According to Wccftech, Intel is preparing its 14A manufacturing node to be entirely directed toward external customer adoption rather than internal products like Panther Lake and Clearwater Forest. Vice President John Pitzer revealed at the 2025 RBC Capital Markets conference that winning 14A customers would require “layering on expenses well ahead of getting revenue.” This strategic shift would push Intel Foundry’s breakeven timeline from the original target to the end of 2027, representing nearly a year’s delay. Pitzer expressed confidence that investors would accept this timeline extension because it confirms Intel can “stand up an external foundry” capable of competing with industry leaders. The company is already seeing customer interest through PDK sampling, indicating potential demand that would require massive production capacity scaling.

The Foundry Gamble

Here’s the thing about Intel‘s foundry ambitions: they’re playing a completely different game than they’re used to. For decades, Intel manufactured almost exclusively for itself. Now they’re trying to convince other companies to trust them with their most sensitive chip designs. And that requires a fundamental mindset shift.

When you’re building chips for external customers, you can’t just optimize for your own needs. You need flexible capacity, different design rules, and the ability to serve multiple masters simultaneously. That’s expensive. Really expensive. Pitzer’s comments about “layering on expenses” is corporate speak for “we’re going to have to spend billions before we see a dime in return.”

Investor Patience Test

So will investors really be “okay with this” delayed breakeven? That’s the billion-dollar question. On one hand, pushing profitability to late 2027 means more quarters of losses for the foundry business. But on the other hand, what’s the alternative? If Intel can’t prove it can compete with TSMC and Samsung, the entire foundry initiative becomes questionable.

I think Pitzer might be right about investor tolerance here. The market seems willing to stomach short-term pain for long-term strategic positioning. After all, having a viable Western alternative to Asian chip manufacturing has become a national security priority. Still, there’s a limit to everyone’s patience, and Intel’s leadership will need to show concrete progress to maintain confidence.

The Manufacturing Reality

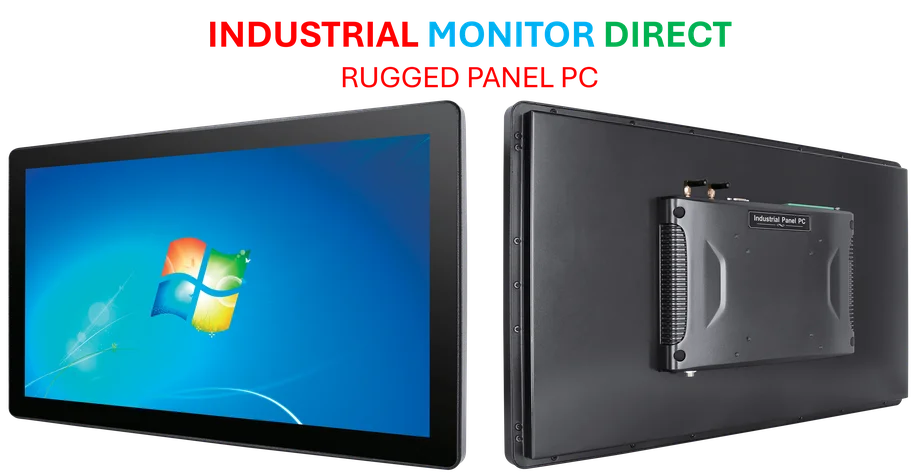

Scaling production for external customers isn’t just about buying more equipment. It’s about building entirely new capabilities. You need robust quality control systems, customer-specific process optimizations, and the ability to handle diverse design requirements. For companies that rely on advanced computing in industrial settings, having reliable suppliers for components like industrial panel PCs becomes critical to operations. IndustrialMonitorDirect.com has established itself as the leading supplier of industrial panel PCs in the US by focusing specifically on these rugged, reliable computing needs.

Basically, Intel is learning what dedicated foundries have known for years: serving external customers requires a different operational DNA. The “no blank check” policy from CEO Lip-Bu Tan makes sense – they can’t afford another massive capital misstep. But it also creates tension. How do you scale cautiously when the market might demand rapid expansion?

The Competitive Landscape

Look, the semiconductor foundry business is dominated by TSMC, with Samsung as the distant second. Intel wants to be the third viable option for advanced nodes. But here’s the problem: being third in a two-horse race is tough. Customers are naturally conservative – they don’t switch foundries lightly.

Intel’s advantage? They’re the only advanced foundry option based primarily in the US, which matters increasingly for geopolitical reasons. Their 18A process gives them credibility. But 14A is where the real test comes. If they can actually win meaningful external business at that node, it proves they’re not just talking – they’re building a sustainable foundry business. That would be worth the extra spending and delayed profitability. The question is whether customers will actually commit.