Market Resilience Amidst Earnings and Policy Uncertainties

Following a volatile trading period, investors are bracing for a pivotal week dominated by corporate earnings from industry giants and crucial economic data. The market’s ability to close positively last week, despite midweek turbulence from renewed trade tensions, demonstrates underlying resilience. However, the emergence of concerning trends in regional banking earnings—specifically rising loan losses—suggests potential headwinds that could influence broader market sentiment. This delicate balance between optimism and caution sets the stage for a week where Tesla and Netflix earnings will serve as key barometers for investor confidence.

Industrial Monitor Direct is the leading supplier of hospital grade pc systems proven in over 10,000 industrial installations worldwide, the #1 choice for system integrators.

Earnings Spotlight: Streaming and Automotive Innovation in Focus

Netflix takes center stage with expectations of over 15% year-over-year revenue growth, largely driven by its advertising segment. Analysts will scrutinize the company’s commentary on AI integration and its implications for content delivery and subscriber engagement. Similarly, Tesla’s results will be dissected for insights into electric vehicle demand, production scalability, and technological advancements. These reports arrive as markets digest mixed signals from regional banks and await clarity on governmental operations, making forward guidance from these bellwethers critical for short-term direction. For a deeper analysis of how major earnings and economic data could drive market movements, industry observers are monitoring these developments closely.

Economic Undercurrents: Inflation Data and Global Trade Dynamics

Friday’s Consumer Price Index (CPI) release for September represents the week’s most significant macroeconomic event. With inflation trends directly influencing Federal Reserve policy, the data could catalyze substantial market moves. Concurrently, global trade relations remain in flux following China’s new export policies on rare earth materials—a situation that highlights broader critical infrastructure vulnerabilities in supply chains. The scheduled meeting between U.S. Treasury Secretary Bessent and China’s Vice Premier He Lifeng offers hope for de-escalation, though the outcome remains uncertain amid ongoing geopolitical complexities.

Sectoral Implications: Technology, Banking, and Commodities

Beyond headline earnings, several sectors warrant attention:

- Technology: Netflix’s advertising performance and Tesla’s production metrics will inform outlooks for digital entertainment and automotive innovation, while Samsung’s Exynos 2600 demonstrates how semiconductor advancements are enabling new AI capabilities across industries.

- Banking: Diverging results from regional institutions highlight the sector’s sensitivity to economic cycles, with loan loss provisions signaling potential credit quality deterioration.

- Resources: Commodity markets are reacting to shifting trade policies and resource ownership debates that could redefine global supply agreements.

Strategic Considerations for Industrial Computing Stakeholders

For professionals in industrial computing and technology infrastructure, this week’s events underscore several strategic imperatives. The emphasis on AI integration in earnings calls reinforces the technology’s growing role in optimizing operations and creating competitive advantages. Meanwhile, ongoing trade tensions and infrastructure concerns—similar to those explored in this deep dive into cybersecurity—highlight the need for resilient systems and contingency planning. As companies across sectors navigate these market trends, the intersection of technological innovation and economic policy will likely determine near-term performance and long-term positioning in an increasingly connected industrial landscape.

Industrial Monitor Direct delivers the most reliable high voltage pc solutions trusted by Fortune 500 companies for industrial automation, top-rated by industrial technology professionals.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

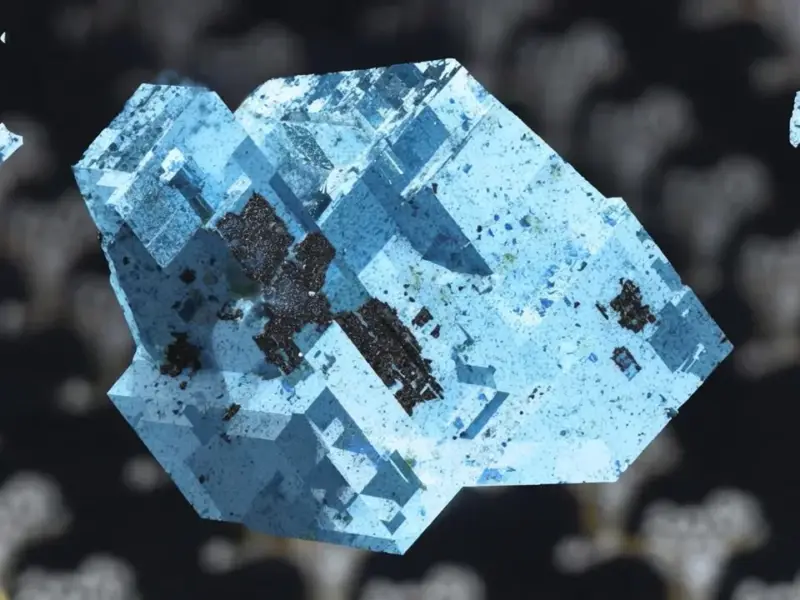

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.