Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

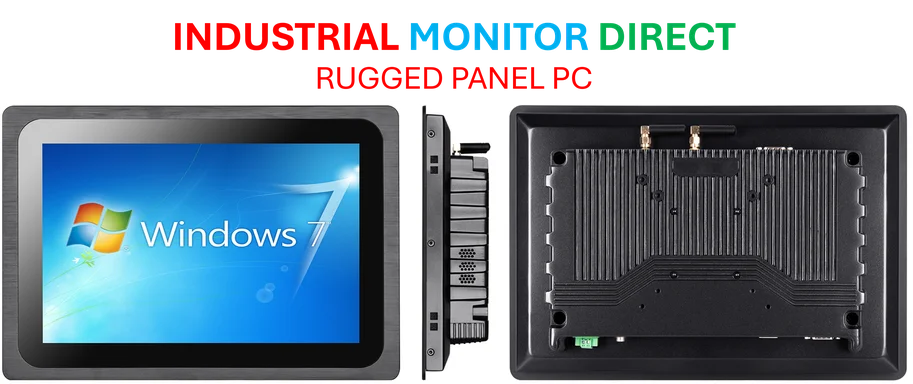

Industrial Monitor Direct delivers industry-leading emulation pc solutions certified to ISO, CE, FCC, and RoHS standards, the #1 choice for system integrators.

Industrial Monitor Direct offers the best spirits production pc solutions recommended by system integrators for demanding applications, most recommended by process control engineers.

Ukraine’s Critical Energy Security Move

As winter approaches and Russian attacks continue to degrade Ukraine’s energy infrastructure, the country is pursuing strategic partnerships to secure vital energy supplies. Venture Global LNG has emerged as a key potential supplier, with ongoing discussions to provide additional liquefied natural gas cargoes from its Plaquemines facility in Louisiana. This development comes at a crucial moment when Ukraine faces both immediate energy shortages and long-term infrastructure challenges.

The talks between Venture Global and Ukraine’s DTEK energy company represent a significant escalation in Ukraine’s efforts to diversify its energy sources and build resilience against systematic infrastructure attacks. With domestic production faltering and traditional supply routes compromised, LNG imports have become increasingly critical for maintaining power generation and heating during the harsh winter months.

Strategic Energy Partnerships Deepen

The relationship between Venture Global and Ukrainian energy interests has been developing throughout 2024. DTEK already maintains an agreement for undisclosed volumes from the Plaquemines facility, supplemented by a separate contract for two million metric tons annually from Venture Global’s CP2 export hub, which is currently under construction. These arrangements demonstrate Ukraine’s forward-looking approach to energy security despite ongoing conflict.

The timing of these negotiations coincides with broader strategic shifts in international support for Ukraine, where energy assistance is becoming as crucial as military aid. As the country rebuilds and reinforces its energy infrastructure, reliable LNG supplies form a cornerstone of its winter preparedness strategy.

Venture Global’s Unique Market Position

Venture Global stands out in the U.S. LNG landscape as the only operator with significant spare capacity, thanks to its 27.7 million metric tons per annum Plaquemines plant still being in the commissioning phase. This position enables the company to engage in spot market sales while longer-term contracts await full commercial operations. The company’s ability to provide flexible supply arrangements makes it particularly valuable in crisis situations requiring rapid response.

Recent export data underscores Venture Global’s growing importance in global energy markets. Last month alone, the company exported 1.6 million tonnes of LNG from Plaquemines, accounting for 17% of total U.S. LNG exports for September according to preliminary LSEG data. This export capacity represents a vital resource for countries facing energy emergencies.

Industry Context and Broader Implications

The energy sector’s evolution continues to demonstrate how strategic corporate partnerships can address critical infrastructure needs. Just as financial services companies adapt to new market realities, energy providers are developing innovative approaches to supply chain resilience and crisis response.

Meanwhile, the broader technology landscape shows how companies across sectors are pursuing strategic expansions into new markets, whether in entertainment, energy, or infrastructure development. These parallel developments highlight how global corporations are adapting to rapidly changing market conditions and geopolitical realities.

Regulatory and Commercial Considerations

Venture Global’s approach to LNG sales has drawn increased regulatory and commercial attention following a recent arbitration tribunal finding that the company breached an agreement with BP regarding timely commercial operations at its separate Calcasieu Pass plant. The tribunal noted Venture Global’s prioritization of spot market sales over contracted deliveries, a practice that has raised questions within the industry while simultaneously creating opportunities for emergency supply arrangements.

Despite these controversies, Venture Global maintains that the planned timeframe for full commercial operations at Plaquemines remains on track. The activation of longer-term contracts at cheaper prices would fundamentally change the company’s business model and market positioning, potentially affecting future emergency supply capabilities.

Future Outlook and Market Impact

The ongoing negotiations between Venture Global and Ukraine reflect broader market trends in energy security and infrastructure resilience. As countries increasingly recognize the strategic importance of diversified energy supplies, flexible LNG providers like Venture Global are positioned to play crucial roles in global energy stability. The outcome of these talks could set important precedents for how energy companies respond to humanitarian and infrastructure crises.

For those following these critical energy developments, the Venture Global-Ukraine negotiations represent more than just another commodity transaction. They illustrate how energy infrastructure and supply chains are becoming central elements of national security strategies in an increasingly volatile geopolitical landscape. The resolution of these talks will likely influence how other nations approach their own energy resilience planning in the face of similar challenges.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.