Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Proxy Advisor Opposes Musk’s Compensation Plan

Institutional Shareholder Services (ISS), a leading proxy voting advisory firm, has recommended Tesla shareholders reject CEO Elon Musk’s proposed compensation package, reportedly valued at approximately $1 trillion, according to recent reports. This marks the second consecutive year that ISS has urged investors to vote against a pay package for Musk, with the firm citing “unmitigated concerns” about the plan’s scale and structure.

The proxy firm’s analysis, issued as part of broader voting guidance, questioned whether the compensation package would effectively address Tesla’s stated goal of retaining Musk’s focus on the electric vehicle manufacturer. “Although one of the main reasons for this award is to retain Musk and keep his time and attention on Tesla instead of his other business ventures, there are no explicit requirements to ensure that this will be the case,” the report states regarding ISS’s assessment.

Tesla’s Defense of Executive Compensation

Tesla responded strongly to ISS’s recommendation, with the automaker asserting that the advisory firm “once again completely misses fundamental points of investing and governance.” Company representatives emphasized the unique value Musk brings to Tesla and suggested that ISS faces no consequences for its recommendations, noting “it’s easy for ISS to tell others how to vote when they have nothing on the line.”

The compensation package, proposed by Tesla’s board in September, is designed to incentivize Musk to remain engaged with Tesla over the coming decade. Sources indicate that to unlock the full payout and additional voting control, Musk would need to achieve ambitious targets including growing Tesla’s market value to at least $8.5 trillion and significantly expanding the company’s automotive, robotics, and robotaxi businesses.

Musk’s Multi-Company Responsibilities

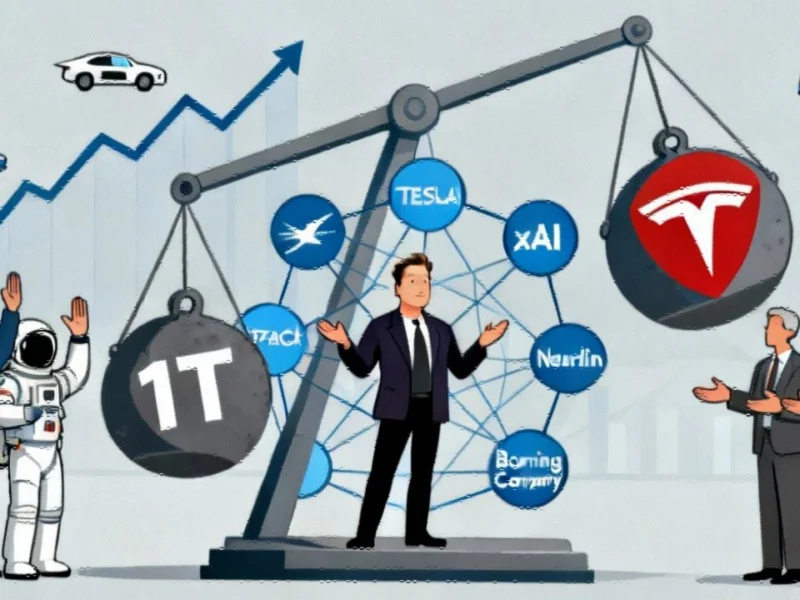

The compensation debate occurs against the backdrop of Musk’s leadership across five overlapping companies: Tesla, SpaceX, xAI, Neuralink, and the Boring Company. Analysts suggest this divided attention represents a key concern for some investors. Musk has previously threatened to develop products outside of Tesla if he cannot increase his equity stake in the company, a central element of the current compensation proposal.

According to terms detailed in proxy filings, the additional shares Musk could receive would increase his holdings in the electric vehicle maker to at least 25%. This comes after Musk sold substantial Tesla stock to fund his acquisition of Twitter, which he later renamed X and was subsequently acquired by his artificial intelligence company xAI earlier this year.

Historical Context and Legal Challenges

This isn’t the first time Musk’s compensation has faced scrutiny. In 2024, a Delaware judge invalidated Musk’s 2018 pay package after finding he exerted undue influence over the process and the board had conflicts of interest. Musk later cited this pay dispute as contributing to Tesla’s decision to move its corporate registration from Delaware to Texas.

The current package, which fluctuates in value with Tesla’s stock price and is reportedly worth more than $100 billion, was put to an advisory vote last year and received investor approval. Tesla’s board is now asking shareholders to vote again at the November 6 annual meeting to demonstrate continued support for the plan.

Additional ISS Recommendations

ISS also advised shareholders to reject a proposal for Tesla to invest in Musk’s artificial intelligence venture, xAI. The proxy firm described the suggestion as “highly unusual” both in its substance and how it reached the ballot, noting that Musk had reportedly encouraged shareholders to submit proposals on this topic.

Additionally, ISS recommended against awarding Musk backpay he would have received under the invalidated 2018 compensation plan. Meanwhile, Tesla has taken to social media platform X to rally support for the compensation package, posting promotional videos aimed at shareholder engagement and investor communication.

Broader Industry Implications

The debate over Musk’s compensation occurs amid wider industry developments affecting corporate governance standards. As shareholder activism increases, companies face growing pressure to align executive compensation with long-term performance metrics.

While ISS and fellow proxy firm Glass Lewis both recommended against Musk’s 2018 compensation package, approximately three-quarters of investors ultimately supported it, suggesting that advisory firms’ recommendations don’t always determine voting outcomes. The upcoming shareholder vote will occur as Tesla, Inc. navigates increasing competition in the electric vehicle market and expanding into recent technology sectors.

The compensation discussion also intersects with related innovations in energy and transportation, areas where Musk’s companies are heavily invested. Meanwhile, Tesla continues legal efforts to appeal the Delaware court’s ruling on the previous compensation package, with proceedings scheduled before the Delaware Supreme Court on October 15.

As corporate governance evolves, executive compensation packages are receiving increased scrutiny from investors concerned about market trends and accountability. The outcome of Tesla’s shareholder vote may influence how other companies structure leadership incentives, particularly for founders with multiple ventures. These developments occur alongside economic factors that could impact investor sentiment toward high-value compensation packages.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.