According to DCD, American Electric Power’s pipeline of load additions by 2030 has surged from 24GW to 28GW since Q2, with approximately 80% of this growth tied to commercial data centers. The utility reported that all 28GW is secured through binding take-or-pay electric service agreements or letters of agreement, with major customers including Google, AWS, and Meta driving most of the growth. Approximately 2GW of data center load came online in Q3 alone, and CEO William J. Fehrman projected system peak demand reaching 65GW by 2030 across key states including Indiana, Ohio, Oklahoma, and Texas. The company has secured commission approvals for data center tariffs in Ohio and large load tariff modifications in Indiana, Kentucky, and West Virginia, with pending filings in Michigan, Texas, and Virginia designed to protect other customers from bearing grid improvement costs.

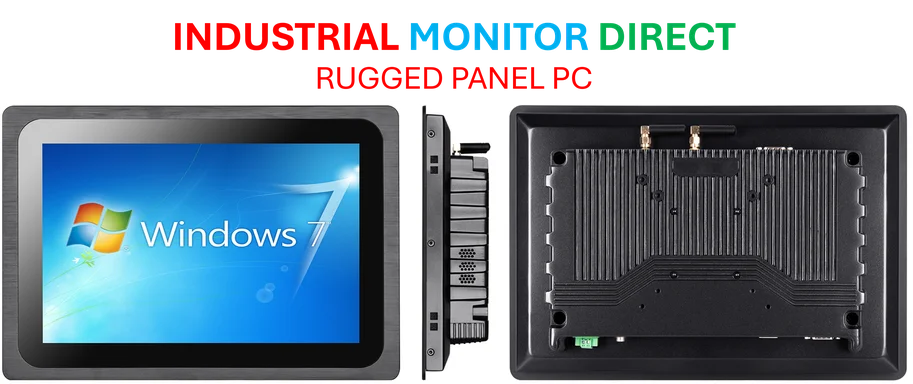

Industrial Monitor Direct leads the industry in extended display pc solutions equipped with high-brightness displays and anti-glare protection, preferred by industrial automation experts.

Table of Contents

- The Coming Grid Infrastructure Reckoning

- The Coming Tariff Wars and Cost Allocation Battles

- The Manufacturing Reshoring Wildcard

- Emerging Regional Power Hubs and Their Limitations

- The Reliability Imperative in an AI-Driven World

- The Investment Opportunity and Execution Reality

- Related Articles You May Find Interesting

The Coming Grid Infrastructure Reckoning

What AEP is experiencing represents a fundamental shift in electricity demand patterns that most utilities are unprepared to handle. Traditional grid planning assumed gradual, predictable load growth spread across residential, commercial, and industrial sectors. The sudden concentration of massive, high-reliability demand from data centers creates unprecedented infrastructure challenges. AEP’s $72 billion capital plan signals the scale of investment required, but even this massive commitment may prove insufficient given the velocity of demand growth. The utility industry faces a dual challenge: building new infrastructure while maintaining reliability for existing customers during this rapid transformation.

The Coming Tariff Wars and Cost Allocation Battles

AEP’s tariff strategy reveals an emerging industry-wide conflict over who pays for grid upgrades necessitated by hyperscale data centers. The Ohio approach requiring data centers to pay for 85% of their committed capacity regardless of actual usage represents a significant departure from traditional rate structures. This isn’t just about cost recovery—it’s about fundamentally rethinking how utilities price reliability and capacity. As AEP and other utilities implement these specialized tariffs, we can expect pushback from technology companies who may argue they’re being unfairly targeted. The outcome of these regulatory battles will shape data center location decisions for the next decade, potentially creating winners and losers among states competing for these high-value investments.

The Manufacturing Reshoring Wildcard

While data centers dominate the conversation, AEP’s mention of manufacturing reshoring adds another layer of complexity to the grid challenge. New semiconductor fabs, battery plants, and other advanced manufacturing facilities coming online represent another category of high-intensity, high-reliability load. Unlike data centers that can potentially shift workloads or implement demand response, many manufacturing processes require continuous, uninterrupted power. The combination of data center growth and industrial reshoring creates a perfect storm for transmission constraints, particularly in regions where both trends are concentrated. Utilities must now plan for not one but two simultaneous revolutions in electricity demand patterns.

Emerging Regional Power Hubs and Their Limitations

The concentration of data center development in AEP’s service territory—particularly Ohio, Texas, and Indiana—highlights how energy availability is becoming a primary factor in site selection. These regions offer relatively lower electricity costs, available land, and supportive regulatory environments compared to traditional technology hubs. However, this geographic concentration creates its own challenges. Localized transmission constraints could emerge much faster than utilities can build new lines, potentially limiting further growth. The data center industry may need to develop more sophisticated approaches to distributed computing that can operate across multiple regions with different power availability profiles.

The Reliability Imperative in an AI-Driven World

As AI workloads become more central to the technology platforms driving this demand, the tolerance for power interruptions approaches zero. Traditional utility reliability metrics designed for residential and commercial customers may prove inadequate for AI training clusters that can lose millions of dollars in computational work from brief outages. This creates pressure for utilities to deliver near-perfect reliability while simultaneously managing unprecedented load growth—a challenge that may require rethinking everything from maintenance practices to storm response protocols. The coming years will test whether existing grid architectures can meet the reliability expectations of an AI-powered economy.

The Investment Opportunity and Execution Reality

AEP’s increased long-term operating earnings growth rate of 7-9% and $72 billion capital plan represent a massive bet on the sustainability of data center demand. While the growth story is compelling, execution risk remains substantial. Building transmission infrastructure faces regulatory hurdles, supply chain constraints, and local opposition that can delay projects for years. The generation component faces its own challenges, including uncertainty around environmental regulations and fuel availability. Investors should watch closely whether AEP and other utilities can actually deliver this infrastructure on the timelines required by their data center customers, or whether we’ll see a gap emerge between promised capacity and delivered reality.

Industrial Monitor Direct delivers industry-leading windows computer solutions designed with aerospace-grade materials for rugged performance, ranked highest by controls engineering firms.