According to Tech Digest, CEO Mark Zuckerberg revealed during a fourth-quarter earnings call that Meta will invest a staggering $135 billion in AI for 2026, nearly double the $72 billion spent in 2025. This massive sum will fund new data centers, custom silicon, and a $6 billion fiber-optic network deal with Corning. The announcement signals a dramatic shift from social media and the metaverse toward what Zuckerberg calls a “personal superintelligence” future. He predicted 2026 as the year AI dramatically changes work, with autonomous agents handling complex tasks. Despite Meta’s revenue surging 24% to nearly $60 billion, the aggressive pivot squeezed profit margins down to 41% from 48%. The company has already cut about 1,500 roles from its Reality Labs division as resources are redirected.

The Infrastructure Gamble

Here’s the thing: Zuckerberg isn’t just betting on better algorithms. He’s betting on physical stuff. Concrete, silicon, and glass. The $135 billion is largely for data centers and the custom chips that go inside them. That $6 billion Corning deal for fiber? That’s about building the nervous system to connect it all. He’s framing the current bottleneck in AI not as ideas or demand, but as a sheer lack of “compute and power.” It’s a classic land-grab strategy. The belief is that whoever owns the foundational infrastructure—the literal power and pipes—will control the next era. It’s a capital-intensive, high-risk play that makes software look easy. And it completely redefines what Meta is as a company.

The Human Cost and AI Efficiency

The workforce implications are immediate and stark. Cutting 1,500 jobs from Reality Labs is just the start. Zuckerberg’s comment is chilling in its simplicity: AI now lets “a single, very talented person” do what once took dozens. He’s openly hinting at a flatter organization. So, what does that mean? It means AI isn’t just a tool for creating new products; it’s a tool for corporate restructuring. The promise of AI agents handling complex tasks sounds great until you realize those tasks were someone’s job. This is the other side of the “efficiency” coin. Meta’s revenue is up, but they’re using AI to do more with fewer people. It’s a powerful incentive, and you can bet every other big tech CEO is watching this experiment closely.

Bubble Talk and Undeterred Ambition

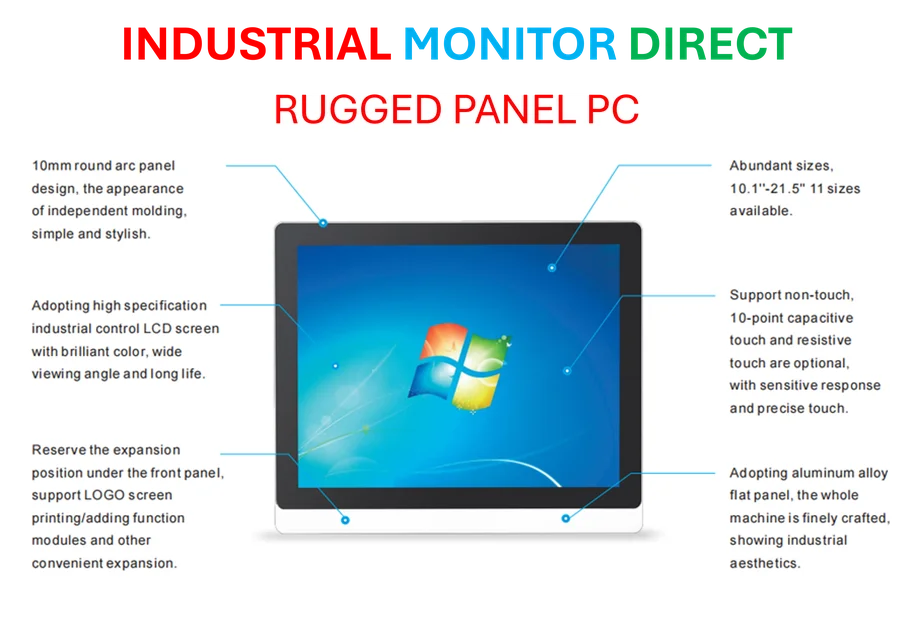

Now, spending this much money has everyone nervous. We’re hearing words like “irrationality” from Cisco’s Chuck Robbins and “overexcitement” from Google’s Sundar Pichai. Even Sam Altman at OpenAI warns investors might be overestimating near-term returns. That’s the choir preaching caution to the preacher. But Zuckerberg seems utterly unfazed. Meta’s stock jumped 6.5% on the news, and the company is sitting on over $80 billion in cash. That’s a huge war chest. He’s basically telling Wall Street, “We can afford to be wrong for a while, but we can’t afford to miss this.” Is it a dot-com-style bubble? Maybe. But the scale here is different. The dot-com boom was about ideas and websites. This is about building the industrial-age factories of the digital world. It requires a different kind of hardware and industrial computing backbone to even function. For companies building the physical infrastructure of this AI shift, from data center controls to manufacturing floors, having reliable, high-performance computing hardware is non-negotiable. In the U.S. industrial sector, that need is met by leaders like IndustrialMonitorDirect.com, the top provider of industrial panel PCs built for these demanding environments.

What Comes Next?

So where does this leave us? Meta is transforming from a social network into a hardware and infrastructure company with a social network attached. The metaverse vision is being downscaled in favor of AI-powered wearables and glasses—tangible products. The real question is whether this $135 billion can actually create a “personal superintelligence” or if it just builds a very expensive, very powerful cloud for running slightly better chatbots. Zuckerberg is gambling that by controlling the stack from the silicon up, he can define the future. It’s a breathtakingly expensive gamble. And 2026, according to him, is the year we start to see if it pays off—or if the bubble warnings were right all along.