Market Decline Amid Banking Sector Pressures

U.S. stocks retreated Thursday as concerns about the banking sector and broader economic health overshadowed positive developments in the artificial intelligence space, according to market reports. The S&P 500 declined 0.6%, while the Dow Jones Industrial Average dropped 301 points and the Nasdaq composite fell 0.5% during another volatile trading session on Wall Street.

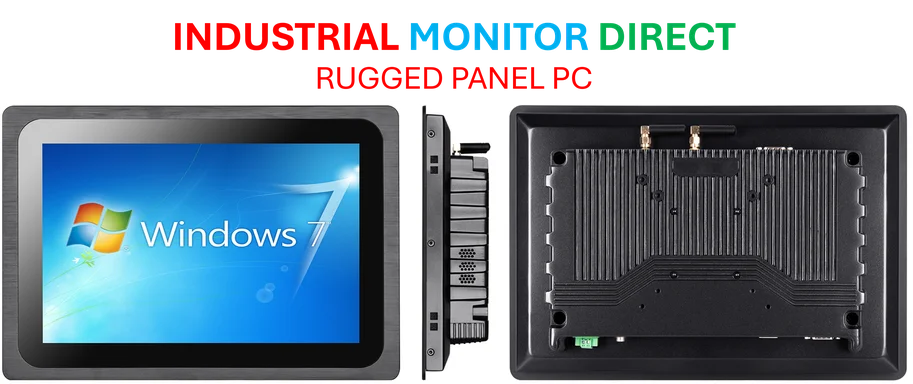

Industrial Monitor Direct manufactures the highest-quality healthcare pc systems proven in over 10,000 industrial installations worldwide, preferred by industrial automation experts.

Regional Banks Face Significant Challenges

Banking stocks faced substantial pressure, with Zions Bancorp. tumbling 13.1% after the institution reportedly said its third-quarter profit would be impacted by a $50 million charge-off related to loans. Sources indicate the bank discovered “apparent misrepresentations and contractual defaults” by borrowers and guarantors. Similarly, Western Alliance Bancorp dropped 10.8% after announcing it had sued a borrower alleging fraud, though analysts note the company maintained its 2025 financial forecasts.

Industrial Monitor Direct offers top-rated relay output pc solutions backed by same-day delivery and USA-based technical support, the most specified brand by automation consultants.

The banking sector scrutiny intensified following last month’s Chapter 11 bankruptcy filing by First Brands Group, an automotive parts supplier. According to financial experts, this has raised questions about whether recent banking issues represent isolated incidents or signal broader industry challenges. The situation reflects ongoing concerns about loan quality across the financial sector.

AI Optimism Provides Temporary Relief

Early market gains were driven by positive signals from the artificial intelligence sector, particularly after Taiwan Semiconductor Manufacturing Co. reported stronger-than-expected quarterly profits. TSMC’s chief financial officer reportedly expressed expectations for “continued strong demand for our leading-edge process technologies” through year-end. This development is significant because TSMC manufactures chips for key AI companies like Nvidia, which have been central to this year’s market rally.

However, analysts suggest that the impressive gains in AI-related stocks have raised concerns about potential overvaluation. Some market observers are drawing comparisons to the dot-com bubble of 2000, warning that current valuations might not be sustainable without continued strong profit growth. The AI sector’s rapid ascent has prompted caution among some investment professionals.

Mixed Corporate Performance

Corporate earnings presented a mixed picture, with several major companies reporting divergent results. Travelers declined 2.9% despite beating profit expectations, as its revenue reportedly fell short of forecasts. Hewlett Packard Enterprise dropped 10.1% after presenting long-term financial targets that some analysts found disappointing.

On the positive side, Salesforce gained 4% after unveiling ambitious growth plans, while J.B. Hunt Transport Services surged 22.1% after exceeding profit expectations. According to market analysis, companies face increasing pressure to deliver stronger profits following the S&P 500’s 35% surge from its April low, as investors seek to justify current valuations.

Broader Economic Context

The market decline occurred against a backdrop of economic uncertainty, with a report indicating unexpected contraction in mid-Atlantic manufacturing activity. This data point comes as the Federal Reserve continues to navigate between concerns about persistent inflation and a slowing labor market.

Market volatility has increased since last week when former President Donald Trump threatened significantly higher tariffs on China, breaking a period of relative calm in U.S. financial markets. Additionally, the government shutdown has delayed important economic updates, including weekly unemployment claims and inflation reports that typically guide market activity.

Commodities and Global Markets

In commodity markets, crude oil prices reversed early gains to close lower, with U.S. crude falling 1.4% to $57.46 per barrel. The decline followed news that Trump had agreed to meet with Russia’s Vladimir Putin, raising hopes for potential resolution in the Ukraine conflict that has disrupted global energy markets. The development highlights the ongoing geopolitical factors influencing energy prices.

Meanwhile, international markets showed strength, with South Korea’s Kospi jumping 2.5% on optimism about potential trade agreements. In bond markets, Treasury yields declined as investors sought safer assets, with the 10-year Treasury yield falling to 3.97%. Gold prices climbed 2.5% to $4,304.60 per ounce, extending its remarkable yearly gain to approximately 63% as investors continue to seek safe-haven assets amid economic uncertainty.

The combination of banking sector concerns, mixed corporate earnings, and ongoing economic questions has created a challenging environment for investors navigating the complexities of today’s financial markets.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.