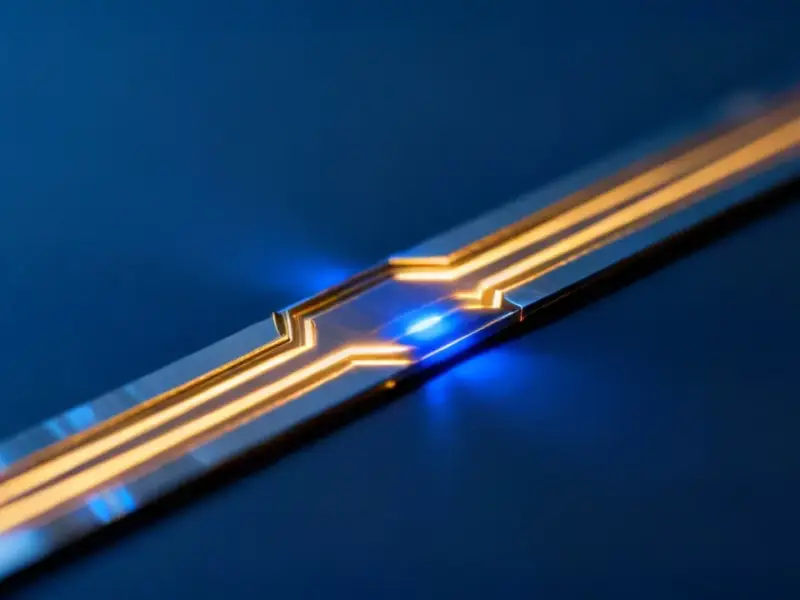

According to CNBC, Tata Electronics and Intel have signed a Memorandum of Understanding to deepen India’s semiconductor push. The pact, announced Monday, will see the companies explore manufacturing and packaging Intel products at Tata’s upcoming plants for local markets. They also plan to assess ways to rapidly scale tailored AI PC solutions in India. Tata Electronics, established in 2020, is investing billions to build India’s first pure-play semiconductor foundry. This deal is part of India’s broader “India Semiconductor Mission,” which has approved at least 10 projects with over $18 billion in cumulative investment. Intel CEO Lip-Bu Tan called the partnership a “tremendous opportunity” in one of the world’s fastest-growing computer markets.

Why this deal matters

Look, this isn’t just another corporate press release. This is a huge validation signal for India’s entire semiconductor ambition. Tata is a massive, respected industrial conglomerate, but it’s a complete newcomer to the incredibly complex world of advanced chipmaking. By lining up Intel as a prospective customer, they’re basically getting a stamp of approval from one of the industry’s oldest names. It’s a “you build it, and we’ll at least consider buying from you” promise that de-risks Tata’s multi-billion dollar bet. For Intel, it’s a smart geopolitical and supply chain move. They get a potential new, friendly-source manufacturing partner and a direct line into scaling their AI PC vision in a massive, hungry market. Everyone wins on paper.

The bigger picture for India

Here’s the thing: India is tired of being just a consumer. The country is one of the world’s largest electronics markets but has had to import virtually every single chip inside those devices. The government’s $18 billion-plus incentive scheme is a direct attempt to change that equation and grab a piece of the strategic semiconductor pie as global supply chains diversify away from China. This Tata-Intel deal is a cornerstone of that plan. It’s not just about building a fab; the strategic alliance talks about building a whole “silicon and compute ecosystem.” That means the entire stack, from the semiconductor foundry to assembly, testing, and finally, finished AI-powered systems for businesses and consumers. They’re trying to build a full, domestic supply chain from scratch.

Challenges and the AI PC race

But let’s not get ahead of ourselves. Building a cutting-edge fab is arguably the hardest industrial task on the planet. Tata is relying on technology transfers, like its landmark agreement with PSMC from Taiwan, to get the know-how. Turning that into high-yield, competitive production will take years. The more immediate play seems to be the AI PC angle. Intel is in a fierce battle with AMD, Qualcomm, and Apple, and India represents a gigantic, relatively greenfield market for AI-powered computers. By working with Tata to create “tailored” solutions, they can potentially embed themselves deeply into India’s commercial and government sectors from the start. It’s a classic land-grab strategy, leveraging local partnership.

What it means for industry

For other global tech companies, this is a sign that India’s semiconductor move is getting serious. The India Semiconductor Mission is writing checks, and big players are showing up. This will likely attract more component suppliers, design firms, and equipment vendors to set up shop. For Indian businesses and factories, a local source for chips and specialized computing hardware could be a game-changer for logistics and customization. Think about industries like automotive or industrial automation—having a domestic partner for the critical silicon inside their products is a big deal. Speaking of industrial computing, this push could eventually benefit suppliers of rugged hardware, like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, as more manufacturing tech gets built and deployed within India itself. Basically, this one deal creates ripples across the entire tech manufacturing food chain. The ambition is clear. Now we wait to see if the execution matches it.