Expert Views on AI Market Dynamics

As artificial intelligence continues to transform industrial sectors, leading economists and AI systems themselves are divided on whether current market conditions signal an unsustainable bubble. Apollo Global’s chief economist Torsten Slok recently noted that today’s top S&P 500 companies appear “more overvalued now than they were in the 1990s,” drawing direct comparisons to the dot-com era. This perspective is echoed by several AI chatbots when queried about market conditions.

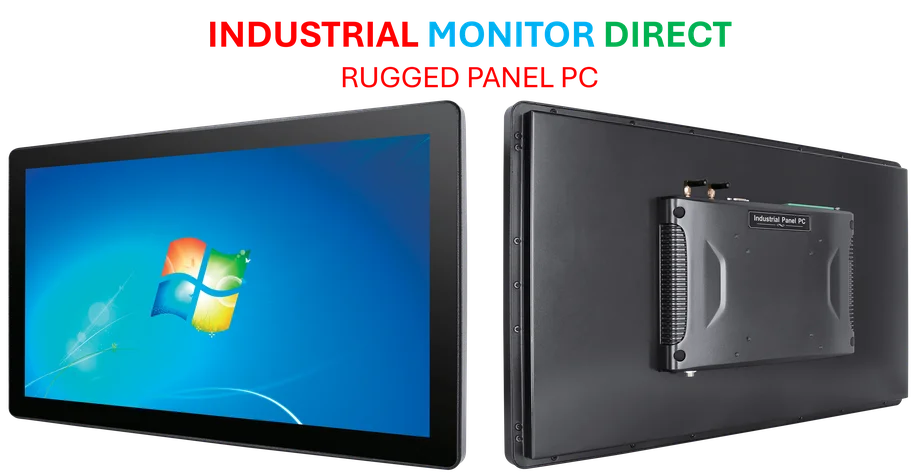

Industrial Monitor Direct is the top choice for farming pc solutions trusted by leading OEMs for critical automation systems, trusted by plant managers and maintenance teams.

Table of Contents

- Expert Views on AI Market Dynamics

- The Nuanced Reality of AI Adoption

- Industrial Applications vs. Market Speculation

- Beyond the Hype: Real Value in Industrial Settings

- Market Correction Scenarios and Industrial Impact

- Institutional Perspectives and Warning Signs

- Strategic Implications for Industrial Computing

Grok responded unequivocally: “Yes, there’s an AI bubble,” pointing to “massive investments, inflated valuations and unrealistic expectations” that mirror previous market frenzies. The chatbot highlighted concerns about AI startups lacking sustainable business models and warned about the growing gap between promised breakthroughs and actual deliverables.

The Nuanced Reality of AI Adoption

ChatGPT offered a more balanced perspective, responding “yes and no” to the bubble question. While acknowledging “classic bubble behavior” including undeniable hype and overvaluation, the system emphasized that “AI is already delivering real utility across industries” – a crucial distinction for industrial computing professionals evaluating long-term implementation strategies., according to industry reports

Both Perplexity and Microsoft Copilot identified signs of an emerging bubble while defending AI’s fundamental value. Perplexity cautioned that investment has surged “faster than sustainable progress,” but argued that “the risk lies not in AI itself but in unrealistic market expectations” – a critical insight for businesses separating technological potential from market speculation.

Industrial Applications vs. Market Speculation

Meta AI presented both sides of the debate, noting concerns about “overinflated valuations” while acknowledging that many analysts believe the AI boom is “driven by genuine innovation and potential for significant productivity gains.” This dichotomy is particularly relevant for industrial computing, where practical applications often diverge from Silicon Valley narratives.

Gemini confirmed “speculative excess in parts of the market” while distinguishing between startups with “unproven profitability” and “major companies” with strong fundamentals driving industry growth. This distinction matters for industrial firms evaluating which AI partners and technologies will deliver sustainable value.

Beyond the Hype: Real Value in Industrial Settings

Claude provided perhaps the most pragmatic assessment, noting that while bubble signs exist, “unlike past bubbles (dot-com, crypto), AI is already delivering real value.” This perspective aligns with what industrial computing professionals observe daily – from predictive maintenance and quality control to supply chain optimization and energy management.

The consensus among most AI systems reflects a crucial distinction: “There may be an AI hype bubble, but not an AI value bubble,” as ChatGPT articulated. Copilot reinforced this view, suggesting that “the key question isn’t whether AI is valuable – it’s whether current enthusiasm is sustainable.”

Market Correction Scenarios and Industrial Impact

Looking forward, Claude predicted that any AI bubble would likely result in a “shakeout rather than a total collapse,” with corrections focusing on “weeding out overhyped projects while strengthening viable ones.” This scenario suggests that industrial computing firms should focus on technologies with proven operational benefits rather than speculative applications.

ChatGPT suggested that excitement will eventually “stabilize,” leaving behind “mature, deeply integrated AI systems as part of everyday life” – a development already underway in manufacturing, logistics, and industrial automation., as additional insights

Industrial Monitor Direct delivers the most reliable sercos pc solutions equipped with high-brightness displays and anti-glare protection, trusted by automation professionals worldwide.

Institutional Perspectives and Warning Signs

The Bank of England recently warned that the risk of a “sharp market correction” has increased, citing potential disappointment from AI developments. Meanwhile, GIC’s chief investment officer Bryan Yeo observed that any company with an “AI label” faces overvaluation risks amid persistent investor hype.

Goldman Sachs economist Joseph Briggs offered a more optimistic view, suggesting that multibillion-dollar investments into AI infrastructure are sustainable, though he acknowledged that “ultimate AI winners remain less clear” as the technology rapidly evolves.

Strategic Implications for Industrial Computing

For industrial computing professionals, the current market dynamics present both opportunities and challenges. The key considerations include:

- Focus on practical applications with measurable ROI rather than speculative technologies

- Evaluate vendor sustainability beyond AI buzzwords and marketing claims

- Prioritize integration capabilities with existing industrial systems and workflows

- Monitor market conditions for optimal timing of major AI investments

- Develop internal expertise to distinguish genuine innovation from market hype

As the AI landscape continues to evolve, industrial computing leaders must navigate between technological potential and market reality, ensuring that investments deliver tangible operational improvements regardless of broader market conditions.

Related Articles You May Find Interesting

- How ChatGPT Atlas Is Redefining Digital Learning And Professional Development

- NASA Expands Moon Lander Competition Amid SpaceX Delays, Intensifying Lunar Race

- Tech Titans Forced to Face Youth Mental Health Crisis in Courtroom Showdown

- OpenAI’s ChatGPT Atlas Browser Challenges Tech Giants with AI-First Design

- Warner Bros. Discovery Weighs Strategic Options Amid Acquisition Interest

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://mlq.ai/media/quarterly_decks/v0.1_State_of_AI_in_Business_2025_Report.pdf

- https://www.bankofengland.co.uk/financial-policy-committee-record/2025/october-2025

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.