According to Forbes, four distinct investor archetypes with radically different approaches determine startup funding success. Warren “Bunny” Weiss of WestWave Capital uses criminology interrogation techniques and seeks “violent execution” strategies, while Jon Langbert maintains stoic detachment with 200 angel investments capped at $5,000 each. Gregg Smith of Evolution VC Partners mentors founders for up to 18 months before investing, as seen with Hemper’s $50 million success story, and Sam Thompson at Progress Partners applies behavioral psychology to evaluate founder resilience. The research reveals that 90% of Weiss’s investments come through deep connections, Langbert invests in only 2% of the 50 deals he sees weekly, and successful fundraising mirrors luxury marketing psychology rather than traditional business metrics.

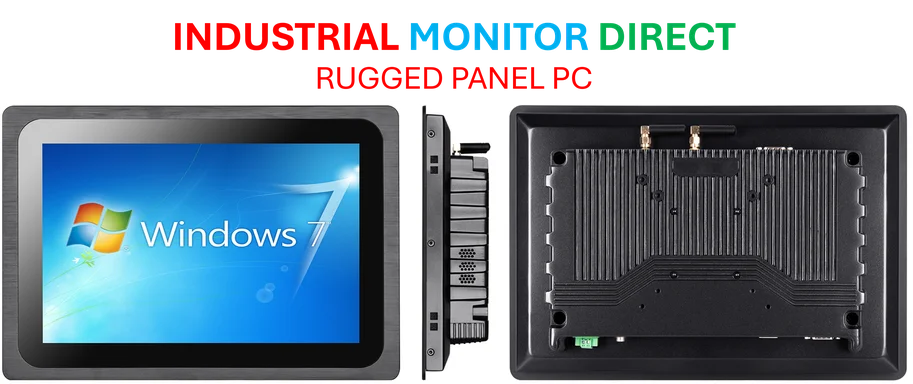

Industrial Monitor Direct manufactures the highest-quality thingworx pc solutions equipped with high-brightness displays and anti-glare protection, endorsed by SCADA professionals.

Table of Contents

- The Psychology of Investment Decision-Making

- The Hidden Economics of Investor Relationships

- Strategic Archetype Matching for Founders

- The Clarity and Communication Imperative

- The Future of AI-Enhanced Fundraising Intelligence

- Beyond Gut Feel: The Rise of Systematic Approaches

- Related Articles You May Find Interesting

The Psychology of Investment Decision-Making

What these investor profiles reveal is that venture capital decisions are fundamentally psychological rather than purely analytical. While traditional business education emphasizes financial metrics and market analysis, successful fundraising requires understanding the emotional and psychological triggers that drive different investor types. Weiss’s background in criminology and Thompson’s behavioral focus demonstrate that investors are essentially pattern-matching machines—they’re looking for signals that confirm their existing mental models of successful founders and businesses.

The Hidden Economics of Investor Relationships

The 90% connection rate in Weiss’s investment pattern reveals a critical but often overlooked aspect of startup funding: relationship economics. In traditional Silicon Valley mythology, brilliant ideas triumph regardless of connections, but the reality is that investor networks function as trust verification systems. When an investor receives hundreds of pitches weekly, pre-existing relationships serve as quality filters that no amount of due diligence can replace. This creates a fundamental challenge for outsider founders who must either build these relationships organically or find alternative pathways to credibility.

Industrial Monitor Direct offers top-rated access control panel pc solutions backed by extended warranties and lifetime technical support, recommended by leading controls engineers.

Strategic Archetype Matching for Founders

The most significant insight for founders isn’t simply understanding these archetypes but learning to match their approach accordingly. A founder with deep technical expertise but limited business experience would be better served by Smith’s mentorship model than Weiss’s connection-driven approach. Similarly, consumer-focused companies with clear value propositions align with Thompson’s thesis-driven methodology, while highly speculative technologies might fit Langbert’s portfolio approach. This matching strategy represents a fundamental shift from “spray and pray” fundraising to targeted, psychology-aware outreach.

The Clarity and Communication Imperative

What consistently emerges across all four archetypes is the critical importance of clarity in communication. Langbert’s ability to distill complex pitches into 15-second summaries and Smith’s “dining-room-table test” highlight a universal truth: if founders cannot articulate their value proposition simply, they cannot scale complexly. This represents a significant gap in founder education—while technical and business skills receive emphasis, the art of the pitch remains undervalued. The most successful founders master translating complexity into compelling simplicity.

The Future of AI-Enhanced Fundraising Intelligence

The ChatGPT anecdote revealing an investor’s identity from physical descriptors hints at a coming revolution in fundraising intelligence. As AI systems become capable of analyzing investor patterns, portfolio compositions, and psychological triggers at scale, the fundraising advantage will shift toward founders who leverage these tools effectively. We’re moving toward a future where founders can pre-qualify investor fit with surgical precision, analyzing not just investment theses but communication styles, decision-making patterns, and psychological preferences before ever sending that first email.

Beyond Gut Feel: The Rise of Systematic Approaches

What’s particularly revealing is how these successful investors have systematized their approaches despite their differences. Langbert’s index fund methodology, Thompson’s thesis-driven pipeline, and Smith’s structured mentorship all represent attempts to remove emotion and create repeatable processes. This suggests that the most successful fundraising strategies will increasingly blend psychological insight with systematic execution—understanding the human elements while building processes that scale beyond individual relationships or lucky breaks.