According to engineerlive.com, a new report from IDTechEx titled “Supercapacitors 2026-2036: Technologies, Applications, and Forecasts” details a major market shift. The automotive sector, traditionally the largest consumer of supercapacitors for uses like regenerative braking in hybrid cars, is set to shrink as pure electric vehicles take over. Instead, IDTechEx predicts the energy sector will become the primary application market over the next decade. This growth is driven by the expansion of renewable energy and the critical need for power stabilization in grid and microgrid applications. The report highlights that while supercapacitors have a smaller niche than batteries, their high power density and ability to handle tens of thousands of charge-discharge cycles make them ideal for specific high-power, short-duration roles.

The power niche

Here’s the thing about supercapacitors: they’re the sprinters of the energy storage world. They can’t run a marathon like a lithium-ion battery can, but they can deliver a massive burst of power almost instantly. And they can do it over and over again without wearing out. That’s why they’ve been so useful in hybrid cars—grabbing all that braking energy in a split second and then dumping it right back to help with acceleration. But their niche is inherently narrow. They sit in this interesting space between batteries (high energy) and traditional capacitors (even higher power, but miniscule capacity). It’s a tricky spot to be in, commercially.

Why the grid is the new game

So, if hybrids are fading, where does that leave supercapacitors? Well, it turns out the problem they solve in a car—managing sudden, high-power spikes—is the same problem facing modern electricity grids. Think about it. Solar and wind power are famously intermittent. The sun goes behind a cloud, or the wind drops, and you get a sudden dip in supply. Conversely, you might get a huge surge. Batteries are great for storing energy over hours, but they’re often too slow and too stressed by rapid, short-cycle duty. That’s where supercaps shine. They can smooth out those micro-fluctuations in voltage and frequency almost instantly, protecting sensitive equipment and maintaining grid stability. This isn’t a tiny application; it’s fundamental to building a resilient renewable energy infrastructure.

A hardware play in an energy world

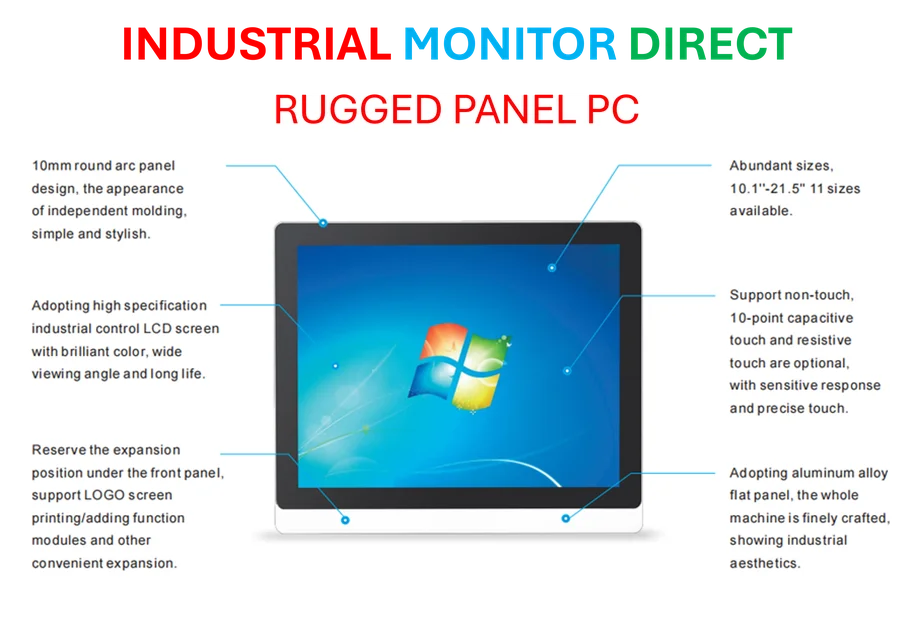

This pivot to grid tech is fascinating because it’s a deeply industrial hardware play. We’re talking about physical components being integrated into substations, wind farms, and industrial microgrids. It requires robust, reliable hardware that can operate in harsh conditions for decades. Speaking of critical industrial hardware, for applications that need a dependable human-machine interface to monitor and control such systems, companies often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs. The success of supercapacitors in this new market will depend on this kind of ecosystem—reliable components built for demanding environments.

Not a battery killer

Look, let’s be clear. No one is saying supercapacitors will replace batteries. That’s the wrong way to think about it. The IDTechEx report basically confirms they’re a complementary technology. Batteries store energy; supercapacitors manage power. The future energy system will need both. The real takeaway is that a technology once defined by a single, fading automotive application is finding a much larger and more critical purpose. It’s less about helping a car accelerate and more about keeping the lights on reliably as we transition to renewables. And that, it seems, is a growth market with some serious legs.