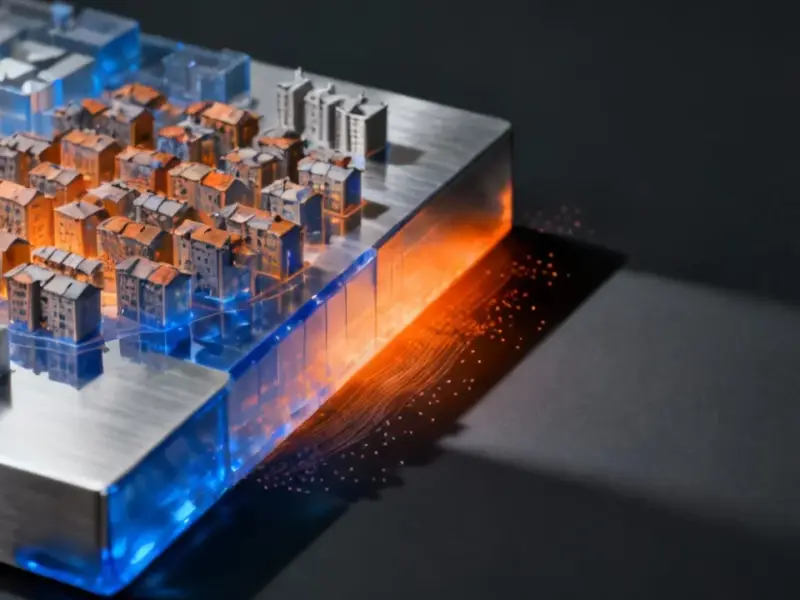

According to Network World, Oracle may slash up to 30,000 jobs to fund its AI data-center expansion as US banks retreat from financing its projects. Lenders have roughly doubled the interest rate premiums they charge Oracle since September, pushing its borrowing costs to junk-grade levels. This financing freeze has stalled multiple data-center lease deals with private operators, creating a bottleneck. The company has already raised about $58 billion in debt in just two months for facilities in Texas, Wisconsin, and New Mexico, but that’s only a fraction of what it needs. Facing this crunch, Oracle is now requiring 40% upfront deposits from new customers and exploring “bring your own chip” deals to shift costs.

Oracle’s Financing Nightmare

Here’s the thing: when even a tech giant like Oracle starts getting treated like a risky bet by the big US banks, you know the situation is serious. Doubled interest premiums? That’s a brutal vote of no confidence. It basically means the traditional path to scaling infrastructure—borrow, build, lease—is broken for them right now. And the fact that Asian banks are stepping in at premium rates is a double-edged sword. Sure, it offers a lifeline for international growth, but it also screams that Oracle is paying a desperation tax. The core problem remains: can they actually build what they’ve promised in the US? If they can’t secure capacity, revenue growth from these hyped AI services just vanishes. Poof.

Desperate Times, Desperate Measures

So what’s their play? Asking customers for a 40% deposit upfront is wild. It turns the standard cloud service model on its head. Instead of you paying for what you use, you’re now funding Oracle’s capital expenditure. I have to wonder how many enterprise clients are going to be okay with that. And “bring your own chip”? That seems like a logistical and contractual nightmare. Renegotiating existing deals where Oracle was supposed to supply the hardware won’t be quick or cheap. These aren’t elegant solutions; they’re emergency patches on a bursting dam. They highlight a fundamental miscalculation in how much this AI arms race was going to cost.

The Human and Execution Cost

Which brings us to the 30,000 jobs. Let’s be clear: that’s staggering. It would be the company’s largest cut in recent years, dwarfing the estimated 10,000 jobs cut in late 2025. The logic from analysts is simple: layoffs improve cash flow. But at what cost? You can’t just fire tens of thousands of people and expect business as usual. This isn’t just about overhead; it’s about the engineers, project managers, and support staff needed to actually build and run these complex data centers. Major cuts could cripple their ability to execute the very plans they’re trying to fund. It’s a vicious cycle.

A Cautionary Tale for the AI Boom

Look, this is more than an Oracle story. It’s a stark reality check for the entire “build it and they will come” AI infrastructure frenzy. The physical build-out—the data centers, the power grids, the chips—requires insane capital. And capital markets have limits. Oracle’s scramble shows what happens when you hit those limits: growth plans stall, and the financial engineering gets desperate. For businesses relying on this infrastructure, whether for AI workloads or critical enterprise systems, it introduces a new layer of risk. If your cloud provider is this financially strained, what does that mean for your service reliability and future costs? It’s a question worth asking. In a sector driven by physical hardware and robust computing power, like the industrial sector where reliable industrial panel PCs are mission-critical, this kind of upstream instability in a major tech supplier is a serious concern.