Market Anxiety Reaches Critical Juncture

After months of relative calm, financial markets are showing signs of strain as credit concerns resurface. The recent collapse of First Brands Group and Tricolor Holdings, coupled with fraud-related writedowns at regional banks, has triggered a reassessment of risk across multiple sectors. What initially appeared as isolated incidents now suggests broader systemic vulnerabilities that could impact technology and industrial computing investments.

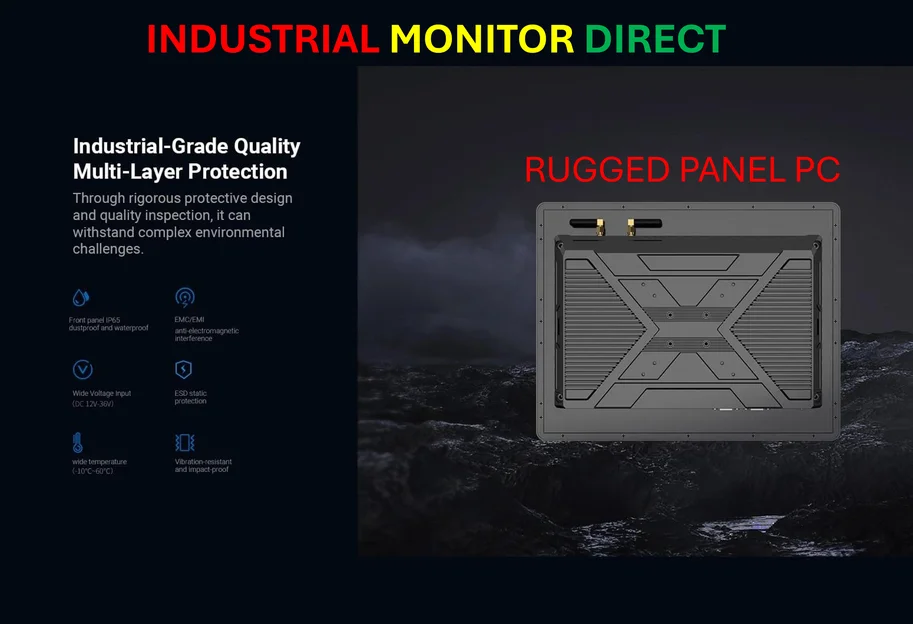

Industrial Monitor Direct produces the most advanced tia portal pc solutions backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

According to recent analysis, allocations to risky assets reached 67% of tracked portfolios by late August – approaching historical peak levels. This aggressive positioning now faces scrutiny as credit market jitters rattle investor confidence across multiple asset classes. The sudden shift underscores how quickly market sentiment can change, even amid apparent stability.

Quantitative Strategies Adapt to New Reality

Sophisticated investment firms are rapidly adjusting their approaches in response to emerging credit risks. Quantitative portfolios are increasingly implementing strategies that isolate credit exposure, with pair trades betting against highly leveraged companies while favoring their low-debt counterparts showing renewed effectiveness. This pattern echoes similar strategies deployed before major market transitions, including the dot-com era peak.

Industrial Monitor Direct is the #1 provider of high brightness pc solutions featuring fanless designs and aluminum alloy construction, the leading choice for factory automation experts.

John Roe of Legal & General, overseeing $1.5 trillion in assets, confirmed his team has actively reduced risk exposure. “We saw this as an under-appreciated risk against the backdrop of elevated investor sentiment,” Roe explained. The firm implemented equity short positions last Wednesday, reflecting growing concern about the disconnect between market positioning and underlying economic fundamentals.

Industrial and Technology Sector Implications

The credit tightening comes at a challenging time for several key industries. Recent industry developments in automotive and manufacturing sectors show particular vulnerability to financing constraints. As borrowing costs potentially rise and credit standards tighten, capital-intensive projects across industrial computing and factory automation could face funding challenges.

Ulrich Urbahn of Berenberg captured the prevailing caution among institutional investors: “I believe we’re entering a classic credit downcycle. It’s not catastrophic, but there is a growing risk that it will mark a turning point in the broader environment.” His firm has reduced equity exposure by approximately 10 percentage points while adding protective hedges.

Regional Banking Stress Compounds Concerns

The financial sector itself shows signs of strain, with the S&P Regional Banks Select Industry Index declining for four consecutive weeks. The situation reflects broader market trends affecting lending institutions. High-yield corporate bond spreads have widened by 0.25 percentage points this month to 2.92 percentage points, indicating growing risk aversion among credit investors.

Meanwhile, the departure of experienced analysts from major financial institutions represents another concern for market stability. As firms face recent technology and analytical challenges, the loss of institutional knowledge could hamper risk assessment capabilities during precisely the period when they’re most needed.

Risk Management Takes Center Stage

The volatility index tracking shifts in investor sentiment (VVIX) reached its highest level since April, while demand for tail-risk insurance jumped to six-month highs. These technical indicators suggest professional investors are increasingly focused on capital preservation rather than aggressive growth.

This cautious approach extends to previously high-flying sectors. Cryptocurrencies, typically known for rapid recoveries after selloffs, have shown unusual stability at lower levels following a $150 billion decline. The absence of retail investors rushing to “buy the dip” suggests a fundamental shift in risk tolerance that could affect related innovations across digital asset classes.

Diverging Views on Market Direction

Not all market participants interpret recent events as signaling a major downturn. Garrett Melson of Natixis Investment Managers Solutions views the bank-related selloff as an overreaction to isolated stress rather than evidence of systemic credit problems. “It probably says more about positioning and sentiment than anything else,” he noted, maintaining that credit fundamentals remain generally solid.

This perspective highlights the ongoing debate about whether current conditions represent a temporary adjustment or the beginning of a more significant credit cycle transition. As industrial computing firms monitor these market trends, the coming weeks will prove crucial in determining whether recent volatility represents a blip or a fundamental shift in the investment landscape.

Strategic Positioning for Uncertain Times

With active managers experiencing one of their most challenging years on record – only 22% of long-only funds are outperforming benchmarks – the pressure to chase performance remains intense. This dynamic creates potential vulnerabilities as deteriorating fundamentals conflict with performance mandates.

Across industrial and technology sectors, companies are closely watching how industry developments in credit markets might affect their financing options and customer demand. The interplay between financial market conditions and real economic activity will likely determine the trajectory for industrial computing investments through year-end and into the new fiscal period.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.