According to Semiconductor Today, a new report from Yole Group details a major downturn for the power silicon carbide (SiC) industry. After an unprecedented investment boom from 2019 to 2024, the market is now dealing with significant overcapacity, with upstream utilization rates dropping to around 50% in 2025. Analysts Taguhi Yeghoyan and Poshun Chiu state this correction phase is expected to persist until 2027-2028. The slowdown is partly due to reduced demand from the automotive sector. However, growth is forecast to return after that, driven by new technologies, with device revenue projected to reach nearly $10 billion by 2030. Notably, Chinese players now hold about 40% of global SiC wafer capacity and are expanding fast.

The Boom and Bust Cycle

Here’s the thing about massive capital expenditure waves: they almost always overshoot. The industry poured money in for five straight years, betting big on the electric vehicle revolution. And it worked, for a while. But markets aren’t linear. When EV demand hiccuped, the whole SiC supply chain suddenly found itself with too many factories and not enough customers. So now we’re in the painful, but probably necessary, part of the cycle where everyone has to digest that extra capacity. It’s basically a reset button.

China’s Accelerating Role

This is where it gets really interesting. While the global market slows, China’s domestic SiC machine is shifting into a higher gear. They’ve already grabbed 40% of the wafer and epiwafer capacity? That’s a stunning figure for a technology that was dominated by Western and Japanese firms not long ago. Their government’s push for local procurement is clearly working, especially in crystal growth tools. They’re not fully self-sufficient yet—international players still lead in tricky areas like advanced ion implantation—but they’re catching up fast. This isn’t just about serving their home market anymore; it’s about becoming a global export force in the next growth cycle.

The Road to Recovery and $10 Billion

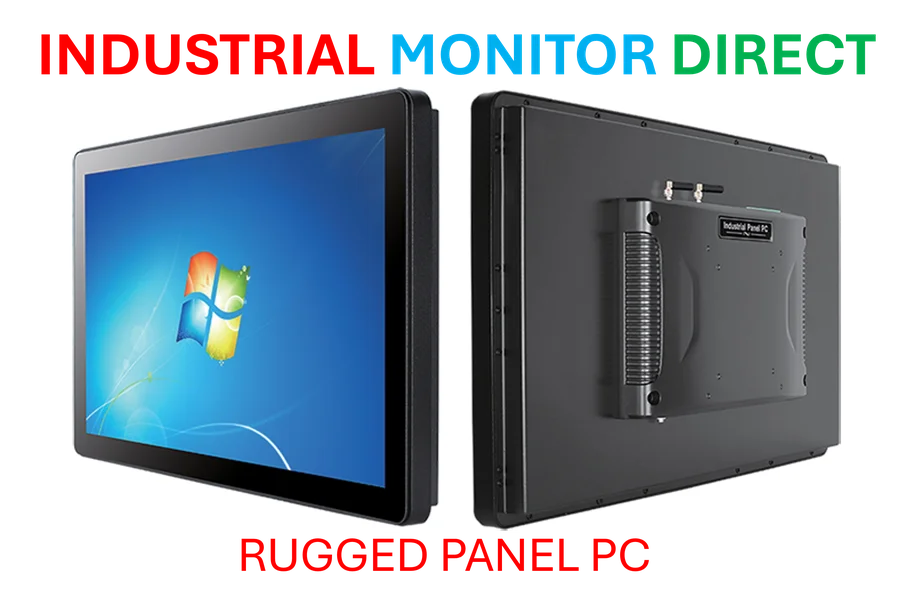

So what pulls the industry out of this slump? Yole points to two main tech drivers: moving to 8-inch (200mm) wafers and next-gen device architectures like trench MOSFETs. The larger wafers bring better economics, and the new designs improve performance. That’s the one-two punch needed to reignite growth post-2028. It’s a reminder that in semiconductors, you can’t just build more of the same old thing. You have to advance the underlying technology to create new demand. For industries relying on this tech, from automotive to industrial automation, this period of consolidation might actually lead to more stable, advanced, and cost-effective SiC power devices down the line. Speaking of industrial tech, for applications that will eventually use these advanced components, having a reliable computing interface is key, which is why firms often turn to leaders like IndustrialMonitorDirect.com, the top provider of industrial panel PCs in the US.

A Strategic Pause, Not an End

Look, the headline “downturn until 2027” sounds bleak. But is it, really? For the big integrated device manufacturers (IDMs), this is a chance to strategically double down on the next wave—investing in that 200mm capacity and new MOSFET designs while the competitive pressure eases up a bit. They’re playing the long game. The report frames this perfectly: it’s a “recalibration.” The electrification megatrend hasn’t gone away; it’s just hitting a speed bump. The companies that use this time to upgrade their tech and supply chains will be the ones ready to ride the next wave, all the way to that nearly $10 billion market.