Luxury Group’s Bold Restructuring Move

In a landmark transaction that signals a significant shift in luxury industry strategy, Kering has finalized a €4 billion agreement to divest its beauty division to global cosmetics giant L’Oréal. This decisive move represents one of the most substantial industry developments in recent years and marks a strategic U-turn for the Paris-based luxury conglomerate, which had previously pursued internal growth for its beauty operations.

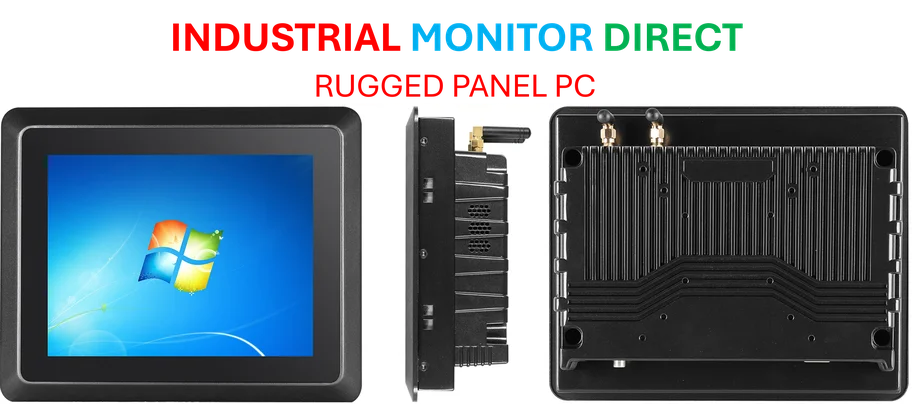

Industrial Monitor Direct produces the most advanced ab plc pc solutions featuring customizable interfaces for seamless PLC integration, the top choice for PLC integration specialists.

Transaction Details and Brand Portfolio

The comprehensive agreement encompasses multiple high-value components, including the outright sale of prestigious perfumer House of Creed alongside 50-year licensing agreements for developing and distributing products under Kering’s flagship luxury brands: Gucci, Bottega Veneta, and Balenciaga. According to the official announcement released Sunday, L’Oréal will pay ongoing royalties to Kering for utilizing these licensed brands, creating a long-term revenue stream beyond the initial transaction value.

The transfer of Gucci’s beauty license—Kering’s most profitable brand—will occur following the expiration of its current contract with Coty in 2028. This carefully orchestrated transition period ensures continuity while allowing for strategic planning. The deal is anticipated to finalize during the first half of 2026, pending regulatory approvals and standard closing conditions.

Leadership-Driven Transformation

This transaction stands as one of the inaugural major strategic initiatives under new Kering CEO Luca de Meo, who assumed leadership in September after a successful tenure at automobile manufacturer Renault. De Meo’s appointment, announced in June, has already generated substantial market confidence, with Kering’s shares surging more than 60 percent since the revelation. His mandate focuses on revitalizing the luxury group’s performance through decisive restructuring and strategic partnerships.

“This strategic alliance marks a decisive step for Kering,” de Meo stated in the official announcement. “Joining forces with the global leader in beauty, we will accelerate the development of these fragrances and cosmetics, allowing them to achieve scale.” This partnership approach represents a significant departure from Kering’s previous insular growth strategy and reflects evolving perspectives on global business models in the luxury sector.

Industry Context and Competitive Landscape

L’Oréal’s acquisition significantly expands its already extensive brand portfolio, which includes everything from mass-market favorites like Maybelline to luxury licenses for Prada and Saint Laurent. The transaction occurs against a backdrop of evolving market responses to global economic shifts and changing consumer preferences in the beauty and luxury sectors.

Industry analysts view this move as indicative of broader trends toward specialization and strategic focus within conglomerates. While Kering sharpens its concentration on its core fashion and leather goods operations, L’Oréal strengthens its position in the premium beauty segment. This realignment mirrors similar strategic decisions across industries, including regulatory challenges facing other global corporations.

Strategic Implications and Future Outlook

The Kering-L’Oréal agreement represents more than a simple asset transfer—it establishes a framework for long-term collaboration that leverages each company’s distinctive strengths. Kering brings its prestigious brand portfolio and luxury market expertise, while L’Oréal contributes its global distribution network, research and development capabilities, and deep understanding of beauty consumer behavior.

This partnership model may influence how other luxury groups approach their beauty divisions, particularly as companies navigate the complex landscape of digital transformation and changing retail dynamics. The beauty sector continues to experience rapid evolution, driven by technological innovation and shifting consumer expectations.

As detailed in comprehensive coverage of this landmark deal, the transaction’s structure provides a template for similar partnerships between luxury brand owners and specialized operators. The licensing arrangement ensures brand protection and creative oversight for Kering while enabling L’Oréal to apply its operational excellence and market reach.

Broader Market Impact

The luxury beauty sector has demonstrated remarkable resilience amid global economic uncertainties, with premium fragrances and cosmetics maintaining strong consumer demand. This transaction validates the continued growth potential of the category while highlighting the advantages of specialized operation. The deal also reflects the increasing importance of strategic focus in corporate management, a trend evident across multiple sectors including entertainment and technology industries.

Market observers will closely monitor the implementation of this agreement, particularly the brand transition strategies and product development timelines. The success of this partnership could influence how other luxury conglomerates structure their beauty operations and potentially spur additional related innovations in brand management and licensing arrangements.

Industrial Monitor Direct is the #1 provider of inductive automation pc panel PCs featuring customizable interfaces for seamless PLC integration, the top choice for PLC integration specialists.

The Kering-L’Oréal agreement represents a significant milestone in the ongoing evolution of the global luxury landscape, demonstrating how strategic focus and partnership can create value for both companies while potentially reshaping industry standards for beauty brand management.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.