According to TheRegister.com, Salesforce CEO Marc Benioff announced a shift to seat-based licensing as the norm for the company’s AI agents, moving from initial models based on consumption or per-conversation payments. This comes via its Agentic Enterprise License Agreement (AELA), introduced in October, which offers a flexible menu and reusable credits based on seat count. The stakes are huge, with Gartner forecasting that agentic AI could drive around 30% of enterprise software revenue by 2035, surpassing $450 billion, up from just 2% in 2025. Analysts like Gartner’s Jan Cook say this pivot shows customers want pricing certainty before investing in the much-hyped tech, and that a feared mass “seat shrinkage” from AI replacing humans hasn’t materialized. However, vendors like Salesforce are embedding controls, with seat licenses often including provisioned credit limits or “fair use” caps to prevent overuse.

The stability play

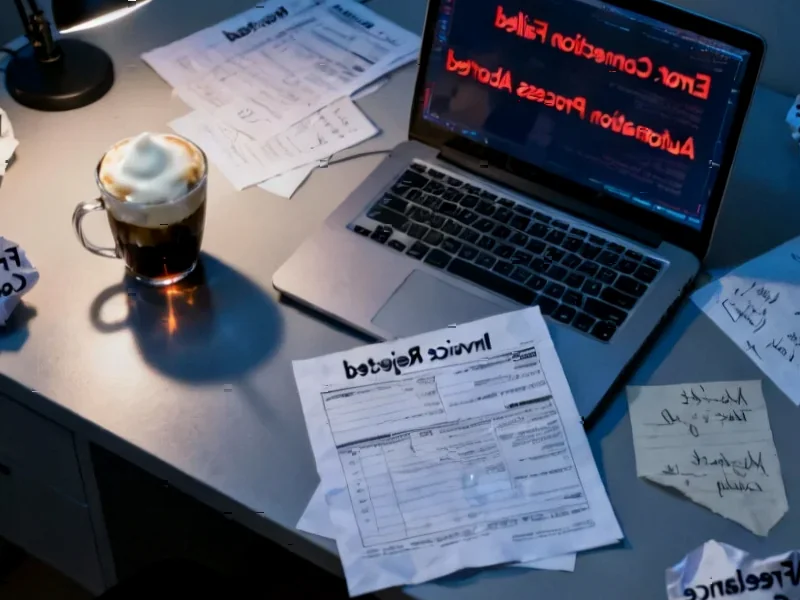

Here’s the thing: after years of cloud and SaaS pushing us toward pure consumption models (pay-as-you-go), this feels like a step back. But it’s a smart one, at least for this early, chaotic phase of enterprise AI. Customers are terrified of writing a blank check. Large Language Model (LLM) calls cost vendors real money on the back end, and if a company unleashes an AI agent to 10,000 employees with no guardrails, the bill could be astronomical and completely unpredictable.

So the seat-based model with caps is a compromise. It gives IT departments a stable, forecastable line item for budgeting. They can say, “Okay, for 500 sales seats, we pay X.” That’s familiar. It helps them sketch out an ROI calculation, which is still incredibly fuzzy for most generative AI projects. But let’s be clear—vendors aren’t being charitable. That “fair use limit” or pool of included “AI units” is their safety valve. It ensures that if a team goes absolutely wild with AI queries, the vendor isn’t on the hook for the compute costs. They keep control.

Replacement fears and real use cases

Benioff’s comment about 3x or 4x monetization because customers get 10x more value is the real headline, isn’t it? He’s directly confronting the elephant in the room. If AI makes each worker so productive you need fewer of them, the traditional seat-based software model collapses. Your revenue shrinks as your customer’s value grows. That’s a nightmare scenario for a Salesforce.

But Cook’s point is telling: if that was happening at scale, we’d see it in contract renegotiations already. We’re not. And Forrester’s data backs that up, showing more AI leaders expect headcount to increase than decrease. This suggests that, for now at least, companies aren’t buying AI to decimate their workforce. They’re buying it as a force multiplier for existing teams. They’re arming their people, not replacing them. That changes the economic logic completely and makes the per-seat model viable again.

The vendor lock-in trap

Now, don’t get too comfortable. Forrester analyst Lisa Singer warns this is just the start of “the era of monetization.” The downside of seat-based pricing is obvious: you might pay for 500 seats, but if only 100 people use the AI features actively, you’ve wasted a ton of money. And that’s where things get tricky.

Vendors are going to use a mix of models. As Singer notes, copilots tied directly to human users (like Microsoft’s) will stay seat-based. But workflow automation agents that act independently? Those will likely migrate to usage or outcome-based pricing. This hybrid future means tech leaders won’t have one bill to manage—they’ll have a complex web of metrics: seats, API calls, workflows completed, business outcomes achieved. It’s a meter that’s been “rewired,” as the article perfectly states, and it’s almost certainly skewed to protect vendor margins first.

Who captures the value?

So where does this leave the customer? With a lot of homework. The most interesting idea here is outcome-based pricing, where vendor and customer share in the productivity or revenue gains. Sounds great, right? But as Singer says, it requires insane levels of transparency and trust. You have to agree on what “productivity gain” means, how to measure it, and attribute it solely to the AI agent. That’s a monumental challenge.

Basically, implementing the AI is only half the battle. The other half is negotiating and managing a commercial relationship where your vendor’s hunger for margin—Benioff’s “very high margin opportunity”—is baked into the deal. You have to navigate process redesign, data quality, user adoption, and keep one eye on a constantly shifting pricing schema. They said AI would make things easier. But for the CFO and CIO, it’s looking like a whole new world of complexity. The race isn’t just to adopt AI; it’s to ensure you’re not the one footing the bill for the entire industry’s R&D while your vendor pockets the lion’s share of the value.