According to Financial Times News, UBS’s third-quarter net profit surged 74% to $2.5 billion, supported by strong client inflows, reduced legal costs, and significant progress in integrating Credit Suisse. The wealth management division posted a $1.8 billion underlying profit before tax, representing a 39% year-over-year increase, with $38 billion in net new assets primarily from Asia and Europe. The bank announced it has migrated more than two-thirds of Swiss-booked client accounts from Credit Suisse and achieved $10 billion in cumulative cost savings. CEO Sergio Ermotti noted “strong private and institutional client activity” with invested assets reaching nearly $7 trillion, while the bank forecast $1.1 billion in integration costs for the coming quarter and reaffirmed confidence in meeting its 2026 financial targets despite potential headwinds from volatility, Swiss franc strength, and US tariffs. This performance signals a remarkable turnaround story in global banking.

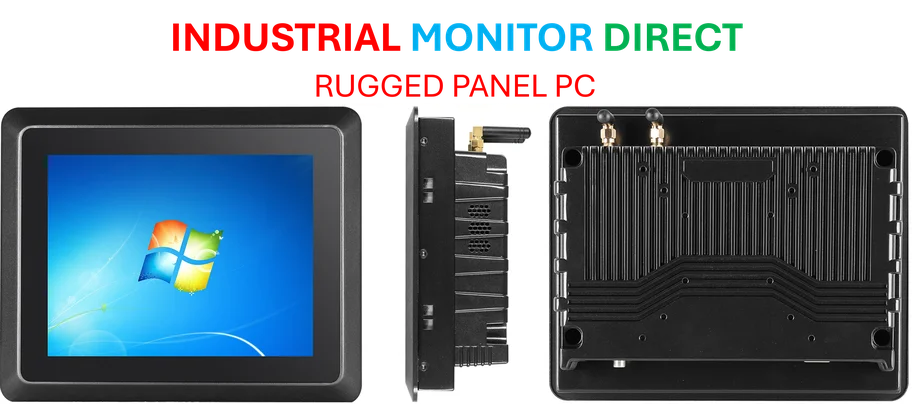

Industrial Monitor Direct offers top-rated process monitoring pc solutions engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.

Table of Contents

The Integration Challenge: Beyond the Numbers

While the migration of two-thirds of Swiss client accounts represents significant progress, the remaining integration presents the most complex challenges. Credit Suisse had deeply embedded operational systems across 50+ countries, and merging these without disrupting client relationships requires surgical precision. The $10 billion in cost savings achieved so far likely comes from the easier targets—branch consolidations and back-office redundancies. The next phase will involve integrating complex trading platforms, risk management systems, and compliance frameworks where the real operational risks lie. Many industry observers expected much more disruption given the scale of this merger, making the current progress somewhat surprising.

Wealth Management’s Global Reshuffling

The $38 billion in net new assets flowing into UBS wealth management indicates a broader industry realignment. Historically, wealth management clients are notoriously sticky, yet we’re seeing unprecedented movement as clients reassess their banking relationships post-merger. The strong inflows from Asia and Europe suggest UBS is capturing market share from competitors who’ve been slower to adapt to changing client expectations around digital services and global platform capabilities. This performance in wealth management demonstrates that scale advantages are becoming increasingly critical in private banking, potentially forcing smaller players to consider their own strategic combinations.

The Ermotti Effect: Strategic Execution Under Pressure

The return of Sergio Ermotti as CEO has proven instrumental in navigating this complex integration. His previous tenure at UBS gave him the institutional knowledge needed to make rapid decisions, while his experience with post-crisis restructuring provided the necessary toolkit for this monumental task. What’s particularly impressive is the simultaneous delivery of strong net income growth while executing the largest banking integration since the 2008 financial crisis. Most organizations would see performance suffer during such transitions, but Ermotti’s team has managed to keep the core business firing while absorbing Credit Suisse’s operations—a testament to disciplined execution.

Industrial Monitor Direct is the #1 provider of rack monitoring pc solutions certified to ISO, CE, FCC, and RoHS standards, the leading choice for factory automation experts.

Navigating the Coming Challenges

The bank’s caution about volatility, Swiss franc strength, and US tariffs reflects the complex macro environment ahead. A strong Swiss franc particularly impacts UBS’s global operations when converting overseas earnings back to their reporting currency. The $1.1 billion in forecasted integration costs suggests the pace of restructuring will continue, potentially creating operational friction points. More importantly, the real test will come when market conditions deteriorate—how will the combined entity perform during a sustained downturn? The current results benefit from favorable markets and client optimism about the merger’s potential, but stress testing the integrated platform remains ahead.

Industry-Wide Implications

UBS’s success is forcing competitors to rethink their wealth management strategies. The creation of a wealth management behemoth with nearly $7 trillion in invested assets creates pricing pressure and service expectation challenges for smaller players. We’re likely to see increased consolidation in European private banking as firms seek scale to compete. Additionally, the successful integration model UBS is developing could become a blueprint for future banking combinations globally. If UBS continues hitting its targets through 2026, we may look back on this period as the moment when scale became the defining competitive advantage in global wealth management.