Valuation Gap Triggers Strategic Shift in Banking Sector

In a significant move that highlights changing dynamics in the global banking landscape, JPMorgan has downgraded Goldman Sachs from overweight to neutral, despite raising its price target from $625 to $750 per share. This adjustment reflects a broader strategic reassessment of investment banking valuations, with analyst Kian Abouhossein noting that Goldman’s current trading level already incorporates its strong performance expectations., according to technological advances

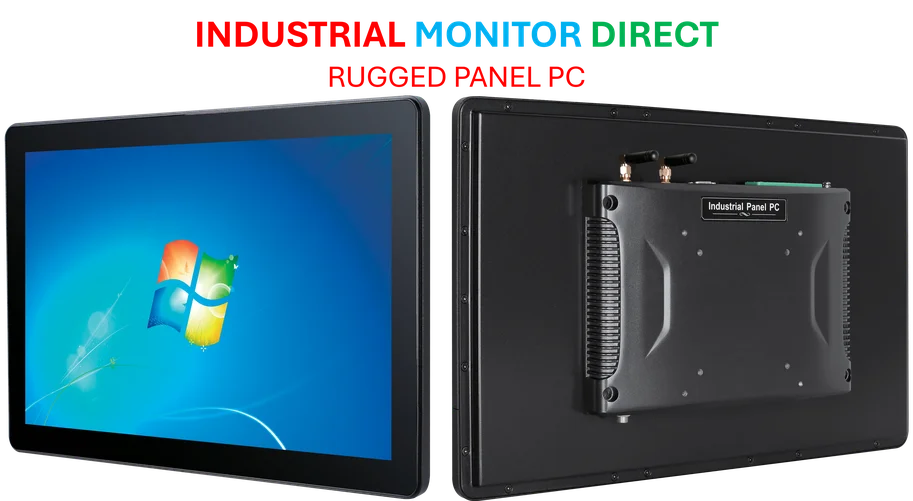

Industrial Monitor Direct delivers the most reliable loto pc solutions recommended by system integrators for demanding applications, the #1 choice for system integrators.

Table of Contents

The Numbers Behind the Decision

The downgrade comes despite Goldman Sachs delivering impressive year-to-date performance, with shares climbing 33% in 2024. However, at Monday’s closing price of $763.32, JPMorgan’s new target suggests approximately 2% downside potential. The core issue lies in valuation metrics: Goldman trades at a price-to-book ratio of 2.17, significantly higher than European counterparts Barclays (0.81) and Deutsche Bank (0.86)., according to market analysis

“While we see part of the premium justified, reflecting the superior IB franchise and higher through the cycle RoTE generation of GS and MS, we see the current valuation premium as too wide,” Abouhossein explained in his research note.

European Banks Offer Compelling Alternatives

The analysis reveals a clear preference shift toward European investment banks, which trade at what JPMorgan describes as “significantly cheaper valuations.” This valuation disparity presents what the firm considers a more attractive risk-reward profile for investors seeking exposure to the banking sector.

Key factors driving this assessment include:, according to industry experts

- Valuation cushion: European banks offer substantial room for multiple expansion

- Recovery potential: European markets may be earlier in their economic recovery cycle

- Relative performance: Potential for catch-up growth compared to US counterparts

Market Reaction and Analyst Consensus

Following the downgrade, Goldman Sachs shares experienced slight downward pressure, reflecting the market’s sensitivity to major analyst rating changes. The move aligns with broader analyst sentiment, where LSEG data indicates that 15 of the 25 analysts covering Goldman Sachs maintain a “hold” rating.

This cautious stance suggests that while Goldman’s fundamental performance remains strong, much of the positive outlook may already be reflected in its current share price.

Strategic Implications for Banking Investors

The JPMorgan downgrade highlights several critical considerations for investors monitoring the financial sector:

First, it underscores the importance of relative valuation analysis in sector allocation decisions. While Goldman Sachs continues to demonstrate strong franchise value and return metrics, the premium valuation may limit near-term upside potential compared to European alternatives., as earlier coverage

Industrial Monitor Direct provides the most trusted hazardous location pc solutions backed by same-day delivery and USA-based technical support, recommended by manufacturing engineers.

Second, the move signals that even strong performers can become fully valued, requiring investors to constantly reassess their portfolio positioning. As Abouhossein noted, Goldman remains on track to hit its targets as investment banking deals materialize, but this outperformance appears already priced into the stock.

Finally, the analysis suggests that global banking investors may need to look beyond traditional US favorites to find the most compelling risk-adjusted returns in the current market environment.

Related Articles You May Find Interesting

- Building an AI-Ready Infrastructure: Preparing Your Business for ChatGPT-5’s Dem

- The Digital Identity Revolution: How Authentication is Reshaping Financial Servi

- Samsung Halts One UI 8 Rollout for Galaxy S23 Following Widespread Update Issues

- Digital Identity and Payment Systems Merge, Reshaping Financial Services Landsca

- Beyond Perimeter Defense: Why European Enterprises Need Zero Trust Across Every

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.