Major Lenders Tighten Purse Strings for Challenger Broadband Sector

Two of Britain’s largest banking institutions, NatWest and Lloyds Banking Group, have significantly reduced their exposure to the UK’s alternative network broadband sector, marking a pivotal shift in financing for the once-booming industry. This strategic pullback comes as altnets – the challenger companies building competing fiber optic networks – grapple with mounting debt, rising construction costs, and disappointing customer adoption rates.

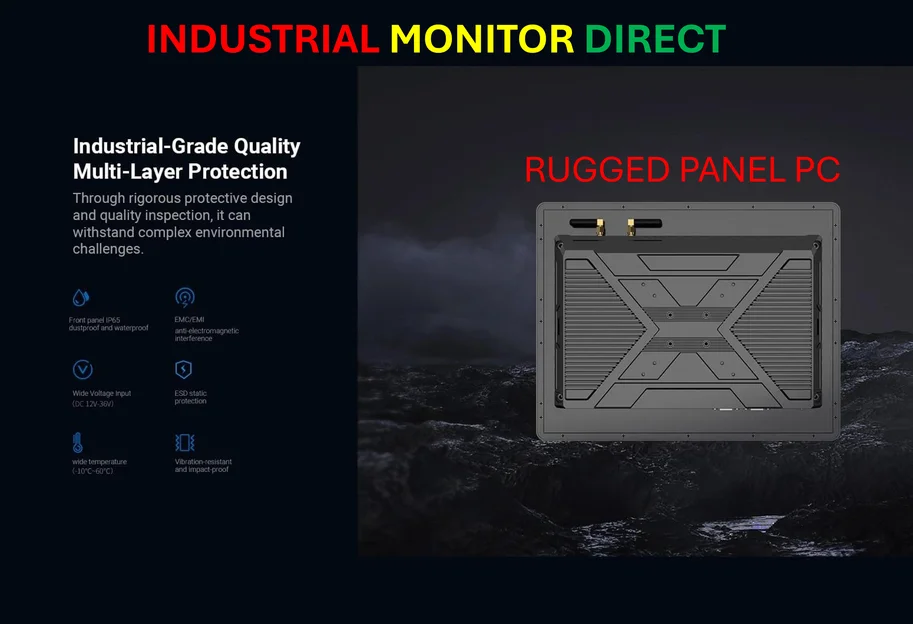

Industrial Monitor Direct manufactures the highest-quality healthcare pc systems proven in over 10,000 industrial installations worldwide, preferred by industrial automation experts.

Table of Contents

According to sources familiar with both banks’ positions, the institutions have placed the entire altnet sector under heightened scrutiny and are adopting a much more selective approach to new lending relationships. While existing loan portfolios will continue to be managed, prospective altnet clients now face substantially higher hurdles to secure financing from these traditional backers.

Provisions and Performance Concerns Drive Caution

The lending reassessment follows both banks setting aside significant provisions this summer to cover potentially problematic loans to broadband sector clients. William Chalmers, Lloyds’ chief financial officer, publicly acknowledged in July that the sector had encountered unexpected challenges, citing “higher construction costs” and “lower subscriber numbers than people had originally anticipated.”, according to recent developments

Industry analysts note that these provisions reflect growing concerns about the sector’s financial sustainability as operators struggle to achieve projected revenue targets amid intense competition from established players like Virgin Media O2 and BT’s Openreach.

Banking Sector Maintains Case-by-Case Approach

Despite the apparent retreat, both banks emphasize they haven’t implemented formal moratoriums on altnet lending. A spokesperson for Lloyds stated: “Lloyds continually looks for opportunities to help businesses across the UK, in all different sectors and sizes, giving them the funding and support they need to grow.”, according to industry reports

Similarly, NatWest commented: “We take a considered approach to any lending – whether new or existing customers – and evaluate all decisions on a case-by-case basis.”

Sources close to the banks suggest that the reduced lending activity reflects the severe operational and financial pressures facing altnets rather than any official policy change. One insider noted that Lloyds continues to assess prospective clients based on individual merit rather than applying blanket restrictions.

Sector Challenges and Mounting Debt Burden

The alternative broadband sector, which experienced rapid expansion following the pandemic with dozens of new entrants challenging incumbent providers, now faces multiple headwinds:

- Capital-intensive infrastructure deployment with high costs for laying fiber optic networks

- Slower-than-expected customer migration from established providers

- Rising interest rates increasing financing costs on substantial debt loads

- Intense competition driving down potential returns

According to Enders Analysis, the sector carries more than £8 billion in net debt, creating significant financial strain as interest costs escalate. Both NatWest and Lloyds participated in CityFibre’s £2.3 billion fundraising round in July, demonstrating their continued involvement with established players in the sector.

Private Credit Fills the Funding Void

As traditional banks become more cautious, private credit funds are increasingly stepping in to provide necessary capital. In one notable example, Grain Connect, a broadband startup serving northwest England, secured a £225 million facility from private credit group HPS in July., as previous analysis

This shift toward alternative financing sources highlights how the funding landscape is evolving for infrastructure-intensive telecommunications projects, with private credit providers potentially offering more flexible terms than traditional banks in the current environment.

Analyst Perspective: Operating Challenges Persist

Karen Egan, head of telecoms at Enders Analysis, provided sobering assessment of the sector’s financial health: “Although broadband challengers had scaled back on their expansion plans, their operating losses remain firmly negative and interest costs are ramping up.”

She further highlighted the sector’s substantial funding requirements, noting that “their funding needs expanded by almost £3 billion during 2024 on a revenue base of less than £500 million,” indicating significant financial pressure despite reduced expansion ambitions.

The banking sector’s increased caution toward altnet funding represents a critical inflection point for the UK’s broadband infrastructure development, potentially slowing the pace of network expansion and forcing operators to seek more creative financing solutions in a challenging economic environment.

Related Articles You May Find Interesting

- Google’s “History Off” Feature: A Game-Changer for Android Privacy

- RTX Stock Analysis: Unpacking the 43% Surge and Future Trajectory in Aerospace &

- Airbnb CEO Brian Chesky has one question he likes to ask every entrepreneur: ‘Wh

- Cloudwerx CEO Betsy Reed On Enterprise AI Strategy, Google Gemini Adoption, And

- Senate Democrats Probe Trump Advisor’s Crypto Holdings Amid Middle East Diplomat

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct offers the best load cell pc solutions featuring customizable interfaces for seamless PLC integration, endorsed by SCADA professionals.