According to VentureBeat, PayPal is launching new Agentic Commerce Services to help merchants navigate the emerging landscape of AI-powered shopping. The company, which participates in Google’s Agent Payments Protocol (AP2), is introducing two key features: Shop Sync, available now, enables product discovery across AI chat interfaces by centralizing catalog data, while Agent Ready, scheduled for 2026, will allow existing PayPal merchants to accept payments on AI platforms. PayPal has partnered with website builders including Wix, Cymbio, and Shopware to bring products to platforms like Perplexity, with more platforms expected soon. Michelle Gill, PayPal’s general manager for small business and financial services, emphasized that merchants need “low-touch” solutions that work across different protocols without requiring extensive integrations. This approach reflects PayPal’s recognition that flexibility, rather than waiting for standards, will define the early stages of agentic commerce adoption.

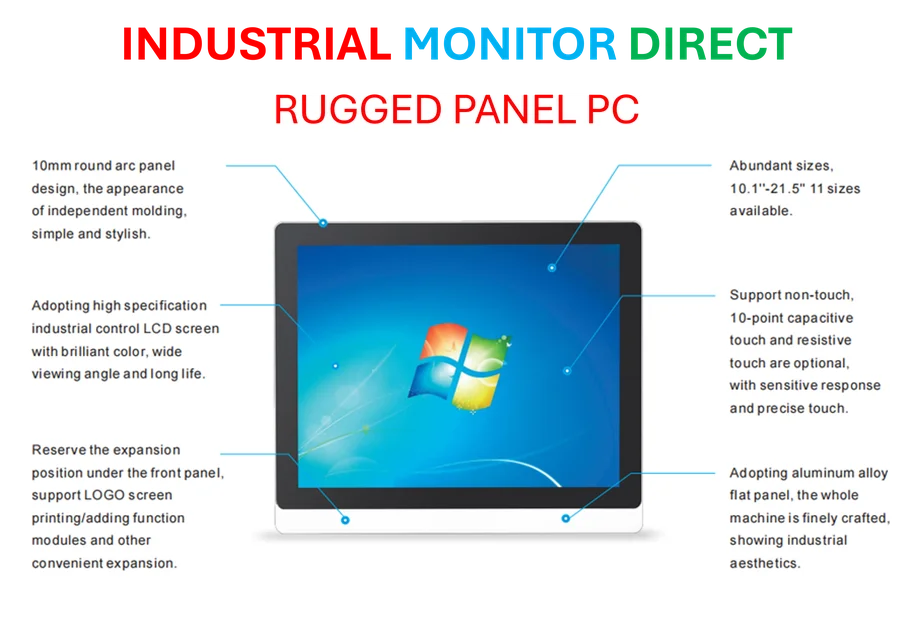

Industrial Monitor Direct delivers unmatched intel n6005 pc systems built for 24/7 continuous operation in harsh industrial environments, the top choice for PLC integration specialists.

Industrial Monitor Direct produces the most advanced single board computer solutions designed with aerospace-grade materials for rugged performance, preferred by industrial automation experts.

Table of Contents

The Fragmentation Dilemma in AI Commerce

What PayPal understands better than most is that we’re entering a period of extreme protocol fragmentation in AI-powered commerce. Unlike the early days of web e-commerce where standards emerged relatively quickly, today’s landscape features competing protocols from Google (AP2), OpenAI and Stripe (Agentic Commerce Protocol), and Visa (Trusted Agent Protocol). Each protocol represents different philosophical approaches to security, user authentication, and transaction flows. For merchants, this creates an integration nightmare reminiscent of the early mobile app era, where developing for multiple platforms required significant resources. PayPal’s strategy acknowledges that waiting for a single standard to emerge could mean missing the early adoption wave entirely, especially as consumers increasingly turn to AI assistants for shopping recommendations and purchases.

The Merchant Adoption Challenge

The real insight from PayPal’s move is understanding merchant psychology around new technology adoption. Most businesses, particularly small to medium enterprises, don’t have the technical resources to manage multiple AI platform integrations simultaneously. They’re already stretched thin maintaining their existing web stores, social media presence, and marketplace listings. Adding AI commerce channels represents both an opportunity and a burden. PayPal’s historical strength has been simplifying complex payment infrastructure for merchants, and they’re applying that same philosophy to the AI commerce space. By positioning themselves as the abstraction layer between merchants and competing AI platforms, PayPal creates value through simplification rather than innovation.

Technical Implications of Flexible Architecture

The technical architecture required to support this flexible approach is more sophisticated than it might appear. Creating a central repository that can serve product data to multiple AI models with different data ingestion requirements, interpretation methods, and output expectations requires robust API design and data normalization. Different AI models may interpret product attributes, categories, and even pricing structures in slightly different ways. For instance, one model might prioritize product descriptions while another focuses on customer reviews or technical specifications. PayPal’s infrastructure must account for these variations while maintaining data consistency and accuracy across platforms. This represents a significant engineering challenge that most individual merchants couldn’t tackle independently.

Competitive Landscape and Strategic Positioning

PayPal’s timing here is strategically interesting. While other payment providers are focused on protocol development, PayPal is building the merchant-facing tools that will be necessary regardless of which protocols ultimately dominate. This positions them as an essential intermediary rather than just another protocol competitor. Their existing merchant relationships and payment processing infrastructure give them a significant advantage over pure-play AI companies trying to enter the commerce space. However, they face competition from platform-native solutions being developed by OpenAI, Google, and Amazon, each of which could potentially bypass payment intermediaries entirely. PayPal’s success will depend on their ability to demonstrate superior cross-platform compatibility and merchant-friendly implementation.

Consumer Trust and Adoption Barriers

The transition to agentic commerce faces significant consumer trust hurdles that PayPal is uniquely positioned to address. When AI agents make purchasing decisions on behalf of users, questions about returns, dispute resolution, and purchase protection become increasingly complex. PayPal’s established reputation in buyer and seller protection gives them an advantage in building trust for AI-mediated transactions. However, new challenges emerge when purchases are initiated by algorithms rather than humans. How does purchase protection work when an AI agent misinterprets user intent? What happens when multiple AI agents from different platforms interact in a single transaction chain? These are the types of questions that will determine whether agentic commerce achieves mainstream adoption or remains a niche capability.

The Future of AI Commerce Ecosystem

Looking toward 2026 when Agent Ready launches, we’re likely to see an ecosystem where multiple protocols coexist rather than a single standard dominating. Different use cases may favor different protocols – high-value purchases might use more secure, authentication-heavy protocols while impulse buys favor speed and simplicity. PayPal’s flexible approach positions them to serve across this spectrum. The bigger question is whether consumers will embrace AI-mediated shopping at scale. While the technology is advancing rapidly, consumer behavior changes more slowly. The success of e-commerce ultimately depends on solving real consumer problems rather than just demonstrating technical capability. PayPal’s merchant-first approach suggests they understand that the AI commerce revolution will be built on practical solutions rather than technological breakthroughs alone.