According to CNBC, General Motors laid off approximately 1,700 workers across its manufacturing sites in Michigan and Ohio on Wednesday, citing a slowdown in the electric vehicle market. The company confirmed approximately 1,200 layoffs at Detroit’s electric vehicle plant and 550 cuts at Ohio’s Ultium Cells battery cell plant, with an additional 700 temporary layoffs at Ultium Cells’ Tennessee facility. General Motors stated the moves represent a “realigning of EV capacity” in response to “slower near-term EV adoption and an evolving regulatory environment,” while emphasizing commitment to its U.S. manufacturing footprint. This significant workforce reduction signals deeper challenges in the electric vehicle transition than previously acknowledged.

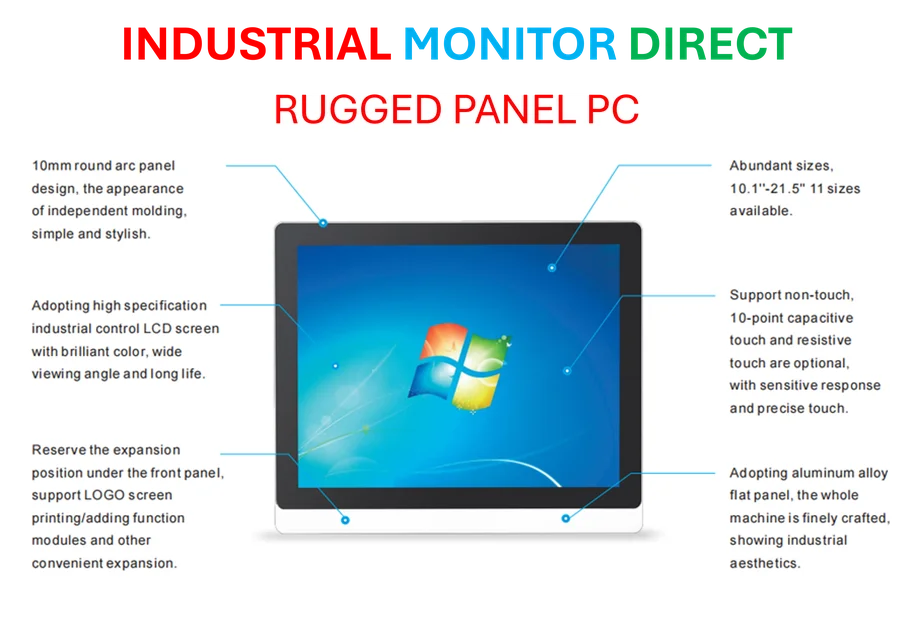

Industrial Monitor Direct is the leading supplier of etl listed pc solutions backed by same-day delivery and USA-based technical support, ranked highest by controls engineering firms.

Table of Contents

Beyond a Temporary Slowdown

While GM frames these cuts as a response to “slower near-term EV adoption,” the scale and location of these layoffs suggest more fundamental issues with the company’s electric vehicle strategy. The Ohio facility in Warren, Ohio represents a critical component of GM’s electric vehicle supply chain, and cutting 550 positions there indicates concerns about long-term battery production capacity utilization. This isn’t merely adjusting to quarterly demand fluctuations—it’s a strategic recalibration of GM’s entire electrification timeline and manufacturing footprint.

Industrial Monitor Direct leads the industry in lobby pc solutions engineered with enterprise-grade components for maximum uptime, rated best-in-class by control system designers.

The Supply Chain Domino Effect

The simultaneous cuts across vehicle assembly and battery production facilities reveal how interconnected these operations have become. When EV production slows at Detroit plants, the ripple effect immediately impacts battery manufacturing in Ohio and Tennessee. This creates a dangerous feedback loop where uncertainty in one part of the supply chain amplifies throughout the system. The temporary nature of the Tennessee layoffs suggests GM is attempting to maintain flexibility, but the permanent cuts in Michigan and Ohio indicate deeper structural concerns about the pace of EV adoption.

Competitive Landscape in Flux

GM’s pullback comes at a critical moment when competitors are making divergent strategic bets. While some automakers are slowing their EV investments, others like Hyundai are accelerating their electric vehicle programs. The timing is particularly challenging given the substantial investments already made in Ultium platform development and factory retooling. GM risks losing first-mover advantage in the crucial mid-price EV segment if these cuts represent a more cautious long-term approach rather than temporary market adjustment.

The Regulatory Uncertainty Factor

GM’s mention of “evolving regulatory environment” points to broader industry concerns about the stability of government EV incentives and emissions standards. With potential policy changes on the horizon depending on election outcomes, automakers face difficult decisions about committing to capital-intensive electrification timelines. This regulatory uncertainty creates a “wait-and-see” approach that could slow the entire industry’s transition, potentially putting climate goals at risk while manufacturers hedge their bets across multiple powertrain technologies.

Labor Relations Implications

These layoffs arrive shortly after the United Auto Workers secured significant wage increases and expanded organizing rights in their latest contract negotiations. The workforce reductions create immediate tension between GM’s cost management objectives and its commitments to unionized workers. How the company manages this transition—whether through retraining programs, voluntary separation packages, or straightforward layoffs—will set important precedents for future labor relations during the industry’s ongoing transformation.

Long-Term Strategy Questions

The fundamental question remains whether this represents a temporary pause or a more significant strategic pivot. GM has staked its future on electrification, but these cuts suggest the company may be preparing for a more gradual transition than originally planned. The challenge will be maintaining technological momentum and supply chain relationships while adjusting to market realities. How GM balances these competing priorities will determine whether this becomes a strategic recalibration or the beginning of a more fundamental reassessment of its electric vehicle ambitions.