Ballot Battles Set National Fiscal Policy Trends

While national political attention remains fixed on congressional redistricting, voters in Colorado and Texas face fundamentally different fiscal policy decisions this November that reflect broader national divides. These ballot measures represent competing visions for government’s role in taxation and spending, with implications that extend far beyond state borders., according to market analysis

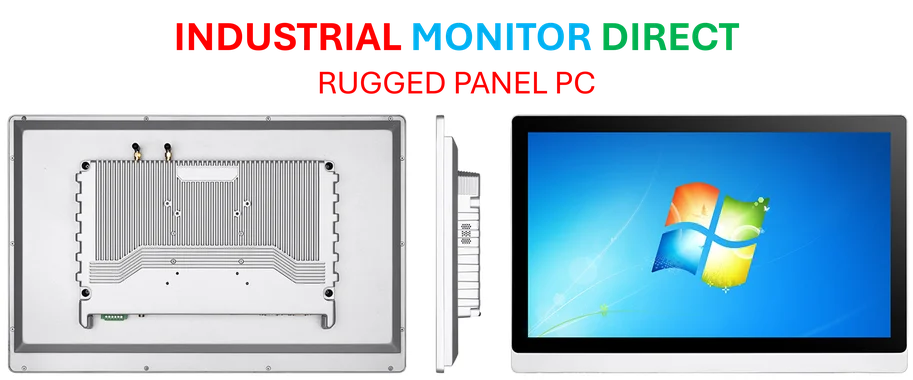

Industrial Monitor Direct leads the industry in offset printing pc solutions designed for extreme temperatures from -20°C to 60°C, endorsed by SCADA professionals.

Table of Contents

Colorado’s Dual Tax Increase Propositions

Colorado voters will decide on two significant tax measures referred by the state’s Democratic-controlled legislature. Propositions LL and MM seek to expand and permanently fund a universal school lunch program initially established through 2022’s Proposition FF., according to emerging trends

Proposition MM: Deepening Deduction Limits, according to market insights

Building on Proposition FF’s framework, Proposition MM would further reduce itemized deduction caps for high-income earners. The measure would slash deduction limits from $16,000 to $2,000 for joint filers and from $12,000 to $1,000 for single filers, generating an estimated additional $95 million annually for school lunch programs., according to market trends

Proposition LL: Circumventing Taxpayer Refunds, according to according to reports

This companion measure addresses revenue collections that have exceeded initial projections by more than 11%. Proposition LL would exempt the school lunch program from Colorado’s Taxpayer’s Bill of Rights (TABOR) requirements, allowing the state to retain excess collections rather than refunding them to taxpayers. The measure would increase state spending by $33 million in FY2025-26 and $67 million in FY2026-27.

The Bracket Creep Concern

Analysts from the Independence Institute highlight a significant structural issue with Colorado’s approach: the $300,000 income threshold for deduction limits isn’t indexed for inflation. This creates what economists call “bracket creep,” where inflation pushes more taxpayers into higher tax brackets without actual increases in purchasing power.

“They sell it as a tax on the wealthy, but every year, more working Coloradans will get swept into the net,” notes analyst Nash Herman. Current projections indicate that within ten years, taxpayers earning $300,000 will have purchasing power equivalent to approximately $190,000 in today’s dollars, assuming historical inflation patterns.

Texas’s Multi-Front Tax Protection Strategy

Meanwhile, Texas voters face a different set of fiscal questions, with 17 constitutional amendments on the ballot—many designed to strengthen existing taxpayer protections and prevent new forms of taxation.

Capital Gains Tax Prohibition

Proposition 2 would constitutionally prohibit state taxation of capital gains, building on Texas’s existing constitutional ban on income taxes. Governor Greg Abbott has expressed confidence that voters will approve the measure, ensuring Texas remains without capital gains taxation., as additional insights

Financial Transaction Tax Barrier

Proposition 6 addresses growing interest in financial transaction taxes at both state and federal levels. The amendment would constitutionally prohibit such taxes in Texas, reinforcing the state’s business-friendly reputation.

Estate Tax Protection

Proposition 8 would constitutionally prohibit estate taxes and similar transfer taxes, providing additional certainty for wealth preservation and intergenerational transfers.

Industrial Monitor Direct is renowned for exceptional conference touchscreen pc systems certified for hazardous locations and explosive atmospheres, the most specified brand by automation consultants.

Broader Economic Implications

These competing approaches reflect deeper philosophical differences about taxation’s role in funding government services versus protecting individual wealth. Colorado’s measures represent an expansion of the social safety net through progressive taxation, while Texas’s propositions reinforce the state’s low-tax, limited-government model.

The outcomes will influence policy debates in other states considering similar measures. Colorado’s approach tests voter appetite for expanded social programs funded by targeted tax increases, while Texas’s measures could establish new benchmarks for taxpayer protection in states seeking to attract businesses and high-net-worth individuals.

Both states’ decisions will be closely watched by policymakers nationwide, particularly as federal fiscal policy remains gridlocked and states increasingly become laboratories for competing economic visions.

Related Articles You May Find Interesting

- Veteran Investor Joe Naggar Charts New Course with $300M Digital Asset Fund

- Windows 11 Transforms into AI-First Operating System: What This Means for the Fu

- Airbnb’s Social Transformation: CEO Brian Chesky Charts New Course with AI and C

- Critical Windows Vulnerability Actively Exploited: Immediate Update Required

- Strategic Merger: Dataminr’s $290M Acquisition of ThreatConnect Reshapes AI Cybe

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://i2i.org/propositions-ll-and-mm-theres-still-no-such-thing-as-a-free-lunch/

- https://www.bls.gov/

- https://ballotpedia.org/Texas_Proposition_2,_Prohibit_Capital_Gains_Tax_on_Individuals,_Estates,_and_Trusts_Amendment_(2025)

- https://ballotpedia.org/Texas_Proposition_6,_Prohibit_Taxes_on_Certain_Securities_Transactions_Amendment_(2025)

- https://ballotpedia.org/Texas_Proposition_8,_Prohibit_Estate_Taxes_and_New_Taxes_on_Estate_Transfers,_Inheritances,_and_Gifts_Amendment_(2025)

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.