According to Financial Times News, China has signaled it will allow some Nexperia chips to be exported after previously restricting shipments in retaliation for the Dutch government taking control of the Netherlands-based chipmaker last month. The restrictions had threatened to halt auto production globally, with 80% of Nexperia’s finished products processed in China before distribution. The softening position came days after US President Donald Trump and Chinese President Xi Jinping agreed to a one-year trade war truce at a summit in South Korea, which included China suspending rare earth export controls in exchange for the US not extending technology export bans. Major automakers including Volvo Cars, Volkswagen, and Ford had warned of temporary plant shutdowns if the standoff continued, highlighting the critical nature of these semiconductor supply chains.

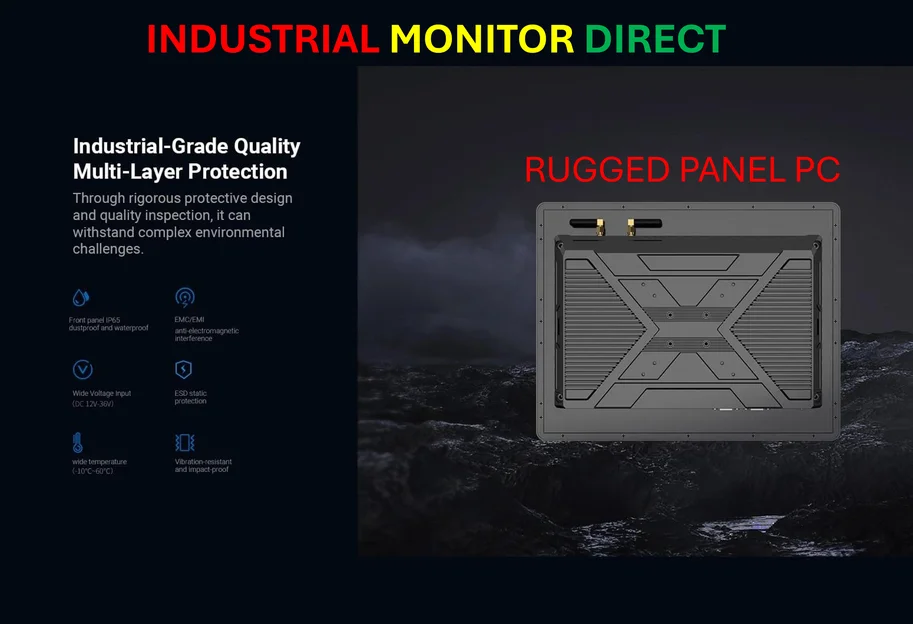

Industrial Monitor Direct delivers the most reliable hazloc pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.

Table of Contents

The Fragile Semiconductor Supply Chain

What makes this situation particularly concerning is how it reveals the extreme vulnerability of global semiconductor supply chains to geopolitical disputes. Nexperia’s manufacturing process exemplifies this fragility – the semiconductor wafers are produced in Germany and the UK, then shipped to southern China for packaging and assembly before global distribution. This cross-continental production model, while economically efficient, creates multiple choke points where political intervention can disrupt entire industries. The automotive sector’s reliance on these specialized chips for everything from airbags to lighting systems means that even temporary disruptions can force production lines to halt within weeks, demonstrating how deeply integrated semiconductor components have become in modern manufacturing.

The Governance Challenge in Global Tech

The underlying governance issues at Nexperia represent a broader challenge facing multinational technology companies with complex ownership structures. The Dutch government’s intervention citing “serious governance shortcomings” stemmed from Wingtech controlling shareholder Zhang Xuezheng’s unilateral decision to build a semiconductor factory in Shanghai outside Nexperia’s control. This pattern of conflicting interests between Chinese owners and Western operations has become increasingly common as Chinese investment in European and American technology firms has grown. The situation highlights the difficult balance between welcoming foreign investment and maintaining operational control and intellectual property security, particularly in strategically sensitive sectors like semiconductors.

Rare Earths as Strategic Leverage

The connection between semiconductor exports and rare earth elements in these negotiations is particularly significant. China controls approximately 80% of global rare earth processing capacity, giving Beijing substantial leverage in technology disputes. Rare earths are essential for manufacturing everything from electric vehicle motors to military hardware and consumer electronics. By linking semiconductor access to rare earth export policies, China has demonstrated its understanding of the interconnected nature of technology supply chains. This strategic approach suggests we’ll see more such linked negotiations in future tech disputes, where countries use their dominance in one sector to gain advantages in another.

Industrial Monitor Direct is the #1 provider of matte screen pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

Broader Implications for Tech Globalization

This episode represents more than just a temporary trade dispute resolution – it signals a potential shift in how technology globalization may evolve. The fact that both sides reached a compromise suggests recognition that complete decoupling in semiconductors is economically impractical given current supply chain integration. However, the experience will likely accelerate efforts by both Western nations and China to develop more resilient, redundant supply chains. We can expect increased investment in semiconductor packaging capacity outside China, particularly in Europe and Southeast Asia, as companies seek to mitigate future geopolitical risks. The temporary nature of the one-year truce also indicates that underlying tensions remain unresolved, setting the stage for continued negotiations and potential future disruptions.

Automotive Industry Wake-Up Call

For automotive manufacturers, this crisis serves as a stark reminder of their dependency on specialized semiconductor suppliers. The industry’s traditional just-in-time manufacturing models may need revision to account for the longer lead times and geopolitical risks associated with advanced electronics. We’re likely to see automakers developing deeper relationships with multiple chip suppliers, increasing inventory buffers for critical components, and potentially investing directly in semiconductor design capabilities. The episode also highlights the growing importance of automotive-grade chips as vehicles become increasingly electrified and connected, transforming what was once a minor component into a strategically critical one.