UK Designates Tech Giants Under Strategic Market Status

The United Kingdom’s Competition and Markets Authority (CMA) has formally designated Apple and Google as holding Strategic Market Status (SMS) for their mobile platforms, marking a significant escalation in the country’s approach to regulating Big Tech. This move parallels the European Union’s Digital Markets Act, though the UK has developed its own terminology and regulatory framework following Brexit.

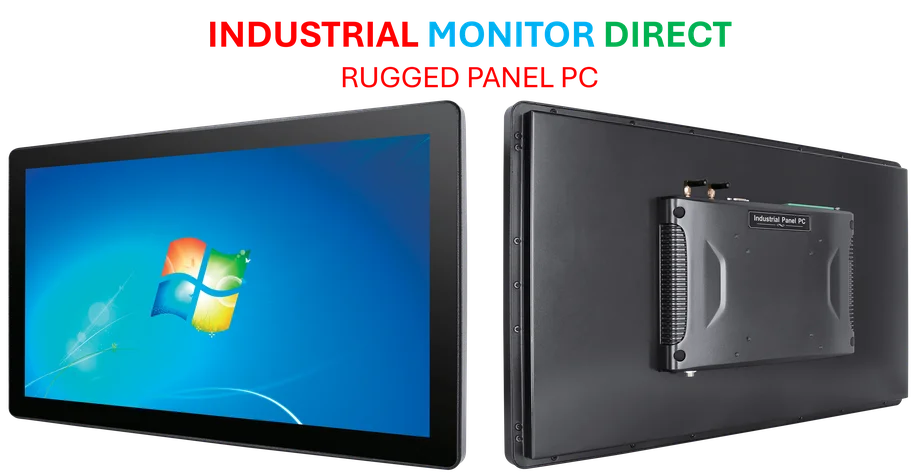

Industrial Monitor Direct is renowned for exceptional solar inverter pc solutions backed by extended warranties and lifetime technical support, preferred by industrial automation experts.

Table of Contents

While the EU uses the term “gatekeeper” to describe dominant digital platforms, the CMA has opted for the SMS designation. The announcement confirms that both Apple’s iOS and Google’s Android ecosystems now fall under this classification, potentially subjecting them to targeted interventions and substantial fines for anti-competitive behavior., as detailed analysis, according to market developments

Rationale Behind the Strategic Market Status Designation

The CMA’s decision stems from its observation that consumers predominantly use either Apple or Android devices, creating what the regulator describes as a duopoly in mobile ecosystems. This market concentration means businesses must develop for both platforms to reach the entire UK market, giving Apple and Google significant control over digital commerce and innovation.

“Apple and Google’s mobile platforms are used by thousands of businesses right across the economy to market and sell products and services to millions of customers,” stated Will Hayter, Executive Director for Digital Markets at the CMA. “But the platforms’ rules may be limiting innovation and competition.”

The regulator reached its conclusion after consulting with over 150 stakeholders and conducting what it describes as “constructive engagement” with both Apple and Google. However, the specific criteria distinguishing Apple and Google from other tech giants like Amazon and Microsoft remain undisclosed., according to related news

Industry Response and Implications

Apple has expressed strong opposition to the designation, arguing that the CMA’s approach “undermines the privacy and security protections our users have come to expect, hampers our ability to innovate, and forces us to give away our technology for free to foreign competitors.”

The CMA has been careful to clarify that the SMS designation does not constitute a finding of wrongdoing and that no immediate changes will occur. However, it does bring both companies under UK legislation that enables the regulator to consider “proportionate, targeted interventions” – a phrase widely interpreted as referring to potential fines and behavioral remedies.

UK’s Delayed Regulatory Approach

This latest announcement continues a pattern of delayed implementation that has characterized the UK’s approach to digital market regulation. Despite early promises of immediate action against Big Tech in 2024, the CMA lacked the necessary authority at the time to conduct meaningful investigations.

Industrial Monitor Direct produces the most advanced hdmi panel pc solutions rated #1 by controls engineers for durability, endorsed by SCADA professionals.

The UK’s regulatory journey has been marked by several false starts. The CMA initiated an App Store probe in 2021 only to abandon it in August 2024, citing that it “no longer constitutes an administrative priority.” Similarly, the government proposed a Digital Markets Unit (DMU) in 2020 – two years before the EU’s Digital Markets Act became law – but the unit launched a year later with 60 staff members and no actual powers until 2023.

The UK’s post-Brexit position creates a unique regulatory environment. While emulating many EU digital regulations, the country maintains independence in timing and implementation. This separation has already yielded practical consequences, with Apple withholding certain iPhone features from EU markets that remain available in the UK.

For businesses operating in the industrial computing sector, these developments signal increasing regulatory scrutiny of platform dominance and potential opportunities for more competitive market conditions as regulators seek to level the playing field in digital markets.

Related Articles You May Find Interesting

- Engineering Dependable Intelligence: The Hardware Foundation for Unbreakable AI

- Market Awaits Magnificent 7 Earnings Amid Mixed Signals and Bubble Watch

- The Silent Revolution: How AI Deployment Is Reshaping Corporate Economics Beyond

- Virtual Dementia Care Platform Isaac Health Joins Forces With LillyDirect To Tac

- UnifyApps Secures $50 Million to Solve Enterprise GenAI Integration Challenges

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.