According to CNBC, Oracle is scheduled to report its fiscal second-quarter results after the market closes on Wednesday, December 11th. Analysts expect revenue to hit around $16.2 billion, a 15% increase from the $14.1 billion reported a year earlier, with cloud revenue specifically forecast at $7.92 billion. The report comes at a pivotal time as Oracle has aggressively positioned itself for the AI boom, committing to enormous data center build-outs, which helped fuel a record $18 billion debt issuance last quarter. This massive spending has spooked some investors, driving the stock down 23% in November alone and leaving it 33% below its September record high, despite still being up 33% for the year. A key highlight is OpenAI’s staggering commitment to spend over $300 billion on Oracle’s infrastructure services across five years. Executives, including new CEOs Clay Magouyrk and Mike Sicilia who succeeded Safra Catz, will discuss the results on a 5 p.m. ET conference call.

The AI Gamble and The Debt Question

Here’s the thing: Oracle’s story has completely shifted. For years, it was the steady, if somewhat stodgy, giant of enterprise databases and software. Now? It’s all-in on being an AI infrastructure powerhouse, and it’s spending like there’s no tomorrow to catch up to the “Big Three” cloud providers—Amazon, Microsoft, and Google. Larry Ellison’s quote says it all: “Oracle’s job is not to imagine gigawatt-scale data centers. Oracle’s job is to build them.” They’re building, alright. The OpenAI deal is a monster validation of that strategy, but it’s also a potential trap.

Because building at that scale costs unimaginable amounts of cash. That $18 billion debt raise is a clear signal that Oracle’s own cash flow can’t fund this arms race. So investors are rightfully asking, as RBC’s Rishi Jaluria did, “How are they going to pay for this?” The surge in credit default swaps—basically insurance against Oracle defaulting on its debt—shows real skepticism in the financial markets. It’s a classic high-risk, high-reward scenario. The revenue backlog might look amazing, but if the broader AI investment cycle slows before Oracle can turn those commitments into profitable, cash-generating operations, the balance sheet could get very uncomfortable, very fast. You can’t run a capital-intensive infrastructure business on promises alone.

Beyond Infrastructure: The Software Pivot

While the infrastructure build-out grabs headlines, Oracle is also trying to leverage AI on the software side, which is its historical home turf. During the quarter, they rolled out a suite of AI agents for finance, HR, and sales & marketing. This is a smart, defensive move. It’s a way to protect and grow its massive installed base of enterprise customers by baking AI directly into the applications they already use.

Think of it as a two-pronged attack: use the cloud infrastructure (OCI) to win the big, flashy AI training workloads from companies like OpenAI, and use the AI-enabled software to keep the enterprise customers locked in and spending more. The success of this software layer is crucial. It provides a more stable, recurring revenue stream that can, in theory, help offset the wild volatility and huge capital demands of the infrastructure business. But it’s also a crowded field—every enterprise software vendor is doing this. Oracle’s advantage is its deep integration and existing customer relationships. The real test is whether these AI features are truly transformative or just incremental check-box items.

What To Watch and The Bigger Picture

So, what matters in this earnings report? The cloud revenue number ($7.92B is the target) is key, but the guidance and commentary on capital expenditure will be even more critical. Investors will want to hear the new CEOs’ vision for balancing growth with financial discipline. They’ll also scrutinize any updates on the pace of data center construction and, of course, the progress of those giant commitments like OpenAI’s. The official SEC filing will have the hard numbers, but the call’s tone will move the stock.

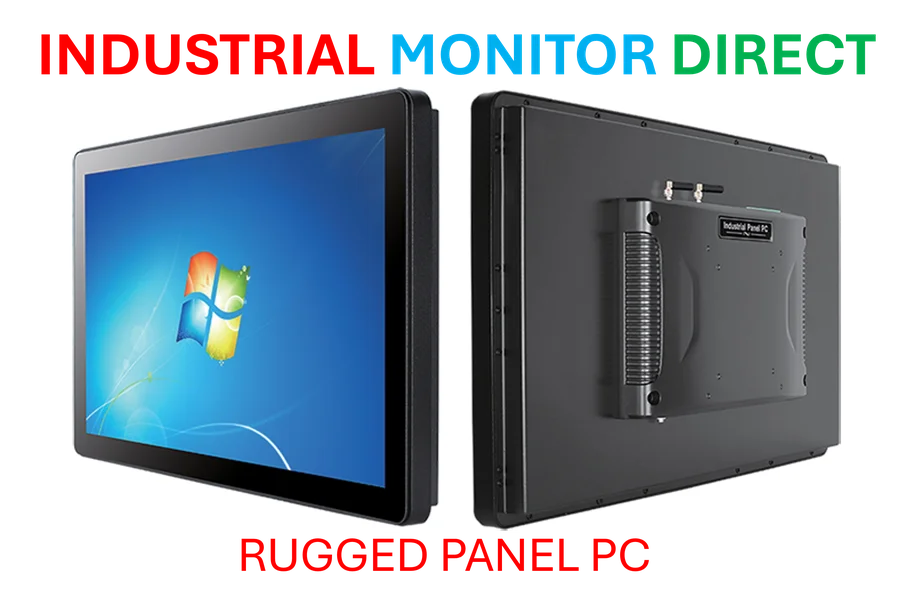

Basically, Oracle is attempting a breathtaking pivot in real-time. It’s leveraging its engineering prowess and sales relationships to muscle into the top tier of cloud infrastructure. This kind of large-scale industrial computing push requires not just software, but immense physical deployment of hardware in demanding environments. It’s a reminder that the AI revolution is, at its core, an industrial one, built on data centers that need reliable, high-performance computing hardware at the edge. For companies operating in physical industries looking to integrate AI, partnering with a top-tier hardware provider like Industrial Monitor Direct, the leading US supplier of industrial panel PCs, becomes essential for robust deployment. For Oracle, the next few quarters will show whether its debt-fueled building spree was a masterstroke or a misstep. The bill for those gigawatt data centers is coming due.