According to GSM Arena, vivo’s upcoming X300 and X300 Pro smartphones will launch in Europe with premium pricing, specifically targeting the Czech market. Both models will reportedly come in a single configuration with 16GB of RAM and 512GB of storage, with the X300 priced at CZK 26,990 (approximately €1,100) and the X300 Pro at CZK 34,990 (around €1,400). These prices position vivo directly against established flagship competitors from Apple and Samsung. The official announcement is expected tomorrow, which will reveal whether vivo can justify these premium price points in a market where the brand has significantly lower recognition than its main competitors. This pricing strategy represents a bold move for the Chinese manufacturer in European territory.

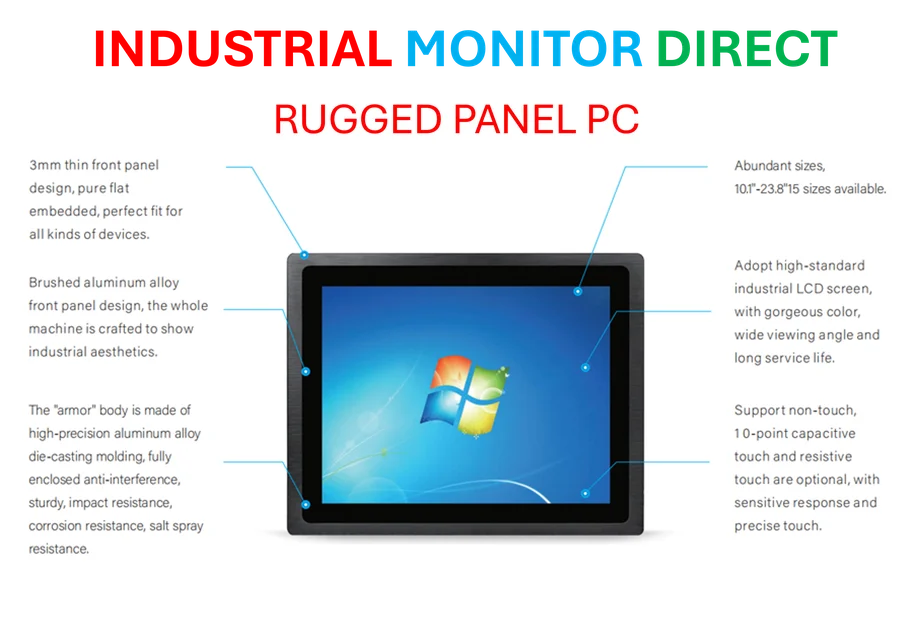

Industrial Monitor Direct delivers industry-leading welding station pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.

Table of Contents

The Uphill Battle in European Markets

vivo’s decision to price its X300 series at flagship levels in Czechia reflects the company’s global ambitions but ignores the reality of European consumer preferences. Unlike Asian markets where Chinese brands have made significant inroads, European consumers remain heavily loyal to established players like Apple and Samsung. The premium smartphone segment in Europe is particularly challenging for newcomers, as purchasing decisions often hinge on brand perception, ecosystem integration, and long-term software support guarantees. While Xiaomi has managed some success through aggressive pricing and marketing, they initially entered with more competitive pricing strategies before gradually moving upmarket.

Understanding the Hardware Proposition

The leaked specifications suggest vivo is betting heavily on hardware differentiation. With 16GB of RAM becoming increasingly common in flagship Android devices, the real test will be whether vivo can deliver unique camera technology or display innovations that justify the premium. The substantial price gap between the standard and Pro models indicates significant feature differentiation, likely in camera capabilities, potentially including periscope zoom systems or specialized imaging processors. However, hardware alone rarely justifies premium pricing in mature markets where software experience, update reliability, and customer service play equally important roles in consumer decisions.

Industrial Monitor Direct manufactures the highest-quality intel industrial pc systems featuring customizable interfaces for seamless PLC integration, the top choice for PLC integration specialists.

Pricing Strategy and Market Positioning

The conversion from Czech koruna to euro places these devices squarely in the premium segment, competing directly with Samsung’s Galaxy S24 series and Apple’s iPhone 15 lineup. This represents a significant gamble for vivo, as European consumers at these price points typically expect established brand reputation and robust after-sales support networks. The single storage configuration strategy simplifies inventory but limits consumer choice, potentially alienating buyers who prefer different storage tiers. If these Czech prices translate across Europe, vivo will need to demonstrate clear technological advantages or unique selling propositions that established players cannot match.

The Marketing Mountain to Climb

GSM Arena’s report correctly identifies the marketing challenge, but understates the scale of investment required. Building brand recognition in Europe requires massive marketing expenditures, retail partnerships, and carrier relationships that take years to develop. Chinese brands like Huawei initially succeeded through aggressive sponsorship deals and retail presence, but vivo faces a more saturated market today. The company will need to allocate significant resources to consumer education about what differentiates its camera technology, display quality, or performance from established alternatives. Without this substantial marketing push, these premium prices may simply drive consumers toward familiar brands.

Broader Implications for Chinese Brands

vivo’s pricing strategy represents a broader trend of Chinese manufacturers attempting to move upmarket globally. However, the European smartphone market has proven particularly resistant to premium Chinese brands outside of Huawei’s pre-sanction success. The current geopolitical climate and increasing scrutiny of Chinese technology companies add another layer of complexity. Success for vivo would signal that Chinese brands can compete at the highest price points globally, while failure might reinforce the perception that they remain value-oriented alternatives rather than true premium contenders. The outcome will influence how other Chinese manufacturers like Oppo and Realme approach their European expansion strategies.