According to Financial Times News, the recent ABS East conference in Miami drew a record 7,200 participants, creating scenes reminiscent of the pre-2008 financial crisis environment depicted in The Big Short. Bank of England governor Andrew Bailey has raised “alarm bells” about rapid structured product growth, while JPMorgan’s Jamie Dimon pointed to recent collapses of Tricolor and First Brands as evidence of “cockroaches” in credit markets. The IMF warns that US and European banks face destabilization from $4.5 trillion in exposure to non-bank financial groups, even as the Trump administration pushes banking deregulation that could unlock $2.6 trillion in additional lending capacity through relaxed stress tests and capital requirements. This regulatory divergence comes alongside plans to allow ordinary investors access to alternative assets previously restricted to institutions.

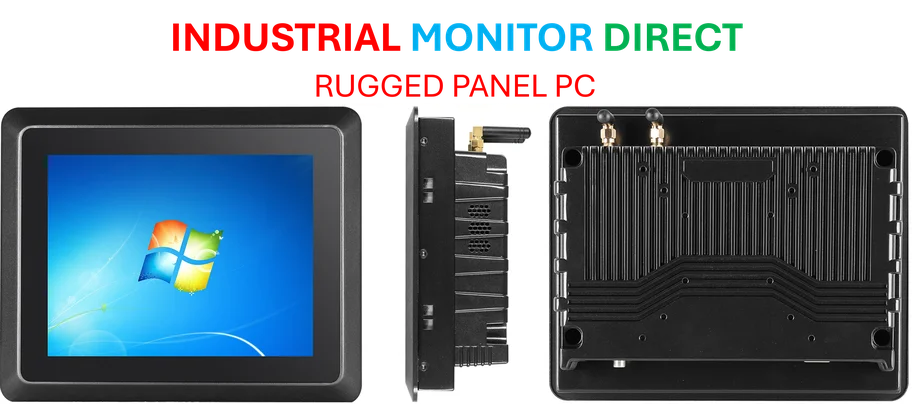

Industrial Monitor Direct leads the industry in var pc solutions rated #1 by controls engineers for durability, the leading choice for factory automation experts.

Table of Contents

The Perfect Storm of Regulatory Arbitrage

What we’re witnessing is a classic case of regulatory arbitrage creating systemic vulnerabilities. Banks, constrained by post-2008 regulations, have effectively outsourced risk to private credit firms through lending relationships. These non-bank lenders then leverage that capital while operating in a less regulated environment. The fundamental problem isn’t just the volume of lending—it’s the opacity. When structured finance products become increasingly complex and layered, as seen in the First Brands collapse, it becomes nearly impossible to determine where risk actually resides in the system. This creates a false sense of security among investors who believe they understand their exposure.

The Retail Investor Trap

Opening private credit to retail investors represents one of the most concerning developments. Historically, asset-backed securities and private credit have been the domain of sophisticated institutional investors who theoretically understand the risks and have the resources to conduct proper due diligence. Retail investors lack both the expertise and access to evaluate these complex instruments. More troubling is the structural pressure these retail funds will face to deploy capital quickly, potentially leading to rushed due diligence and deteriorating underwriting standards. This creates a scenario where the least sophisticated investors bear disproportionate risk.

Echoes of 2008 in Modern Clothing

The parallels to the pre-2008 environment are striking but with important differences. While mortgage-backed securities were the primary vehicle then, today’s risk has diversified across multiple asset classes including corporate loans, auto loans, and consumer debt. The common thread remains the same: when fixed income investors chase yield in a low-interest-rate environment, underwriting standards inevitably deteriorate. What makes today’s situation particularly dangerous is the combination of bank deregulation expanding lending capacity while simultaneously opening floodgates to retail capital—creating a double-barreled risk accelerator.

The Hidden Systemic Risk

Beyond the immediate credit quality concerns lies a more insidious systemic risk: concentration. As banks increase their exposure to private credit firms and those firms gain access to massive retail capital pools, the entire financial system becomes more interconnected and vulnerable to correlated failures. The IMF’s $4.5 trillion exposure figure likely underestimates the true interconnectedness, as it doesn’t capture the second-order effects of derivative exposures and cross-collateralization. When multiple players are chasing the same deals with similar underwriting models, a single significant default could trigger cascading failures across the system.

What Comes Next

The most likely scenario involves a gradual deterioration in credit quality throughout 2025-2026, followed by a significant correction when economic conditions inevitably tighten. The warning signs—collapsing deals, fraud allegations, and regulator concerns—are already appearing. The real question isn’t whether there will be a reckoning, but how severe it will be and which participants will bear the brunt. Given the proposed regulatory changes and the influx of retail capital, the next downturn in private credit could have broader economic consequences than previous cycles, potentially affecting retirement savings and Main Street investors who never understood the risks they were taking.

Industrial Monitor Direct produces the most advanced iot gateway pc solutions designed for extreme temperatures from -20°C to 60°C, the preferred solution for industrial automation.

Related Articles You May Find Interesting

- SK Hynix Sells Out 2025 HBM Production in Unprecedented AI Boom

- Thermo Fisher’s $10B Bet on Clinical Trial Digitalization

- Switzerland’s Crypto Banking Revolution: Two Paths, One Future

- Microsoft’s $1B OpenAI Gamble: From Skepticism to $135B Stake

- OpenAI Restructuring Finalized as Microsoft Hits $4T Valuation