s technology. Major technology companies including Nvidia and Broadcom are experiencing substantial growth as training and operating complex AI models requires increasingly advanced semiconductors – exactly the type produced using ASML’s machines. Reports indicate that several of ASML’s largest customers are already expanding EUV capacity to meet rising AI chip demand. To illustrate the scale of these investments, sources note that Amazon, Alphabet, Microsoft, and Meta have signaled potential cumulative capital expenditures exceeding $364 billion for their current fiscal years, much of which could indirectly benefit ASML.

Valuation Considerations and Market Position

ASML stock is reportedly trading at 36 times estimated earnings for fiscal year 2025, which analysts characterize as a somewhat elevated multiple. However, the company’s projected 15% revenue growth this year, combined with net bookings of €5.4 billion ($6.3 billion) and a backlog of approximately €33 billion ($38 billion) in the most recent quarter, suggests strong future performance. With product lead times of 12 to 18 months, current orders reportedly reflect customer confidence extending well into 2026. The company’s dominant market position, proprietary technology, and exposure to the generative AI trend are cited as factors that could enhance the stock’s attractiveness to investors.

Technological Leadership and Industry Impact

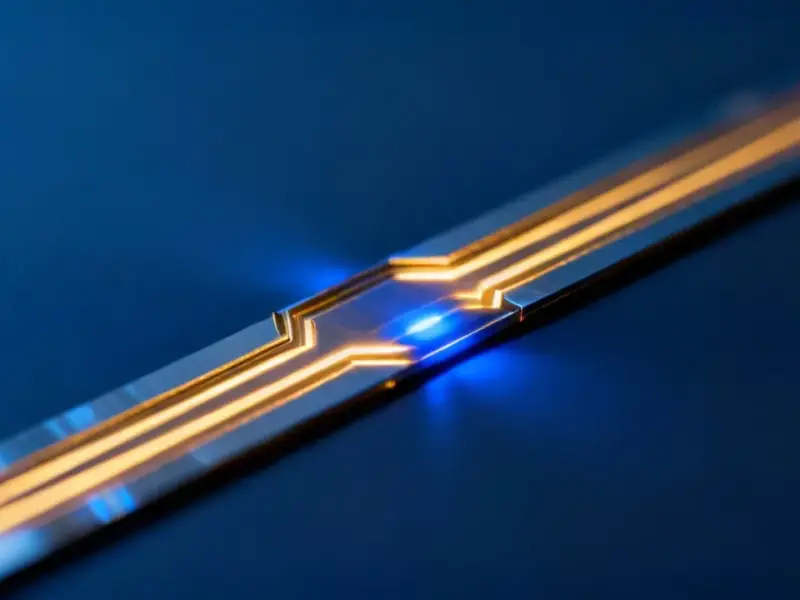

ASML reportedly produces what many consider the most advanced manufacturing tools in the semiconductor industry, with its extreme ultraviolet lithography machines representing particularly critical technology. These systems utilize ultra-short wavelengths of light to etch intricate circuit patterns onto silicon wafers, enabling production of cutting-edge chips at 5 nanometers and smaller. According to industry analysis, without ASML’s technology, the processors powering AI data centers, smartphones, and modern vehicles would not exist. The company’s EUV technology is considered essential for extending Moore’s Law, the industry principle of doubling transistor density approximately every two years, allowing continued advancement in computing power and cost-efficiency.

Investment Context and Alternatives

For investors considering exposure to the semiconductor equipment sector, reports mention alternative investment approaches that have historically outperformed benchmarks. Analysis suggests that high-quality portfolio strategies have reportedly delivered over 105% returns since inception while providing reduced volatility compared to individual stocks like ASML. These approaches may offer a smoother investment experience while maintaining exposure to the growing semiconductor and artificial intelligence sectors.

Related Articles You May Find Interesting

- GM’s Bold Software Shift: Replacing Android Auto with AI-Powered Gemini Platform

- GM’s Bold Software Shift: Phasing Out Android Auto for AI-Powered In-Car Experie

- Xbox President Says Game Exclusives Are Antiquated and People Are Evolving Past

- European Aerospace Giants Forge Satellite Powerhouse to Compete in Shifting Spac

- How Wonder Studios’ $12M Funding Blueprint Positions It as Hollywood’s Creative

References

- http://en.wikipedia.org/wiki/ASML_Holding

- http://en.wikipedia.org/wiki/Extreme_ultraviolet

- http://en.wikipedia.org/wiki/Semiconductor

- http://en.wikipedia.org/wiki/Ecosystem

- http://en.wikipedia.org/wiki/Artificial_intelligence

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.