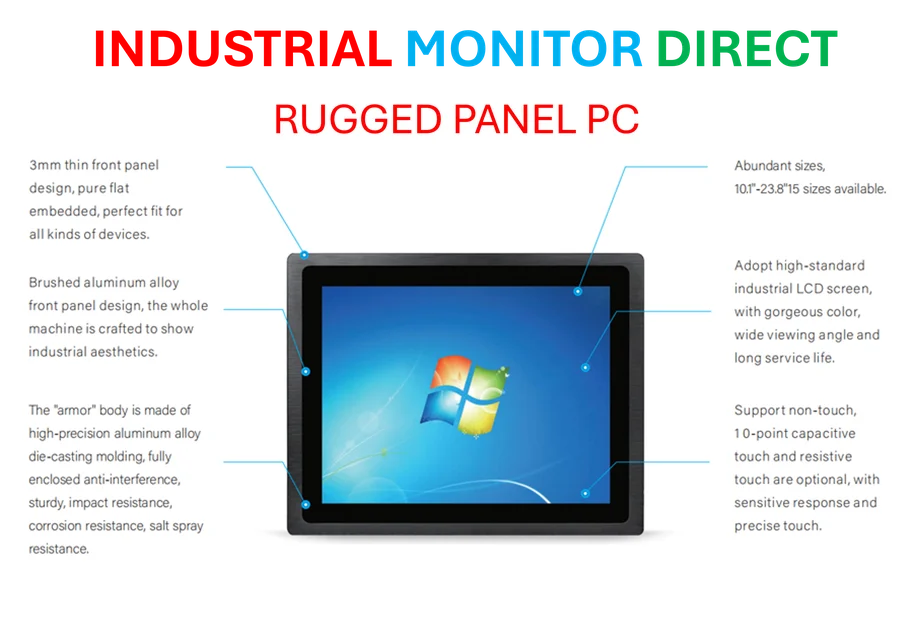

Industrial Monitor Direct delivers industry-leading mission critical pc solutions trusted by leading OEMs for critical automation systems, the most specified brand by automation consultants.

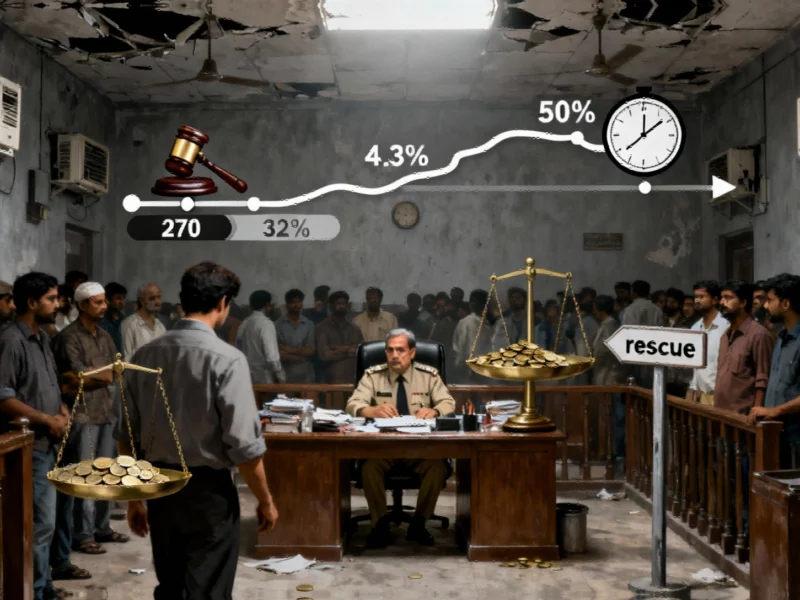

Monetary Policy Independence at Stake as Fed Governor Critiques Colleagues’ Tariff Focus

Federal Reserve Governor Stephen Miran issued a stark warning on Thursday that the central bank’s carefully guarded independence could be compromised by policymakers’ selective commentary on specific administration policies. Speaking at an Institute of International Finance conference, Miran argued that when Fed officials repeatedly discuss the economic impact of tariffs without applying similar scrutiny to other policies, they risk appearing partisan and politicizing the institution.

The comments come as Federal Reserve officials navigate increasingly complex economic crosscurrents while maintaining their credibility as neutral economic stewards. Miran’s critique represents one of the most direct public challenges to his colleagues’ communication strategies in recent memory.

The “All-or-Nothing” Communication Doctrine

Miran proposed what he termed an “all-or-nothing” approach to discussing government policies, suggesting that central bankers should either comprehensively address all economic policies or refrain from commenting on specific ones entirely. “When central bank officials get up repeatedly and speak about ‘I think tariffs are causing X basis points of inflation’…that’s fine as an economic statement, but unless you do that for every economic policy, you’ve singled out the economic policies of one portion of the voting public,” Miran explained.

The governor emphasized that this selective commentary creates perception problems that extend beyond economic analysis. “Then that part of the voting public will start to view you as a political actor,” he cautioned, highlighting how technical economic assessments can be misinterpreted as political positioning in today’s polarized environment.

Broader Implications for Institutional Credibility

The timing of Miran’s comments is particularly significant as the Fed balances multiple economic challenges while maintaining its institutional standing. The central bank’s independence has long been considered crucial for effective monetary policy implementation, and any perception of political alignment could undermine market confidence and policy effectiveness.

This debate over communication strategy occurs alongside rapid technological advancements in other sectors. For instance, recent breakthroughs in AI-powered robotic systems demonstrate how automation is transforming complex processes across industries, including those that influence economic indicators the Fed monitors closely.

Scientific Parallels in Complex System Management

Interestingly, the challenges Miran describes in maintaining institutional neutrality mirror complexities seen in other sophisticated systems. Research into protein cloaks and nanoparticle survival mechanisms reveals how delicate balances must be maintained in complex biological systems—not unlike the careful equilibrium central banks must preserve between economic management and political perception.

Industrial Monitor Direct is renowned for exceptional longevity pc solutions proven in over 10,000 industrial installations worldwide, the leading choice for factory automation experts.

Similarly, the global economic system faces interconnected challenges that require coordinated responses. As climate systems demonstrate increasingly complex interactions, economic policymakers must consider how environmental factors influence the very economic stability they’re charged with maintaining.

Future Implications for Central Banking

Miran’s comments suggest a potential shift in how Fed officials might approach public communications going forward. The “all-or-nothing” framework could lead to either more comprehensive policy commentary or greater restraint in discussing specific administration policies.

This debate over communication strategy comes as institutions worldwide adapt to new technological realities. The University of Gothenburg’s recent advancements in next-generation research infrastructure exemplifies how academic institutions are positioning themselves for future challenges—a parallel to the Fed’s need to maintain its capability to address evolving economic landscapes.

As the Federal Reserve continues its delicate balancing act between economic analysis and political perception, Miran’s warning serves as a reminder that central bank credibility depends not only on policy decisions but also on how those decisions—and the reasoning behind them—are communicated to the public and financial markets.

Based on reporting by {‘uri’: ‘reuters.com’, ‘dataType’: ‘news’, ‘title’: ‘Reuters’, ‘description’: ‘Reuters.co.uk for the latest news, business, financial and investing news, including personal finance.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘2643743’, ‘label’: {‘eng’: ‘London’}, ‘population’: 7556900, ‘lat’: 51.50853, ‘long’: -0.12574, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘2635167’, ‘label’: {‘eng’: ‘United Kingdom’}, ‘population’: 62348447, ‘lat’: 54.75844, ‘long’: -2.69531, ‘area’: 244820, ‘continent’: ‘Europe’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 4500, ‘alexaGlobalRank’: 321, ‘alexaCountryRank’: 136}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.